- United Kingdom

- /

- Personal Products

- /

- LSE:ULVR

Exploring Unilever (LSE:ULVR) Valuation: Is There Quiet Upside Beneath Recent Steady Trading?

Reviewed by Simply Wall St

See our latest analysis for Unilever.

Unilever’s share price has been steady lately, with a recent dip to $45.64 reflecting ongoing market uncertainty rather than any company-specific shock. Although short-term price returns have been modest, the bigger story is in the 4.33% total shareholder return over the past year and a robust 24.76% in three years. This signals steady long-term wealth creation even as market sentiment ebbs and flows.

If you’re rethinking your portfolio as momentum shifts, now is the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership.

With shares hovering below analyst targets and Unilever trading at a discount to its estimated value, investors are left to wonder: is there untapped upside ahead or has the market already accounted for the company's growth potential?

Most Popular Narrative: 7.9% Undervalued

Analyst consensus sees a fair value above Unilever’s latest close, which suggests some room for upside if projections hold true. The valuation is based on bold assumptions about future growth and profitability, making the storyline worth exploring.

Portfolio transformation with a sharper focus on premium and science-led Personal Care and Beauty & Wellbeing products, combined with bolt-on acquisitions of fast-growing digitally native brands, is increasing exposure to higher-margin categories and supporting long-term margin and earnings expansion.

Curious which specific profit drivers analysts expect to transform Unilever’s margins? The full narrative breaks down the projected changes that unlock this valuation advantage. Don’t miss the surprising focus and future assumptions that could define the company’s next chapter.

Result: Fair Value of $49.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in key markets and continued input cost pressures could quickly dampen Unilever’s margin progress and challenge its growth trajectory.

Find out about the key risks to this Unilever narrative.

Another View: What Do Valuation Ratios Tell Us?

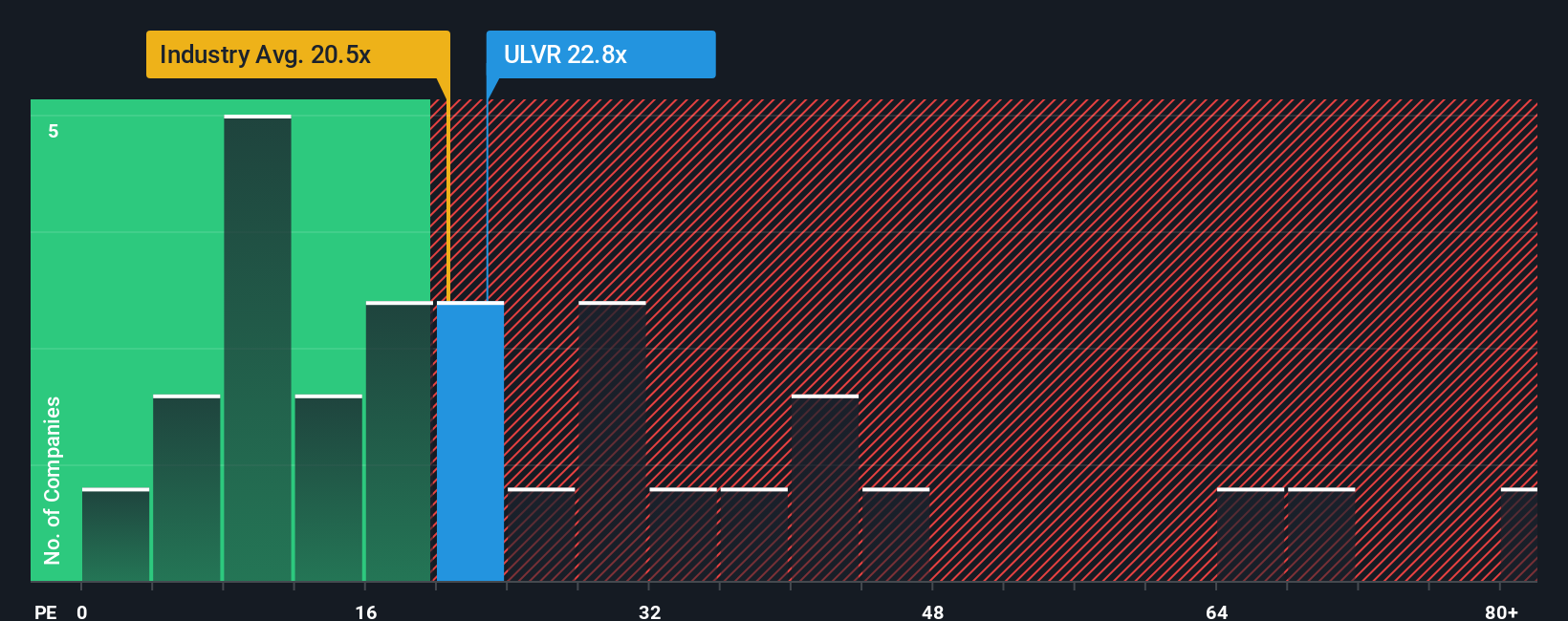

Looking at Unilever’s valuation through its price-to-earnings ratio shows a different picture than the fair value approach. At 23.2x, it is above the European Personal Products industry average of 18.7x, but right in line with peers at 23.5x and almost exactly at its fair ratio of 23.4x. This suggests that, while some premium is priced in versus the industry, the current market is broadly agreeing with the numbers. Could this tight gap limit upside, or does it mean Unilever is safer from major valuation swings?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unilever Narrative

If you want to challenge these viewpoints or dive into the fundamentals on your own, you can craft and share your unique perspective in just a few minutes. Do it your way.

A great starting point for your Unilever research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great opportunities are waiting for you. Use the Simply Wall Street Screener to spot game-changing stocks before they hit everyone’s radar and take charge of your next move.

- Spot income powerhouses by checking out these 15 dividend stocks with yields > 3%, offering reliable yields above 3%, bringing stable potential to your investment strategy.

- Fuel your portfolio’s growth with these 880 undervalued stocks based on cash flows, which are trading below their intrinsic cash flow value and may unlock hidden upside others might miss.

- Jump into tomorrow’s tech leaders by exploring these 28 AI penny stocks, where innovation and artificial intelligence are driving standout returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ULVR

Unilever

Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives