- United Kingdom

- /

- Insurance

- /

- AIM:HUW

Should Helios Underwriting Plc (LON:HUW) Be Part Of Your Dividend Portfolio?

Could Helios Underwriting Plc (LON:HUW) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

So you may wish to consider our analysis of Helios Underwriting's financial health, here.

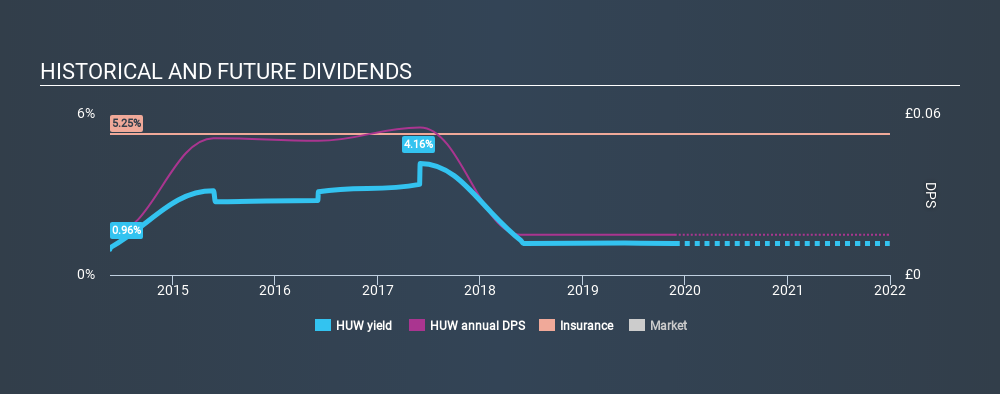

With a 1.2% yield and a six-year payment history, investors probably think Helios Underwriting looks like a reliable dividend stock. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. The company also bought back stock during the year, equivalent to approximately 1.5% of the company's market capitalisation at the time. Some simple analysis can reduce the risk of holding Helios Underwriting for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Helios Underwriting!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Helios Underwriting paid out 23% of its profit as dividends. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Helios Underwriting has been paying a dividend for the past six years. Although it has been paying a dividend for several years now, the dividend has been cut at least once by more than 20%, and we're cautious about the consistency of its dividend across a full economic cycle. Its most recent annual dividend was UK£0.015 per share, effectively flat on its first payment six years ago.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Helios Underwriting's EPS have declined at around 5.7% a year. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

To summarise, shareholders should always check that Helios Underwriting's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Firstly, we like that Helios Underwriting has a low and conservative payout ratio. Earnings per share are down, and Helios Underwriting's dividend has been cut at least once in the past, which is disappointing. In summary, we're unenthused by Helios Underwriting as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Helios Underwriting stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:HUW

Helios Underwriting

Provides a limited liability investment for its shareholders in the Lloyd’s insurance market in the United Kingdom.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026