- United Kingdom

- /

- Basic Materials

- /

- AIM:MBH

A Quick Analysis On Michelmersh Brick Holdings' (LON:MBH) CEO Compensation

Frank Hanna has been the CEO of Michelmersh Brick Holdings plc (LON:MBH) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Michelmersh Brick Holdings

How Does Total Compensation For Frank Hanna Compare With Other Companies In The Industry?

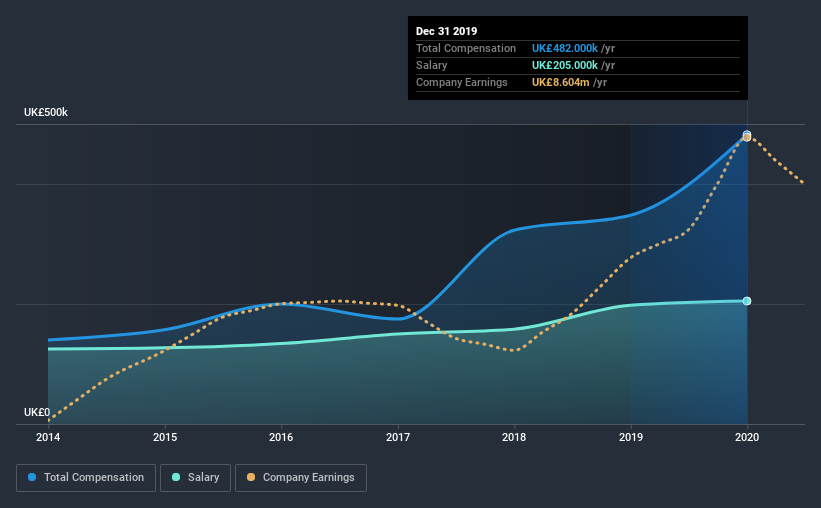

At the time of writing, our data shows that Michelmersh Brick Holdings plc has a market capitalization of UK£116m, and reported total annual CEO compensation of UK£482k for the year to December 2019. We note that's an increase of 39% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£205k.

In comparison with other companies in the industry with market capitalizations ranging from UK£74m to UK£296m, the reported median CEO total compensation was UK£415k. From this we gather that Frank Hanna is paid around the median for CEOs in the industry. Furthermore, Frank Hanna directly owns UK£733k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£205k | UK£198k | 43% |

| Other | UK£277k | UK£150k | 57% |

| Total Compensation | UK£482k | UK£348k | 100% |

On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. Our data reveals that Michelmersh Brick Holdings allocates salary more or less in line with the wider market. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Michelmersh Brick Holdings plc's Growth

Michelmersh Brick Holdings plc's earnings per share (EPS) grew 35% per year over the last three years. In the last year, its revenue is down 3.1%.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Michelmersh Brick Holdings plc Been A Good Investment?

Boasting a total shareholder return of 50% over three years, Michelmersh Brick Holdings plc has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As previously discussed, Frank is compensated close to the median for companies of its size, and which belong to the same industry. The company is growing EPS and total shareholder returns have been pleasing. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. Stockholders might even be okay with a bump in pay, seeing as how investor returns have been so strong.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Michelmersh Brick Holdings that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Michelmersh Brick Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:MBH

Michelmersh Brick Holdings

Together its subsidiaries, manufactures and sells bricks and brick prefabricated products in the United Kingdom and rest of Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.