- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

Does Anglo Asian Mining (LON:AAZ) Deserve A Spot On Your Watchlist?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Anglo Asian Mining (LON:AAZ). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Anglo Asian Mining

Anglo Asian Mining's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that Anglo Asian Mining grew its EPS from US$0.0073 to US$0.091, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

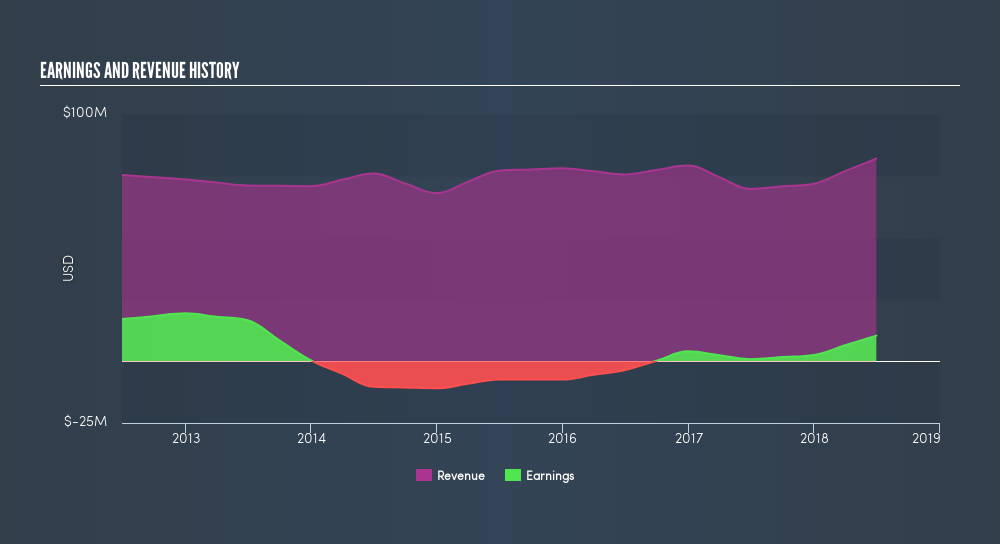

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Anglo Asian Mining is growing revenues, and EBIT margins improved by 12.7 percentage points to 21%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Anglo Asian Mining's future profits.

Are Anglo Asian Mining Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Anglo Asian Mining top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Director of Geology at Azerbaijan International Mining Company, Stephen Westhead, paid US$52k to buy shares at an average price of US$0.87.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Anglo Asian Mining insiders own more than a third of the company. Actually, with 40% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. That means insiders have US$40m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Anglo Asian Mining Deserve A Spot On Your Watchlist?

Anglo Asian Mining's earnings per share growth has been so hot recently that thinking about it is making me blush. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Anglo Asian Mining on your watchlist. Of course, just because Anglo Asian Mining is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Anglo Asian Mining is not the only growth stock with insider buying. Here's a a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:AAZ

Anglo Asian Mining

Engages in the exploration and production of mineral properties in Azerbaijan.

High growth potential with mediocre balance sheet.