The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interconnectedness and its impact on local markets. Despite these broader market fluctuations, investors can still find opportunities by focusing on smaller companies that might offer resilience and growth potential. Penny stocks, often representing newer or smaller firms, remain a relevant investment area as they can present unique opportunities for those seeking affordability combined with robust financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.75 | £372.96M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.15M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.445 | £354.36M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.84 | £63.62M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.625 | £189.49M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.316 | £202.97M | ★★★★★☆ |

| Alumasc Group (AIM:ALU) | £3.01 | £108.25M | ★★★★★★ |

| Central Asia Metals (AIM:CAML) | £1.60 | £278.36M | ★★★★★★ |

| Billington Holdings (AIM:BILN) | £4.40 | £54.31M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

James Cropper (AIM:CRPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: James Cropper PLC is a company that manufactures and sells paper products and advanced materials, with a market cap of £23.41 million.

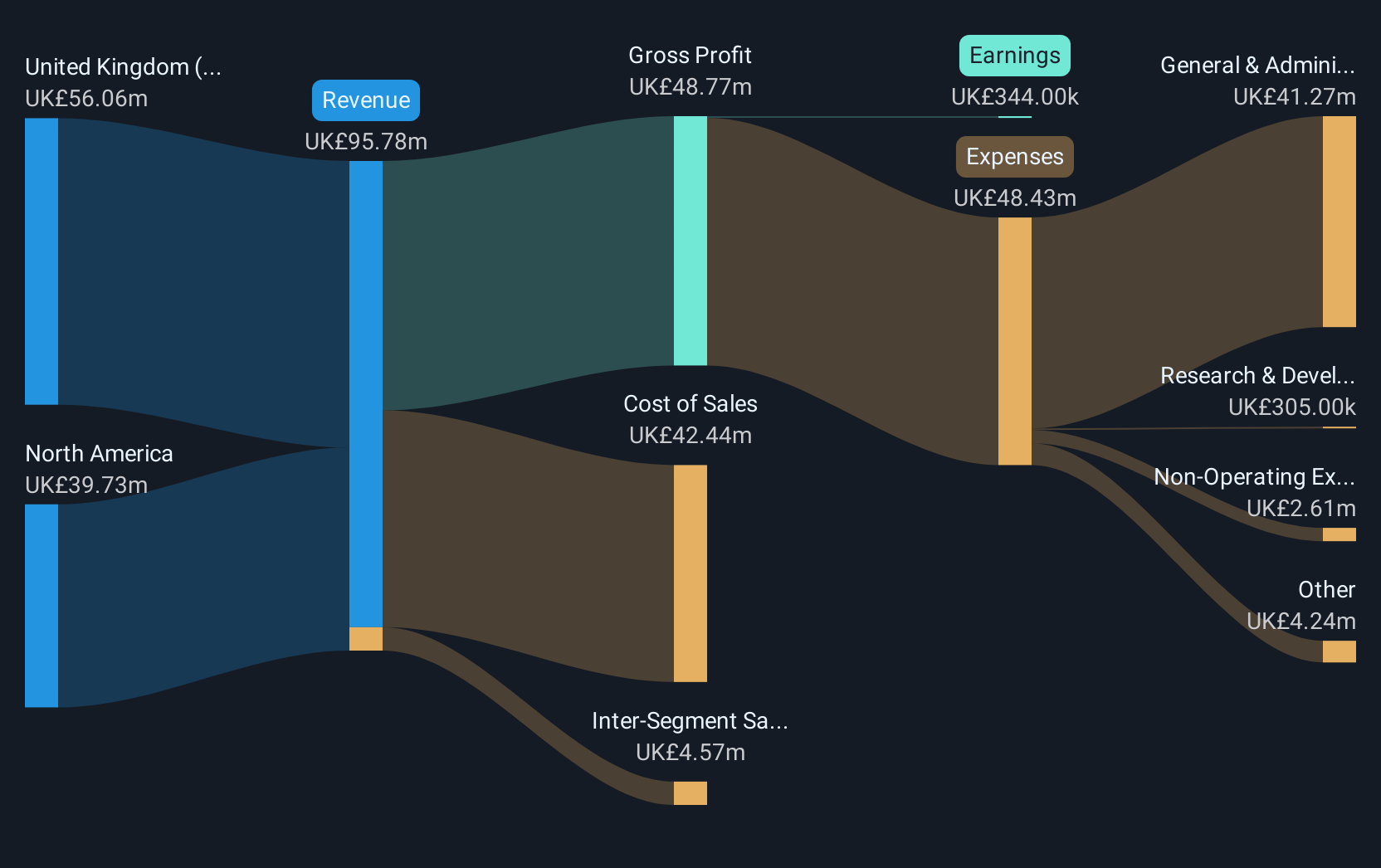

Operations: The company's revenue is derived from two main segments: Paper and Packaging, which generated £68.47 million, and Technical Fibre Products (TFP), contributing £34.50 million.

