- United Kingdom

- /

- Metals and Mining

- /

- AIM:SLP

Is Now The Time To Put Sylvania Platinum (LON:SLP) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Sylvania Platinum (LON:SLP), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Sylvania Platinum

How Fast Is Sylvania Platinum Growing Its Earnings Per Share?

In the last three years Sylvania Platinum's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Sylvania Platinum's EPS shot from US$0.15 to US$0.37, over the last year. You don't see 150% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

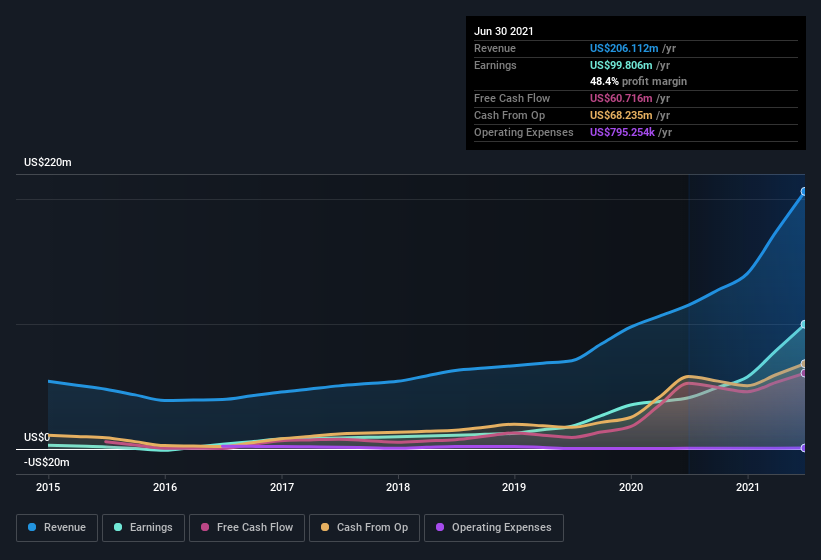

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Sylvania Platinum shareholders can take confidence from the fact that EBIT margins are up from 48% to 68%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Sylvania Platinum's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Sylvania Platinum Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Sylvania Platinum insiders both bought and sold shares over the last twelve months, but they did end up spending US$18k more on stock than they received from selling it. So, on balance, the insider transactions are mildly encouraging.

On top of the insider buying, it's good to see that Sylvania Platinum insiders have a valuable investment in the business. Indeed, they hold US$15m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 6.1% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Jaco Prinsloo is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between US$200m and US$800m, like Sylvania Platinum, the median CEO pay is around US$787k.

The Sylvania Platinum CEO received US$456k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Sylvania Platinum Worth Keeping An Eye On?

Sylvania Platinum's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Sylvania Platinum belongs on the top of your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Sylvania Platinum you should be aware of, and 2 of them make us uncomfortable.

The good news is that Sylvania Platinum is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SLP

Sylvania Platinum

Engages in the retreatment of platinum group metals (PGM) bearing chrome tailings materials in South Africa.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives