- United Kingdom

- /

- Chemicals

- /

- AIM:BIOM

Here's Why Biome Technologies plc's (LON:BIOM) CEO Is Unlikely to Expect A Pay Rise This Year

The anaemic share price growth at Biome Technologies plc (LON:BIOM) over the past few years has probably not impressed shareholders and may be due to earnings not growing over that period. Some of these issues will occupy shareholders' minds as the AGM rolls around on 21 April 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Biome Technologies

How Does Total Compensation For Paul Mines Compare With Other Companies In The Industry?

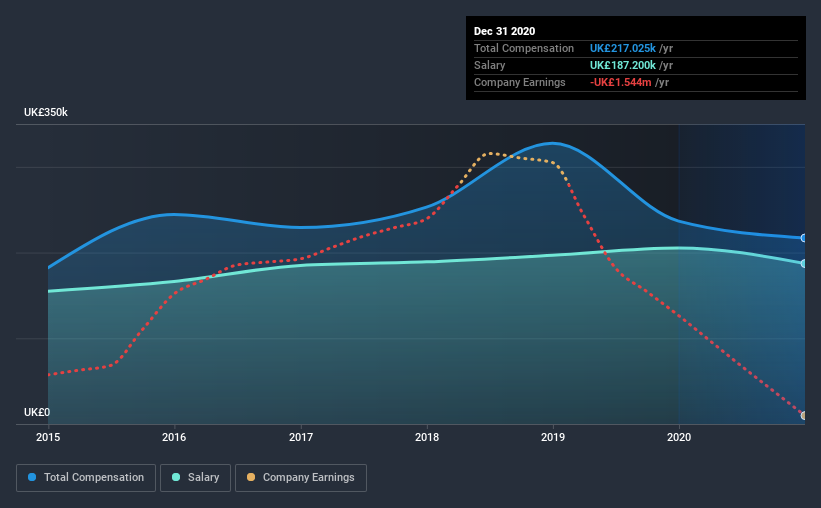

According to our data, Biome Technologies plc has a market capitalization of UK£11m, and paid its CEO total annual compensation worth UK£217k over the year to December 2020. Notably, that's a decrease of 8.3% over the year before. In particular, the salary of UK£187.2k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under UK£145m, the reported median total CEO compensation was UK£216k. So it looks like Biome Technologies compensates Paul Mines in line with the median for the industry. Moreover, Paul Mines also holds UK£163k worth of Biome Technologies stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£187k | UK£205k | 86% |

| Other | UK£30k | UK£31k | 14% |

| Total Compensation | UK£217k | UK£237k | 100% |

Speaking on an industry level, nearly 65% of total compensation represents salary, while the remainder of 35% is other remuneration. It's interesting to note that Biome Technologies pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Biome Technologies plc's Growth Numbers

Over the last three years, Biome Technologies plc has shrunk its earnings per share by 86% per year. In the last year, its revenue is down 18%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Biome Technologies plc Been A Good Investment?

Biome Technologies plc has generated a total shareholder return of 2.8% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

The lacklustre share price returns along with the lack of earnings growth makes us think that a strong rebound in the share price may be difficult. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 5 warning signs for Biome Technologies (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Biome Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Biome Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:BIOM

Biome Technologies

Engages in the bioplastics and radio frequency (RF) technology businesses in the United Kingdom, Europe, Canada, the United States, Asia, and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.