- United Kingdom

- /

- Insurance

- /

- LSE:SAGA

Top UK Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

In recent times, the United Kingdom's stock market has faced headwinds, with the FTSE 100 index experiencing a downturn due to weak trade data from China and broader global economic pressures. Amid these challenges, investors often seek growth companies with high insider ownership as they can offer strong alignment between management and shareholder interests, potentially providing resilience in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 13.3% | 67.7% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.6% | 62% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 40.7% |

Here's a peek at a few of the choices from the screener.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £542.46 million.

Operations: The company's revenue is derived from three primary segments: Infrastructure (£95.89 million), Private Equity (£50.52 million), and Foresight Capital Management (£7.58 million).

Insider Ownership: 34.7%

Foresight Group Holdings shows potential as a growth company with high insider ownership, trading 11.8% below its estimated fair value. Its earnings are forecast to grow at 19.9% annually, outpacing the UK market's 14.6%, while revenue is expected to increase by 10.2% per year, surpassing the market average of 4.2%. Analysts agree on a potential stock price rise of 26.2%. The company's Return on Equity is projected to reach a very high level in three years.

- Click to explore a detailed breakdown of our findings in Foresight Group Holdings' earnings growth report.

- The valuation report we've compiled suggests that Foresight Group Holdings' current price could be quite moderate.

Saga (LSE:SAGA)

Simply Wall St Growth Rating: ★★★★☆☆

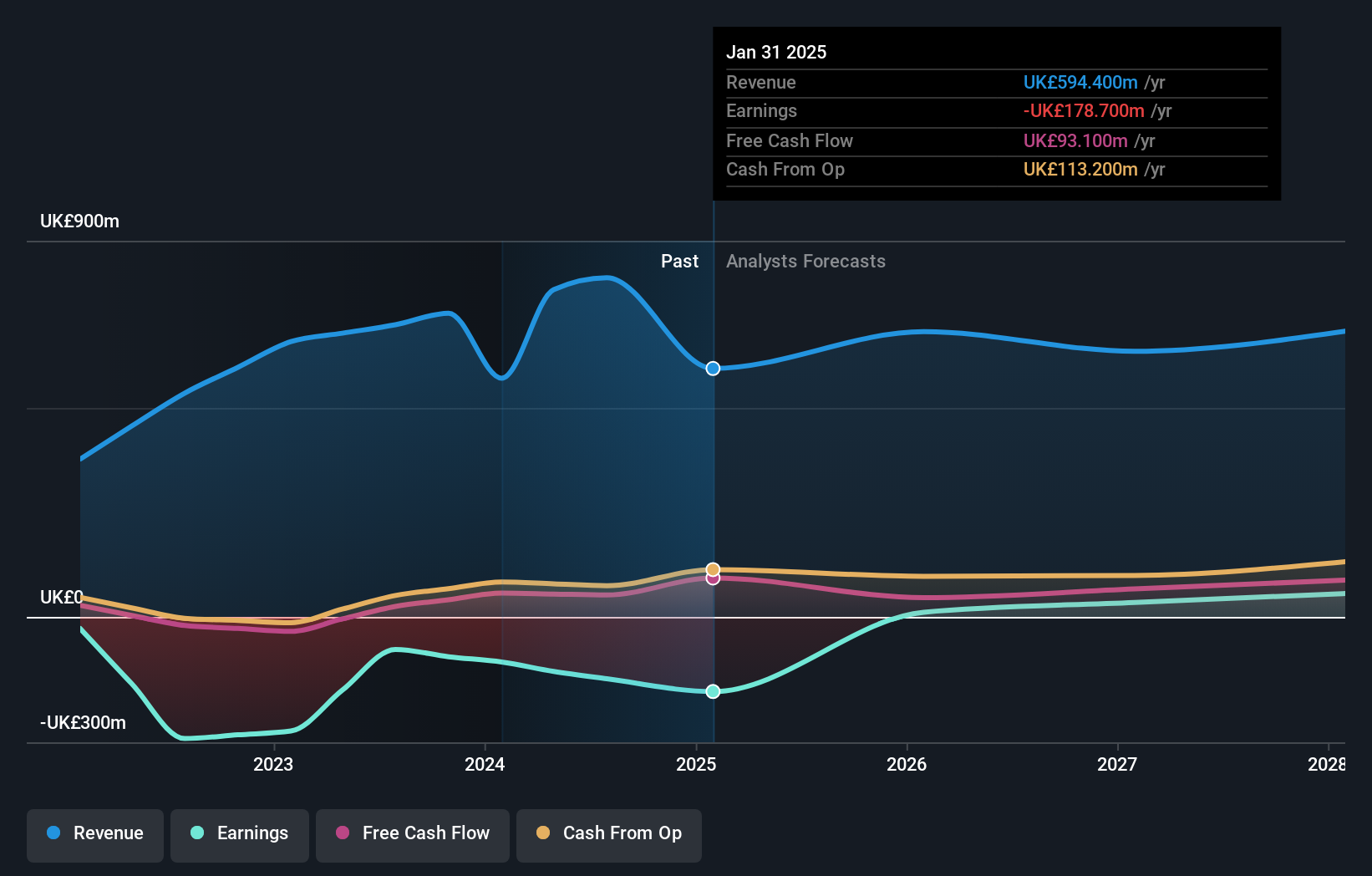

Overview: Saga plc, along with its subsidiaries, offers package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom, with a market cap of £381.48 million.

Operations: The company's revenue is primarily derived from travel (£475.50 million), home broking insurance (£26.70 million), motor broking insurance (£54.80 million), and other broking insurance services (£41.40 million).

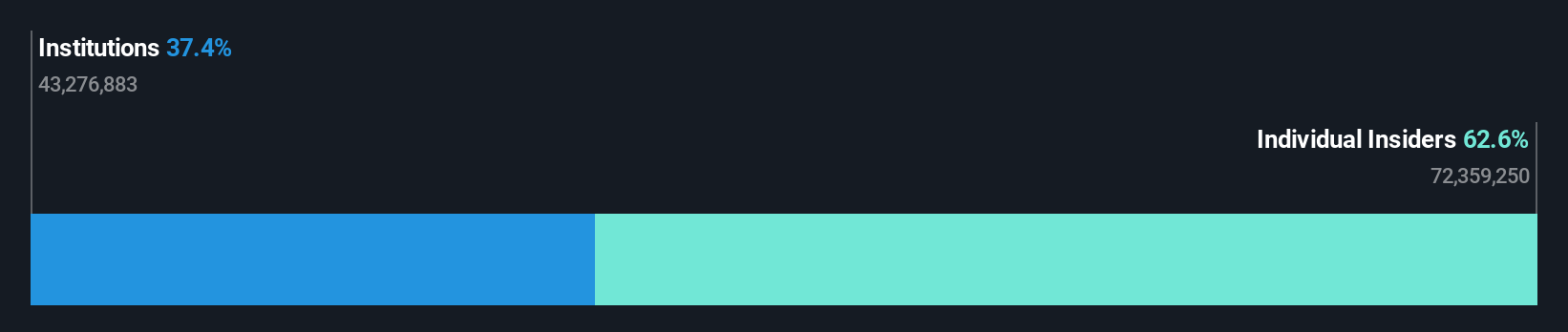

Insider Ownership: 36.9%

Saga demonstrates potential with substantial insider ownership and a significant reduction in net loss to £3.4 million for H1 2026, compared to £106.1 million the previous year. While its revenue growth forecast of 3% annually lags behind the UK market, its earnings are expected to grow at an impressive rate of over 100% per year, leading to profitability within three years. The company trades at a favorable value relative to peers and industry standards.

- Delve into the full analysis future growth report here for a deeper understanding of Saga.

- Insights from our recent valuation report point to the potential undervaluation of Saga shares in the market.

Stelrad Group (LSE:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

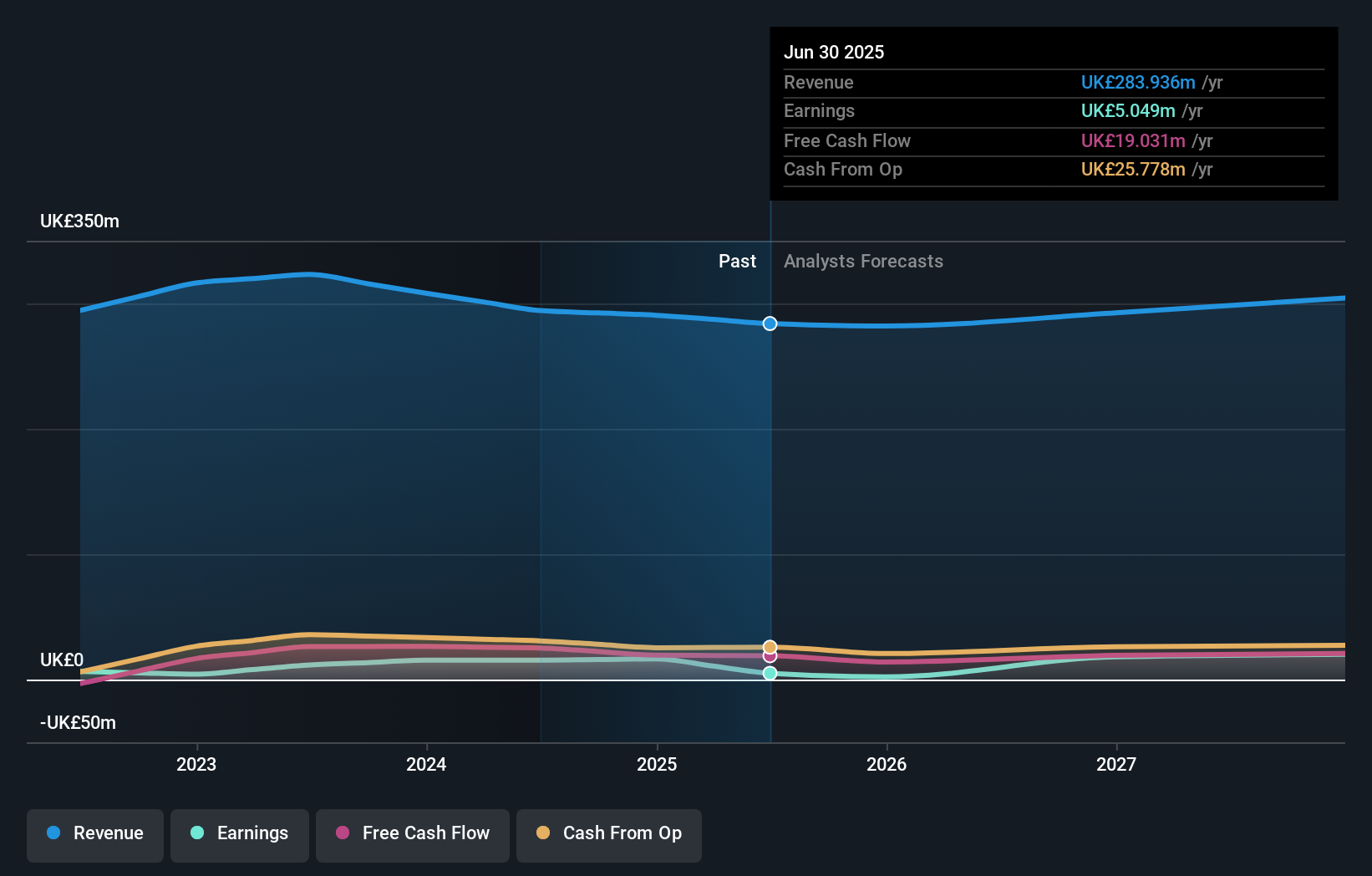

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £216.50 million.

Operations: The company generates revenue of £283.94 million from its radiator manufacturing and distribution operations in the UK, Ireland, Europe, Turkey, and other international markets.

Insider Ownership: 15.6%

Stelrad Group faces challenges with a reported net loss of £3.45 million for H1 2025, down from a net income of £8.02 million the previous year. Despite this, its earnings are forecast to grow significantly at 37.52% annually, outpacing the UK market's growth rate. The company's return on equity is expected to reach 28.5% in three years, although revenue growth lags behind market expectations and dividends remain poorly covered by earnings.

- Take a closer look at Stelrad Group's potential here in our earnings growth report.

- Our valuation report here indicates Stelrad Group may be overvalued.

Summing It All Up

- Click here to access our complete index of 60 Fast Growing UK Companies With High Insider Ownership.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SAGA

Saga

Provides package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives