- United Kingdom

- /

- Chemicals

- /

- AIM:BYOT

If You Like EPS Growth Then Check Out Byotrol (LON:BYOT) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Byotrol (LON:BYOT). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Byotrol

How Fast Is Byotrol Growing Its Earnings Per Share?

Over the last three years, Byotrol has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Byotrol's EPS shot from UK£0.0016 to UK£0.0045, over the last year. Year on year growth of 184% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

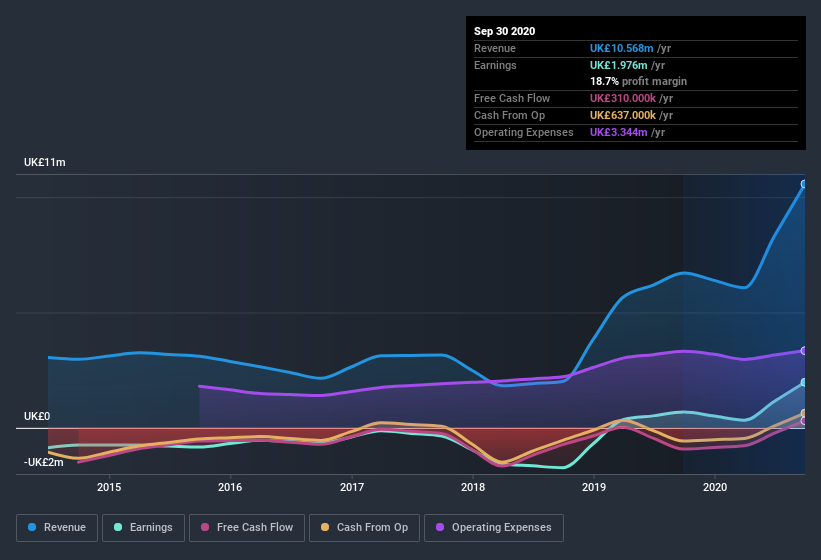

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Byotrol shareholders can take confidence from the fact that EBIT margins are up from 8.9% to 12%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Byotrol isn't a huge company, given its market capitalization of UK£27m. That makes it extra important to check on its balance sheet strength.

Are Byotrol Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Byotrol shares, in the last year. So it's definitely nice that CFO & Executive Director Nicholos Hellyer bought UK£10k worth of shares at an average price of around UK£0.077.

I do like that insiders have been buying shares in Byotrol, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. For companies with market capitalizations under UK£144m, like Byotrol, the median CEO pay is around UK£246k.

The Byotrol CEO received UK£135k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Byotrol Worth Keeping An Eye On?

Byotrol's earnings per share have taken off like a rocket aimed right at the moon. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Byotrol may be at an inflection point. If so, then it the potential for further gains probably merit a spot on your watchlist. We should say that we've discovered 2 warning signs for Byotrol (1 is a bit unpleasant!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Byotrol, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Byotrol, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Byotrol might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:BYOT

Byotrol

Develops and commercialize antimicrobial technologies and products in the United Kingdom, North America, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success