Market Cap: £23.41M

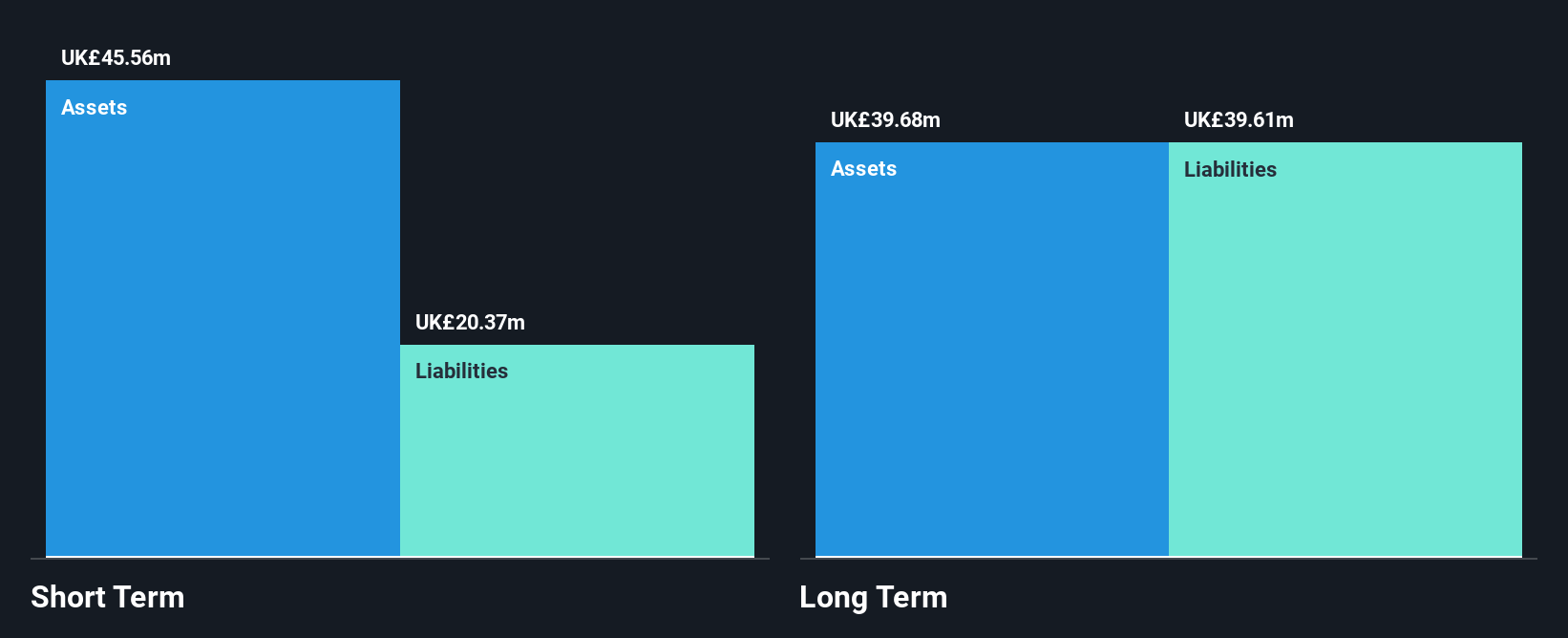

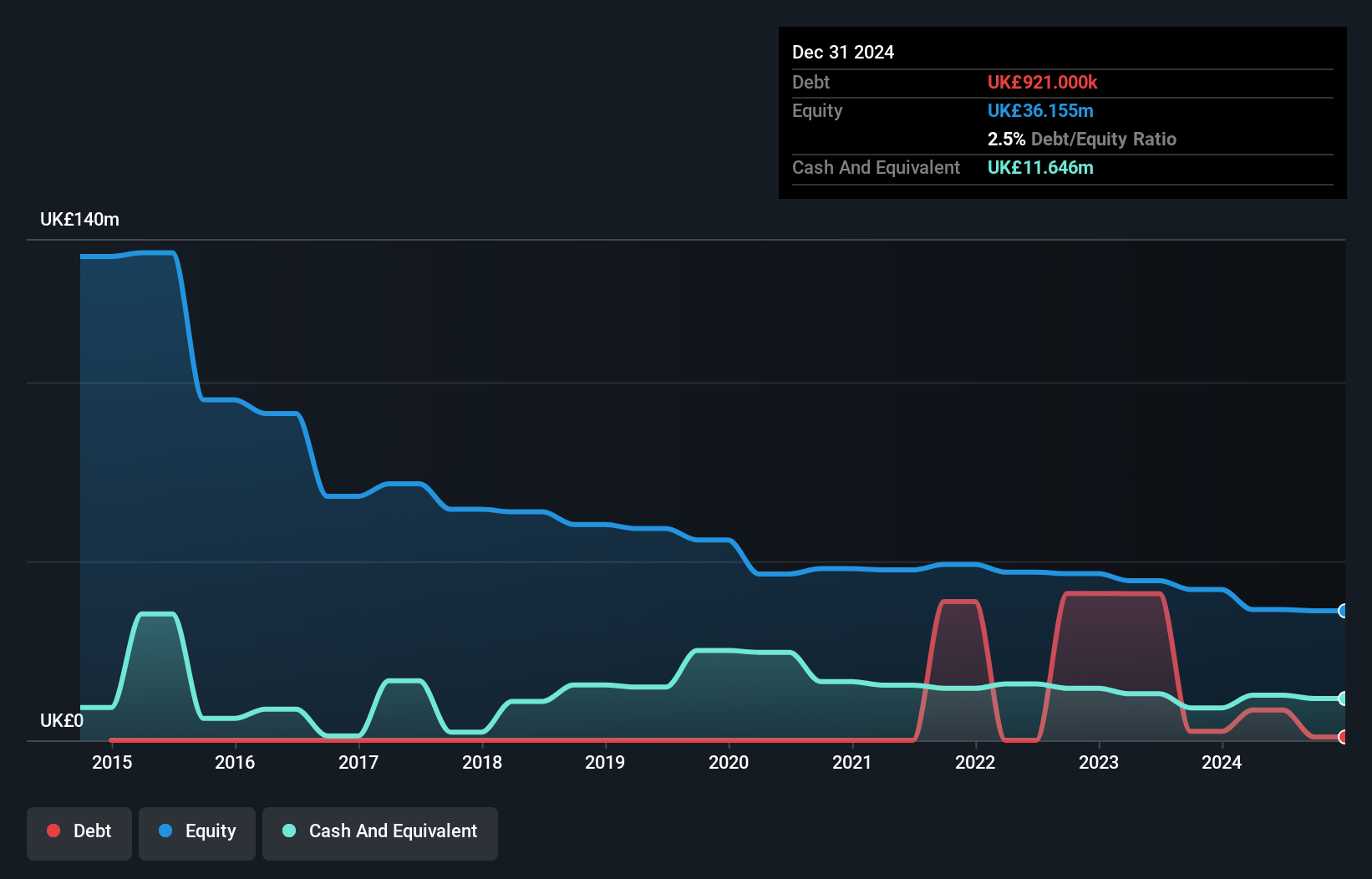

James Cropper PLC, with a market cap of £23.41 million, trades at 83.7% below its estimated fair value but faces challenges as it remains unprofitable and has seen increasing losses over the past five years. Despite this, the company maintains a satisfactory net debt to equity ratio of 38%, with short-term assets exceeding both short-term and long-term liabilities. The recent appointment of David Stirling as CEO could bring strategic growth opportunities given his extensive leadership experience. However, investors should note the stock's high volatility and negative return on equity amidst its current financial struggles.

- Jump into the full analysis health report here for a deeper understanding of James Cropper.

- Understand James Cropper's earnings outlook by examining our growth report.

Portmeirion Group (AIM:PMP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Portmeirion Group PLC, along with its subsidiaries, is involved in the manufacturing, marketing, and distribution of ceramics, home fragrances, and related homeware products across the United Kingdom, South Korea, North America, and other international markets with a market cap of £30.96 million.

Operations: The company's revenue is primarily generated from the United Kingdom, contributing £57.58 million, and North America, contributing £42.68 million.

Market Cap: £30.96M

Portmeirion Group PLC, with a market cap of £30.96 million, is currently trading at 66.2% below its estimated fair value despite facing profitability challenges and increasing losses over the past five years. The company reported a net loss of £2.64 million for the first half of 2024 amid declining sales, yet maintains a satisfactory net debt to equity ratio of 25.7%, with short-term assets comfortably covering both short-term and long-term liabilities. Recent leadership changes include Jonathan Hill's appointment as Group Finance Director, potentially offering new strategic direction amidst financial headwinds and reduced interim dividends to 1.50 pence per share from last year's 3.50 pence.

- Unlock comprehensive insights into our analysis of Portmeirion Group stock in this financial health report.

- Evaluate Portmeirion Group's prospects by accessing our earnings growth report.

LMS Capital (LSE:LMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LMS Capital plc is a private equity firm that focuses on direct and fund of funds investments across various stages including mid to late ventures, emerging growth, and buyouts, with a market cap of £14.73 million.

Operations: LMS Capital plc has not reported any specific revenue segments.

Market Cap: £14.73M

LMS Capital plc, with a market cap of £14.73 million, operates as a private equity firm but remains pre-revenue and unprofitable. Despite this, the company maintains financial stability with more cash than debt and no long-term liabilities. Its short-term assets of £12.8 million exceed its short-term liabilities of £8.8 million, providing a solid liquidity position. The board is experienced with an average tenure of five years, though management details are insufficient to determine experience levels. While the share price has been highly volatile recently, LMS has not diluted shareholders in the past year and offers a dividend yield of 5.07%.

- Navigate through the intricacies of LMS Capital with our comprehensive balance sheet health report here.

- Understand LMS Capital's track record by examining our performance history report.

Summing It All Up

- Dive into all 466 of the UK Penny Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRPR

James Cropper

Manufactures and sells paper products and advanced materials.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives