- United Kingdom

- /

- Insurance

- /

- LSE:SAGA

Saga plc's (LON:SAGA) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

Saga plc (LON:SAGA) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 110% in the last year.

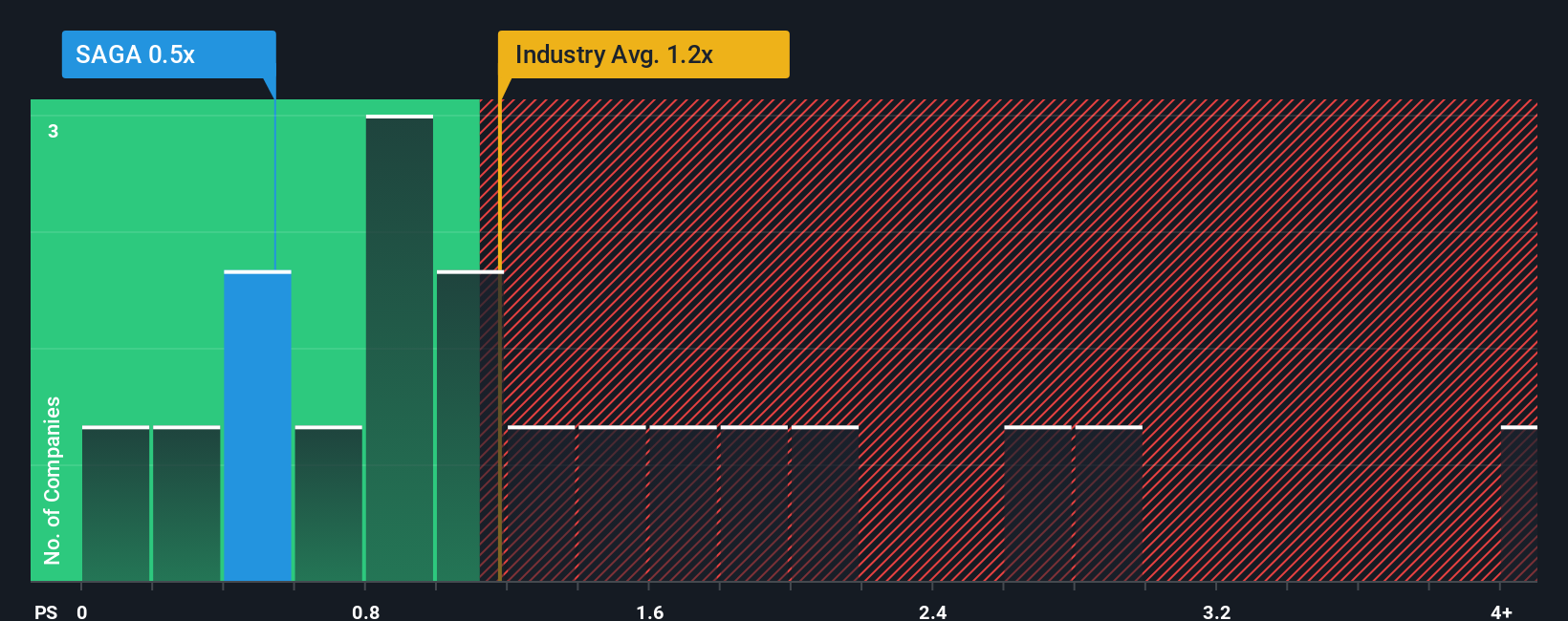

Although its price has surged higher, it would still be understandable if you think Saga is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in the United Kingdom's Insurance industry have P/S ratios above 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Saga

What Does Saga's Recent Performance Look Like?

Saga could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Saga.How Is Saga's Revenue Growth Trending?

In order to justify its P/S ratio, Saga would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 4.1% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 57% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 4.8% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 12% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Saga's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Saga's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Saga's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Saga with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Saga's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SAGA

Saga

Provides package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives