- United Kingdom

- /

- Household Products

- /

- LSE:MCB

Exploring Undiscovered Gems in the United Kingdom February 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences downward pressure due to weak trade data from China, investors are increasingly cautious about the global economic landscape and its impact on large-cap stocks. In this environment, small-cap companies in the UK may present unique opportunities for growth, as they often have less exposure to international markets and can benefit from domestic economic resilience. Identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and innovative business models that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| AltynGold | 77.07% | 28.64% | 38.10% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Applied Nutrition (LSE:APN)

Simply Wall St Value Rating: ★★★★★★

Overview: Applied Nutrition Plc operates in the manufacture, wholesale, and retail of sports nutritional products both in the United Kingdom and internationally, with a market capitalization of £345 million.

Operations: Applied Nutrition Plc generates revenue primarily from its Vitamins & Nutrition Products segment, which accounts for £86.15 million. The company's financial performance is highlighted by a gross profit margin that reflects its efficiency in managing production and distribution costs.

Applied Nutrition, a nimble player in the UK market, has caught attention with its recent addition to the FTSE All-Share Index. Over the past year, its earnings surged by 37.5%, outpacing the Personal Products industry's growth of 9.7%. The company is debt-free and boasts high-quality non-cash earnings, reflecting strong financial health. With a levered free cash flow rising from £2.25M in 2021 to £5.31M in 2024 and trading at 30% below estimated fair value, it presents an intriguing opportunity for investors seeking growth potential within this sector. Earnings are projected to grow annually by nearly 12%.

McBride (LSE:MCB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: McBride plc, with a market cap of £256.73 million, manufactures and sells private label household and personal care products to retailers and brand owners across the United Kingdom, Europe, Asia-Pacific, and other international markets.

Operations: The company operates through five segments: Liquids, Powders, Unit dosing, Aerosols, and Asia Pacific. It focuses on manufacturing private label household and personal care products for various markets.

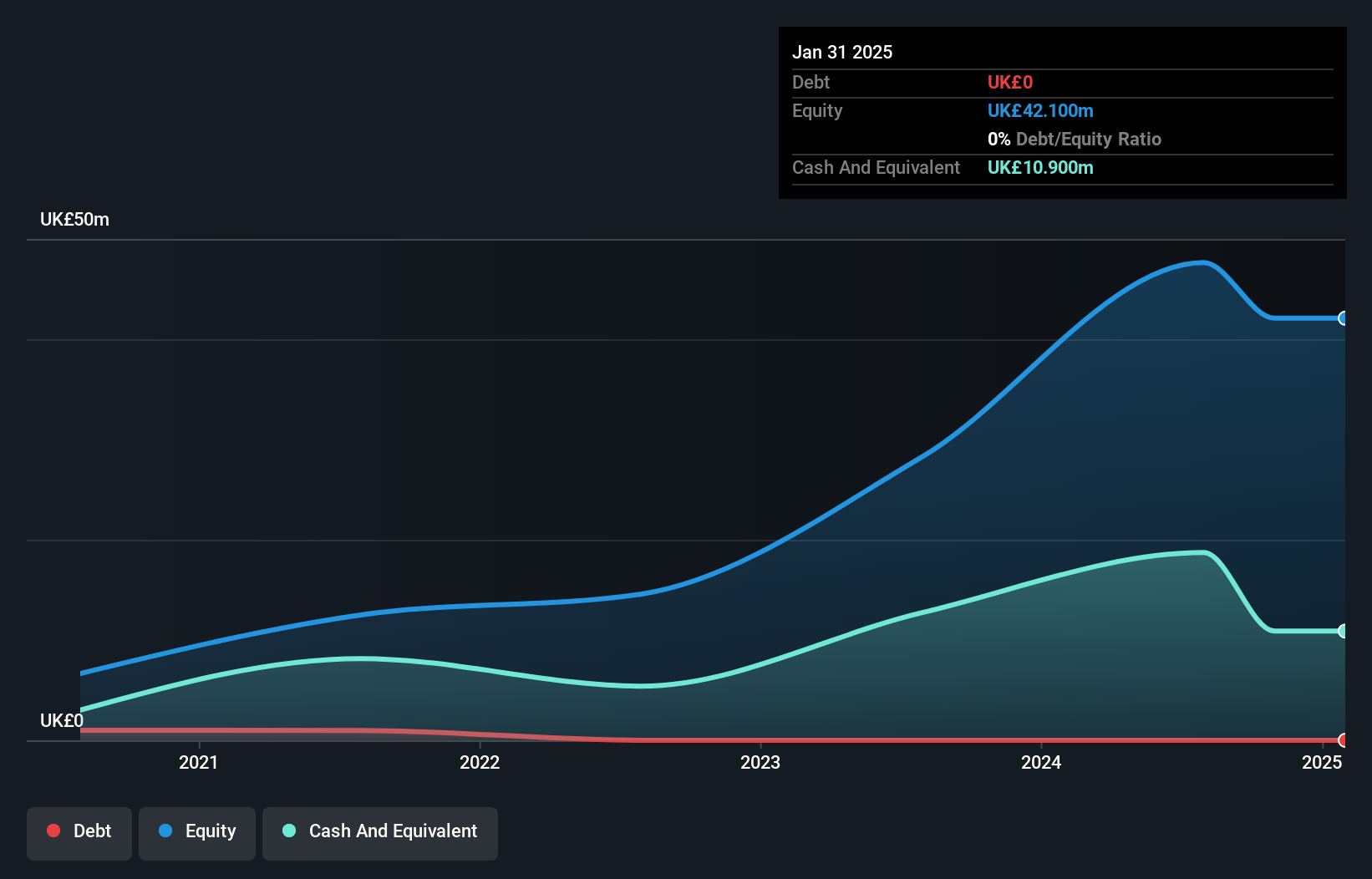

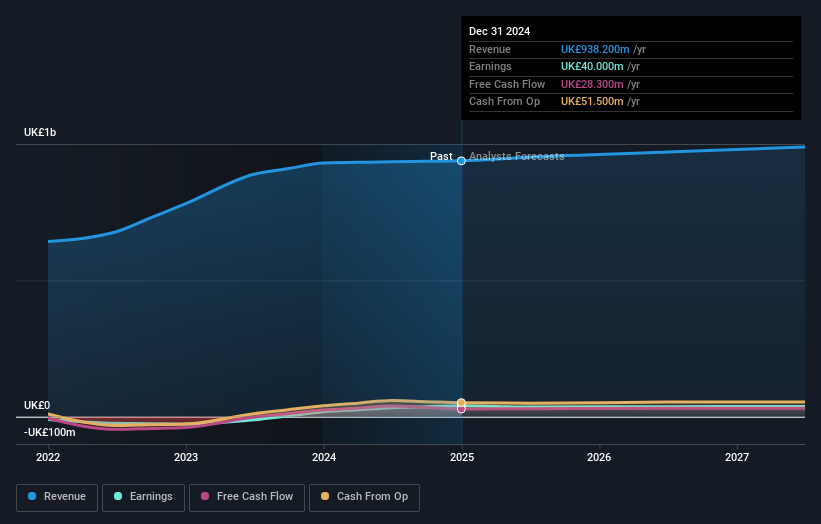

McBride, a notable player in the UK market, has shown impressive earnings growth of 122% over the past year, outpacing its industry peers. The company's net income for the recent half-year was £19.4 million, up from £12.7 million previously. Despite a high net debt to equity ratio of 135.8%, McBride's interest payments are well covered with an EBIT coverage of 5.9 times. The firm trades at a significant discount to its estimated fair value and benefits from improved financing terms after securing a €200 million Revolving Credit Facility, enhancing its financial flexibility and commitment to sustainability goals.

- Take a closer look at McBride's potential here in our health report.

Understand McBride's track record by examining our Past report.

ME Group International (LSE:MEGP)

Simply Wall St Value Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £828.99 million.

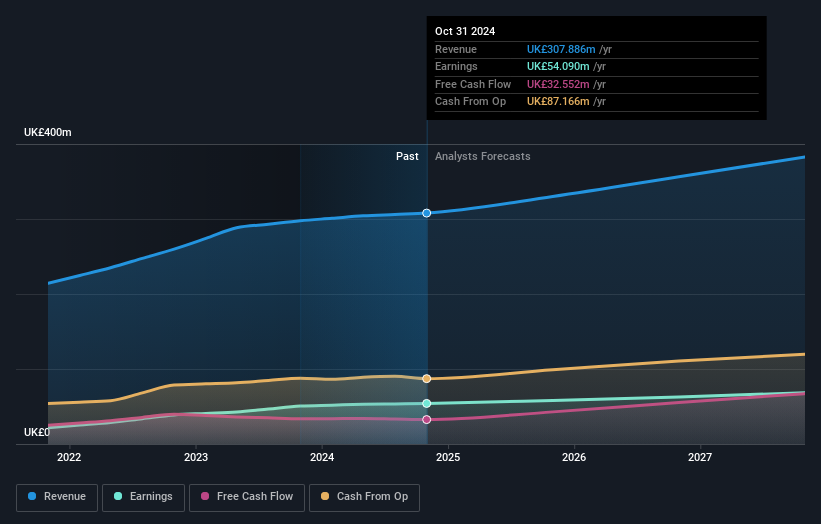

Operations: ME Group International generates revenue primarily from its personal services segment, which contributed £307.89 million. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of its operations and cost management strategies.

ME Group International seems to be a promising player in the UK market, with its earnings showcasing high quality over recent years. The company reported net income of £54.09 million for 2024, up from £50.67 million the previous year, reflecting a steady growth trajectory. With a debt-to-equity ratio reduced to 26.7% over five years and more cash than total debt, financial stability appears robust. Trading at 51.8% below estimated fair value suggests potential undervaluation compared to peers and industry standards, while its earnings per share increased to £0.1436 from £0.134 last year, indicating solid performance improvements across the board.

Next Steps

- Unlock our comprehensive list of 64 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MCB

McBride

Manufactures and sells private label household and personal care products to retailers and brand owners in the United Kingdom, Germany, France, Italy, Spain, rest of Europe, Asia-Pacific, and internationally.It operates through five segments: Liquids, Powders, Unit dosing, Aerosols, and Asia Pacific.

Undervalued with solid track record.

Market Insights

Community Narratives