- United Kingdom

- /

- Metals and Mining

- /

- AIM:SGZ

Investors Give Scotgold Resources Limited (LON:SGZ) Shares A 62% Hiding

The Scotgold Resources Limited (LON:SGZ) share price has fared very poorly over the last month, falling by a substantial 62%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

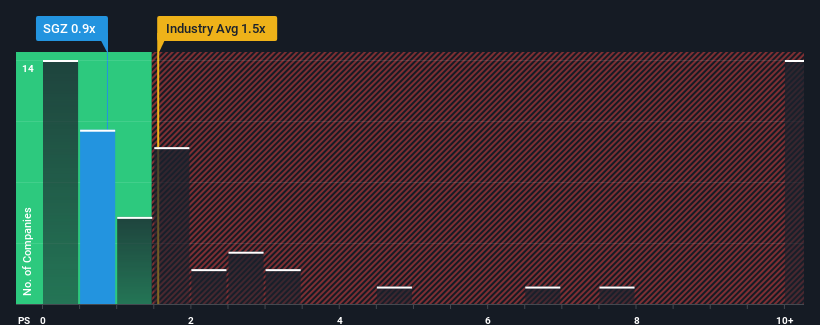

Following the heavy fall in price, Scotgold Resources' price-to-sales (or "P/S") ratio of 0.9x might make it look like a buy right now compared to the Metals and Mining industry in the United Kingdom, where around half of the companies have P/S ratios above 1.5x and even P/S above 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Scotgold Resources

How Scotgold Resources Has Been Performing

Scotgold Resources certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for Scotgold Resources, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Scotgold Resources' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 210% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to shrink 3.3% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that Scotgold Resources is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Scotgold Resources' P/S

Scotgold Resources' P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at the figures, it's surprising to see Scotgold Resources currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for Scotgold Resources (3 are concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SGZ

Scotgold Resources

Scotgold Resources Limited engages in the mine development and mineral exploration businesses in Australia, Scotland, France, and Portugal.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives