- United Kingdom

- /

- Metals and Mining

- /

- AIM:CNG

China Nonferrous Gold Limited's (LON:CNG) Shares Not Telling The Full Story

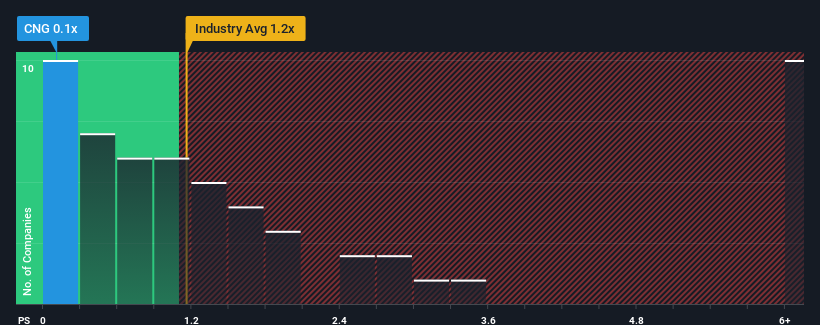

With a price-to-sales (or "P/S") ratio of 0.1x China Nonferrous Gold Limited (LON:CNG) may be sending bullish signals at the moment, given that almost half of all the Metals and Mining companies in the United Kingdom have P/S ratios greater than 1.2x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for China Nonferrous Gold

What Does China Nonferrous Gold's Recent Performance Look Like?

As an illustration, revenue has deteriorated at China Nonferrous Gold over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Nonferrous Gold's earnings, revenue and cash flow.How Is China Nonferrous Gold's Revenue Growth Trending?

In order to justify its P/S ratio, China Nonferrous Gold would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.8%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

In contrast to the company, the rest of the industry is expected to decline by 6.9% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that China Nonferrous Gold's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From China Nonferrous Gold's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of China Nonferrous Gold revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

We don't want to rain on the parade too much, but we did also find 4 warning signs for China Nonferrous Gold (3 make us uncomfortable!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CNG

China Nonferrous Gold

China Nonferrous Gold Limited engages in exploration, mine development, and mining activities in the Cayman Islands.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives