- United Kingdom

- /

- Insurance

- /

- AIM:HUW

If You Like EPS Growth Then Check Out Helios Underwriting (LON:HUW) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Helios Underwriting (LON:HUW). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Helios Underwriting

Helios Underwriting's Improving Profits

Over the last three years, Helios Underwriting has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Helios Underwriting's EPS shot from UK£0.065 to UK£0.19, over the last year. Year on year growth of 193% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

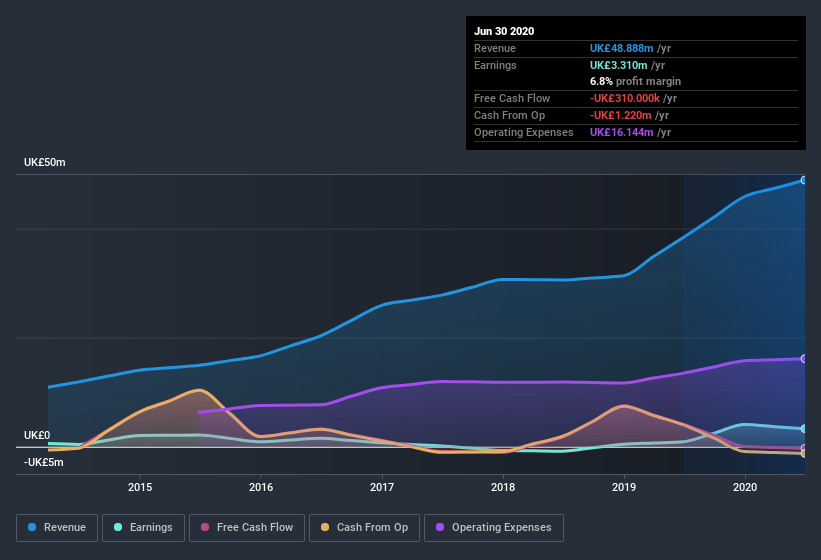

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Helios Underwriting's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Helios Underwriting's EBIT margins were flat over the last year, revenue grew by a solid 27% to UK£49m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Helios Underwriting is no giant, with a market capitalization of UK£60m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Helios Underwriting Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Helios Underwriting, is that company insiders paid UK£29k for shares in the last year. While this isn't much, we also note an absence of sales. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Chairman of the Board Harold Clunie Cunningham for UK£19k worth of shares, at about UK£0.89 per share.

Along with the insider buying, another encouraging sign for Helios Underwriting is that insiders, as a group, have a considerable shareholding. To be specific, they have UK£13m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 21% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Nigel Hanbury, is paid less than the median for similar sized companies. For companies with market capitalizations under UK£146m, like Helios Underwriting, the median CEO pay is around UK£246k.

The Helios Underwriting CEO received UK£192k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Helios Underwriting Deserve A Spot On Your Watchlist?

Helios Underwriting's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Helios Underwriting belongs on the top of your watchlist. Even so, be aware that Helios Underwriting is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

As a growth investor I do like to see insider buying. But Helios Underwriting isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Helios Underwriting, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helios Underwriting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:HUW

Helios Underwriting

Provides a limited liability investment for its shareholders in the Lloyd’s insurance market in the United Kingdom.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)