Nigel Hanbury became the CEO of Helios Underwriting Plc (LON:HUW) in 2012. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Helios Underwriting

How Does Nigel Hanbury's Compensation Compare With Similar Sized Companies?

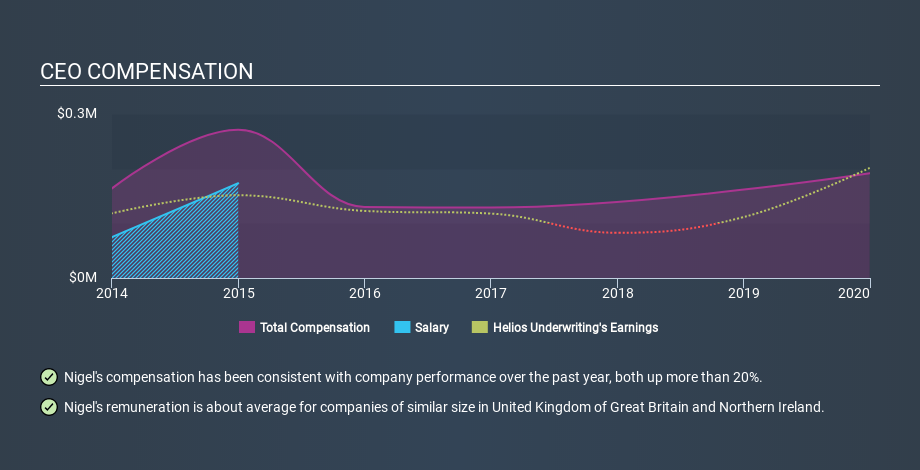

Our data indicates that Helios Underwriting Plc is worth UK£17m, and total annual CEO compensation was reported as UK£192k for the year to December 2019. We looked at a group of companies with market capitalizations under UK£160m, and the median CEO total compensation was UK£273k.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Helios Underwriting stands. On an industry level, roughly 37% of total compensation represents salary and 63% is other remuneration. Talking in terms of the company, Helios Underwriting prefers to reward its CEO through non-salary benefits, opting not to give Nigel Hanbury a salary.

That means Nigel Hanbury receives fairly typical remuneration for the CEO of a company that size. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. You can see, below, how CEO compensation at Helios Underwriting has changed over time.

Is Helios Underwriting Plc Growing?

On average over the last three years, Helios Underwriting Plc has seen earnings per share (EPS) move in a favourable direction by 82% each year (using a line of best fit). Its revenue is up 46% over last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Helios Underwriting Plc Been A Good Investment?

Given the total loss of 36% over three years, many shareholders in Helios Underwriting Plc are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Nigel Hanbury is paid around the same as most CEOs of similar size companies.

We'd say the company can boast of its EPS growth, but it's disappointing to see negative shareholder returns over three years. Considering the improvement in earnings per share, one could argue that the CEO pay is appropriate, albeit not too low. Taking a breather from CEO compensation, we've spotted 5 warning signs for Helios Underwriting (of which 1 is significant!) you should know about in order to have a holistic understanding of the stock.

If you want to buy a stock that is better than Helios Underwriting, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About AIM:HUW

Helios Underwriting

Provides a limited liability investment for its shareholders in the Lloyd’s insurance market in the United Kingdom.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives