- United Kingdom

- /

- Professional Services

- /

- AIM:PPHC

UK Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, underscoring the interconnectedness of global markets and their impact on domestic indices. In such volatile conditions, growth companies with high insider ownership can be particularly intriguing to investors as they often signal strong confidence in the company's prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 23.6% | 57.8% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.6% | 62% |

| Brave Bison Group (AIM:BBSN) | 32.1% | 115.0% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 40.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services across the United Kingdom and has a market cap of £395.27 million.

Operations: The company generates revenue of £289.64 million from its financial services offerings in the UK.

Insider Ownership: 18.2%

Earnings Growth Forecast: 19.1% p.a.

Mortgage Advice Bureau (Holdings) demonstrates solid growth potential with earnings forecasted to grow 19.1% annually, surpassing the UK market average. Despite a slower revenue growth rate of 11%, it remains above the market's 4.1%. Recent earnings doubled compared to last year, reflecting strong performance, though dividend payouts have decreased as part of strategic distribution adjustments. Insider buying has been more prevalent than selling recently, indicating confidence in future prospects despite an unstable dividend history.

- Dive into the specifics of Mortgage Advice Bureau (Holdings) here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Mortgage Advice Bureau (Holdings) is trading beyond its estimated value.

Public Policy Holding Company (AIM:PPHC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Public Policy Holding Company, Inc. offers consulting services in the United States and has a market cap of £277.74 million.

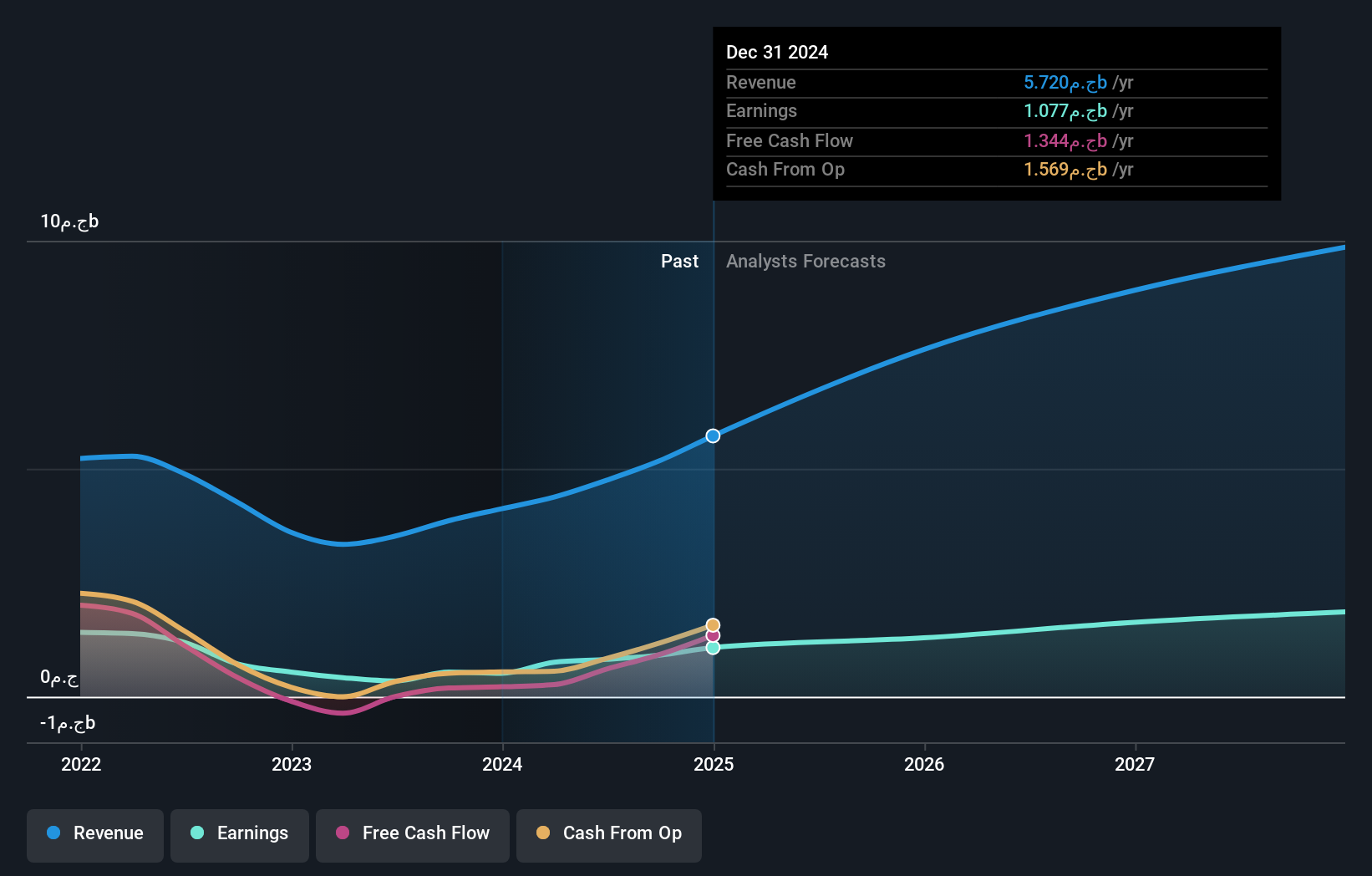

Operations: The company's revenue segments include Government Relations Consulting at $105.60 million, Compliance and Insights Services at $11.70 million, and Corporate Communications & Public Affairs Consulting at $49.02 million.

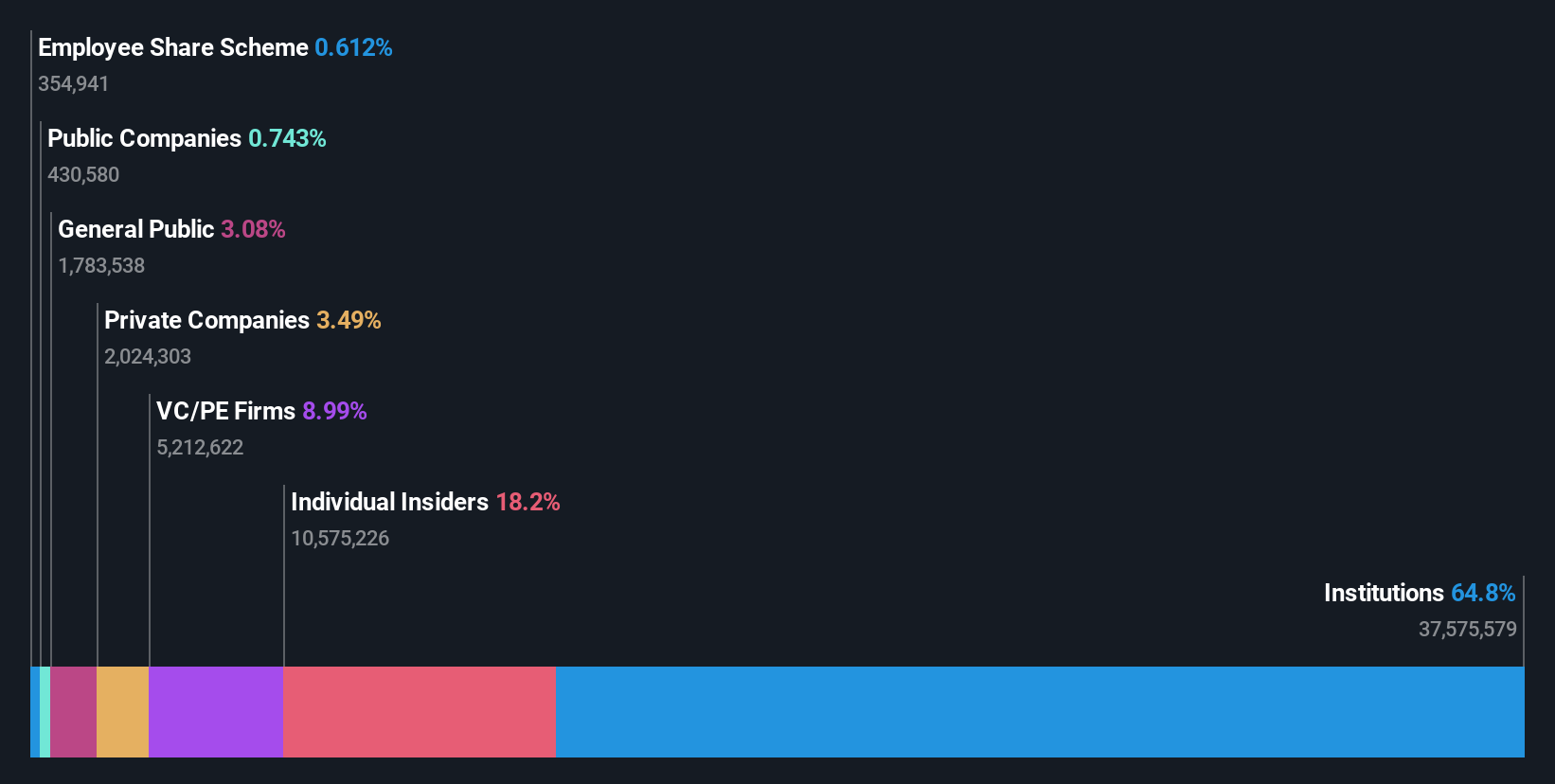

Insider Ownership: 17.4%

Earnings Growth Forecast: 123.9% p.a.

Public Policy Holding Company is expected to become profitable within three years, with earnings projected to grow significantly at 123.94% annually. Although revenue growth is slower at 9.5% annually, it still exceeds the UK market average of 4.1%. The company trades well below its estimated fair value and has recently filed a $60 million equity offering while preparing for a Nasdaq listing to enhance capital access and shareholder liquidity amidst board changes and dividend reductions.

- Unlock comprehensive insights into our analysis of Public Policy Holding Company stock in this growth report.

- Our valuation report here indicates Public Policy Holding Company may be overvalued.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering medical diagnostics services, with a market cap of $319.73 million.

Operations: Integrated Diagnostics Holdings plc operates as a consumer healthcare provider specializing in medical diagnostics services.

Insider Ownership: 27.9%

Earnings Growth Forecast: 21% p.a.

Integrated Diagnostics Holdings is experiencing substantial growth, with half-year sales rising to EGP 3.54 billion from EGP 2.50 billion year-on-year and net income increasing slightly. The company forecasts over 30% revenue growth for 2025, surpassing UK market expectations. Despite high share price volatility, it trades significantly below its estimated fair value and shows strong earnings growth potential at 21% annually. However, the dividend track record remains unstable despite robust financial performance indicators.

- Click to explore a detailed breakdown of our findings in Integrated Diagnostics Holdings' earnings growth report.

- According our valuation report, there's an indication that Integrated Diagnostics Holdings' share price might be on the cheaper side.

Taking Advantage

- Click through to start exploring the rest of the 58 Fast Growing UK Companies With High Insider Ownership now.

- Contemplating Other Strategies? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PPHC

Public Policy Holding Company

Provides consulting services in the United States.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives