Despite Its High P/E Ratio, Is Highland Gold Mining Limited (LON:HGM) Still Undervalued?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

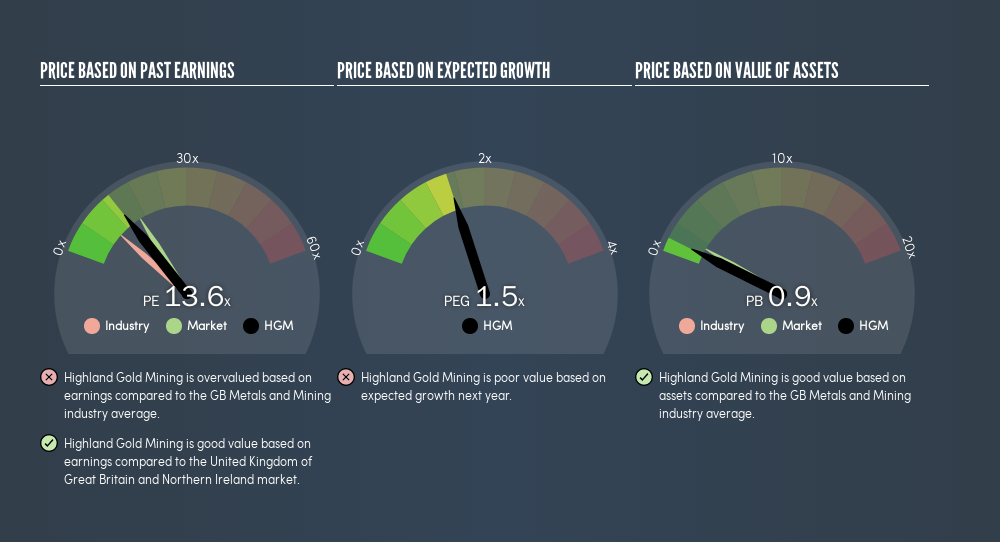

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. We'll apply a basic P/E ratio analysis to Highland Gold Mining Limited's (LON:HGM), to help you decide if the stock is worth further research. Looking at earnings over the last twelve months, Highland Gold Mining has a P/E ratio of 13.56. That is equivalent to an earnings yield of about 7.4%.

View our latest analysis for Highland Gold Mining

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share (in the reporting currency) ÷ Earnings per Share (EPS)

Or for Highland Gold Mining:

P/E of 13.56 = $2.09 (Note: this is the share price in the reporting currency, namely, USD ) ÷ $0.15 (Based on the trailing twelve months to December 2018.)

Is A High P/E Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each £1 of company earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. And in that case, the P/E ratio itself will drop rather quickly. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Highland Gold Mining's earnings per share fell by 23% in the last twelve months. And EPS is down 1.7% a year, over the last 5 years. This growth rate might warrant a below average P/E ratio.

How Does Highland Gold Mining's P/E Ratio Compare To Its Peers?

The P/E ratio indicates whether the market has higher or lower expectations of a company. As you can see below, Highland Gold Mining has a higher P/E than the average company (9.5) in the metals and mining industry.

That means that the market expects Highland Gold Mining will outperform other companies in its industry. Clearly the market expects growth, but it isn't guaranteed. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

So What Does Highland Gold Mining's Balance Sheet Tell Us?

Net debt is 28% of Highland Gold Mining's market cap. While that's enough to warrant consideration, it doesn't really concern us.

The Bottom Line On Highland Gold Mining's P/E Ratio

Highland Gold Mining's P/E is 13.6 which is below average (16.4) in the GB market. Since it only carries a modest debt load, it's likely the low expectations implied by the P/E ratio arise from the lack of recent earnings growth.

When the market is wrong about a stock, it gives savvy investors an opportunity. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course you might be able to find a better stock than Highland Gold Mining. So you may wish to see this free collection of other companies that have grown earnings strongly.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026