- United Kingdom

- /

- Insurance

- /

- AIM:HUW

Helios Underwriting plc's (LON:HUW) Business Is Yet to Catch Up With Its Share Price

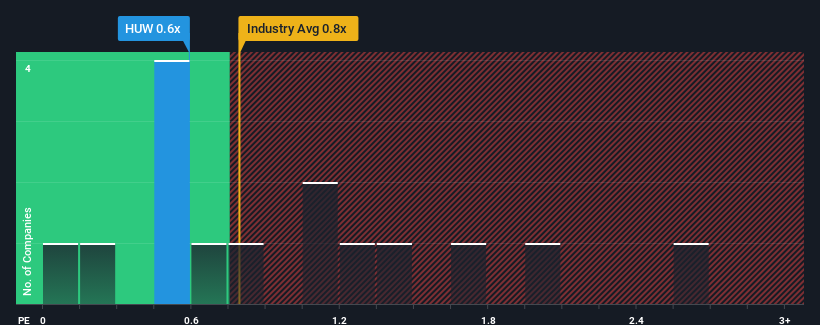

It's not a stretch to say that Helios Underwriting plc's (LON:HUW) price-to-sales (or "P/S") ratio of 0.6x seems quite "middle-of-the-road" for Insurance companies in the United Kingdom, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Helios Underwriting

How Has Helios Underwriting Performed Recently?

Recent times have been pleasing for Helios Underwriting as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Helios Underwriting.How Is Helios Underwriting's Revenue Growth Trending?

In order to justify its P/S ratio, Helios Underwriting would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 89% last year. The strong recent performance means it was also able to grow revenue by 282% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 35% per year as estimated by the two analysts watching the company. That's not great when the rest of the industry is expected to grow by 14% per year.

In light of this, it's somewhat alarming that Helios Underwriting's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Helios Underwriting's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Helios Underwriting with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Helios Underwriting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HUW

Helios Underwriting

Provides a limited liability investment for its shareholders in the Lloyd’s insurance market in the United Kingdom.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives