- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

After Leaping 28% Anglo Asian Mining PLC (LON:AAZ) Shares Are Not Flying Under The Radar

Anglo Asian Mining PLC (LON:AAZ) shareholders have had their patience rewarded with a 28% share price jump in the last month. The annual gain comes to 105% following the latest surge, making investors sit up and take notice.

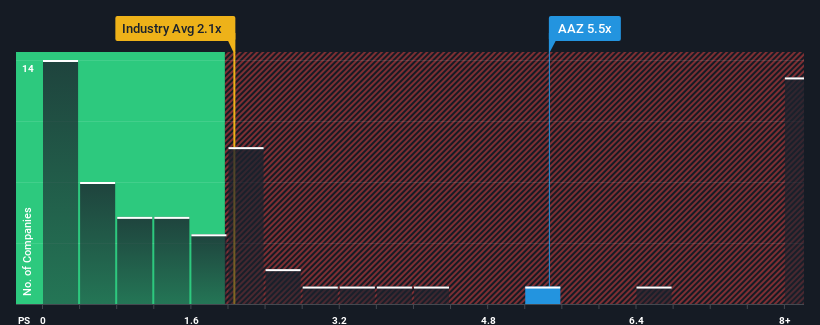

Since its price has surged higher, when almost half of the companies in the United Kingdom's Metals and Mining industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Anglo Asian Mining as a stock not worth researching with its 5.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Anglo Asian Mining

What Does Anglo Asian Mining's Recent Performance Look Like?

Anglo Asian Mining could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anglo Asian Mining.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Anglo Asian Mining would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 66%. As a result, revenue from three years ago have also fallen 71% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 221% over the next year. With the industry only predicted to deliver 2.0%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Anglo Asian Mining's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Anglo Asian Mining's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Anglo Asian Mining maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Metals and Mining industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Anglo Asian Mining (1 is significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Anglo Asian Mining, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026