- United Kingdom

- /

- Metals and Mining

- /

- AIM:HUM

Hummingbird Resources PLC Just Missed EPS By 23%: Here's What Analysts Think Will Happen Next

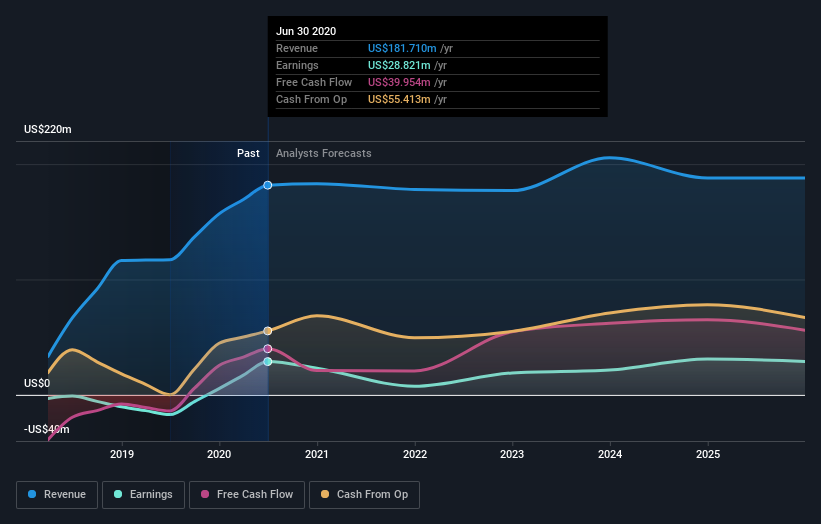

It's been a good week for Hummingbird Resources PLC (LON:HUM) shareholders, because the company has just released its latest yearly results, and the shares gained 8.6% to UK£0.24. It looks like a pretty bad result, all things considered. Although revenues of US$182m were in line with analyst predictions, statutory earnings fell badly short, missing estimates by 23% to hit US$0.049 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Hummingbird Resources

Following the recent earnings report, the consensus from dual analysts covering Hummingbird Resources is for revenues of US$178.0m in 2021, implying a small 2.0% decline in sales compared to the last 12 months. Statutory earnings per share are expected to dive 78% to US$0.018 in the same period. In the lead-up to this report, the analysts had been modelling revenues of US$178.0m and earnings per share (EPS) of US$0.041 in 2021. The analysts seem to have become more bearish following the latest results. While there were no changes to revenue forecasts, there was a pretty serious reduction to EPS estimates.

It might be a surprise to learn that the consensus price target fell 16% to UK£0.29, with the analysts clearly linking lower forecast earnings to the performance of the stock price.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Hummingbird Resources' past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 2.0% by the end of 2021. This indicates a significant reduction from annual growth of 55% over the last year. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 1.9% per year. It's pretty clear that Hummingbird Resources' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Hummingbird Resources. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Hummingbird Resources' revenues are expected to perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Hummingbird Resources. Long-term earnings power is much more important than next year's profits. We have analyst estimates for Hummingbird Resources going out as far as 2025, and you can see them free on our platform here.

You can also view our analysis of Hummingbird Resources' balance sheet, and whether we think Hummingbird Resources is carrying too much debt, for free on our platform here.

If you’re looking to trade Hummingbird Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hummingbird Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:HUM

Hummingbird Resources

Engages in the exploration, evaluation, and development of mineral properties in Liberia, Mali, and Guinea.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives