- United Kingdom

- /

- Medical Equipment

- /

- AIM:TSTL

European Small Caps With Insider Buying Highlight 3 Undervalued Picks

Reviewed by Simply Wall St

In recent weeks, the European market has faced challenges, with the pan-European STOXX Europe 600 Index declining by 1.54% amid concerns over Middle East tensions and economic uncertainties. Despite these hurdles, small-cap stocks continue to capture investor interest due to their potential for growth and resilience in navigating fluctuating market conditions. Identifying promising small-cap opportunities often involves looking at factors such as insider buying trends, which can signal confidence in a company's prospects despite broader economic pressures.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.7x | 0.5x | 34.68% | ★★★★★☆ |

| Stelrad Group | 12.3x | 0.7x | 37.85% | ★★★★★☆ |

| Nyab | 21.4x | 0.9x | 33.96% | ★★★★☆☆ |

| Italmobiliare | 11.2x | 1.5x | -201.12% | ★★★☆☆☆ |

| Tristel | 31.7x | 4.5x | 1.62% | ★★★☆☆☆ |

| A.G. BARR | 19.2x | 1.8x | 44.14% | ★★★☆☆☆ |

| Absolent Air Care Group | 22.1x | 1.7x | 49.73% | ★★★☆☆☆ |

| Fuller Smith & Turner | 12.0x | 0.9x | -33.46% | ★★★☆☆☆ |

| Eastnine | 19.0x | 9.1x | 37.08% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.7x | 38.28% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: B.P. Marsh & Partners is a specialist private equity investor focusing on the financial services sector, with a market cap of £115.24 million.

Operations: The company's revenue is primarily derived from consultancy services and trading investments in financial services, with the latest reported revenue at £115.24 million. The gross profit margin has shown an upward trend, reaching 88.14% in recent periods. Operating expenses are consistently minimal or non-existent, contributing positively to net income margins that have also increased over time, currently at 86.34%.

PE: 2.6x

B.P. Marsh & Partners, a smaller company with potential for growth, reported impressive financial results for the year ending January 31, 2025. Revenue more than doubled to £115.24 million from the previous year's £51.17 million, while net income also saw significant growth to £99.5 million from £42.53 million. Insider confidence is evident with recent buybacks totaling 156,702 shares worth £0.84 million between August 2024 and January 2025, suggesting management's belief in the company's value proposition amidst its high-quality earnings profile and strategic dividend proposals set for July 2025 approval.

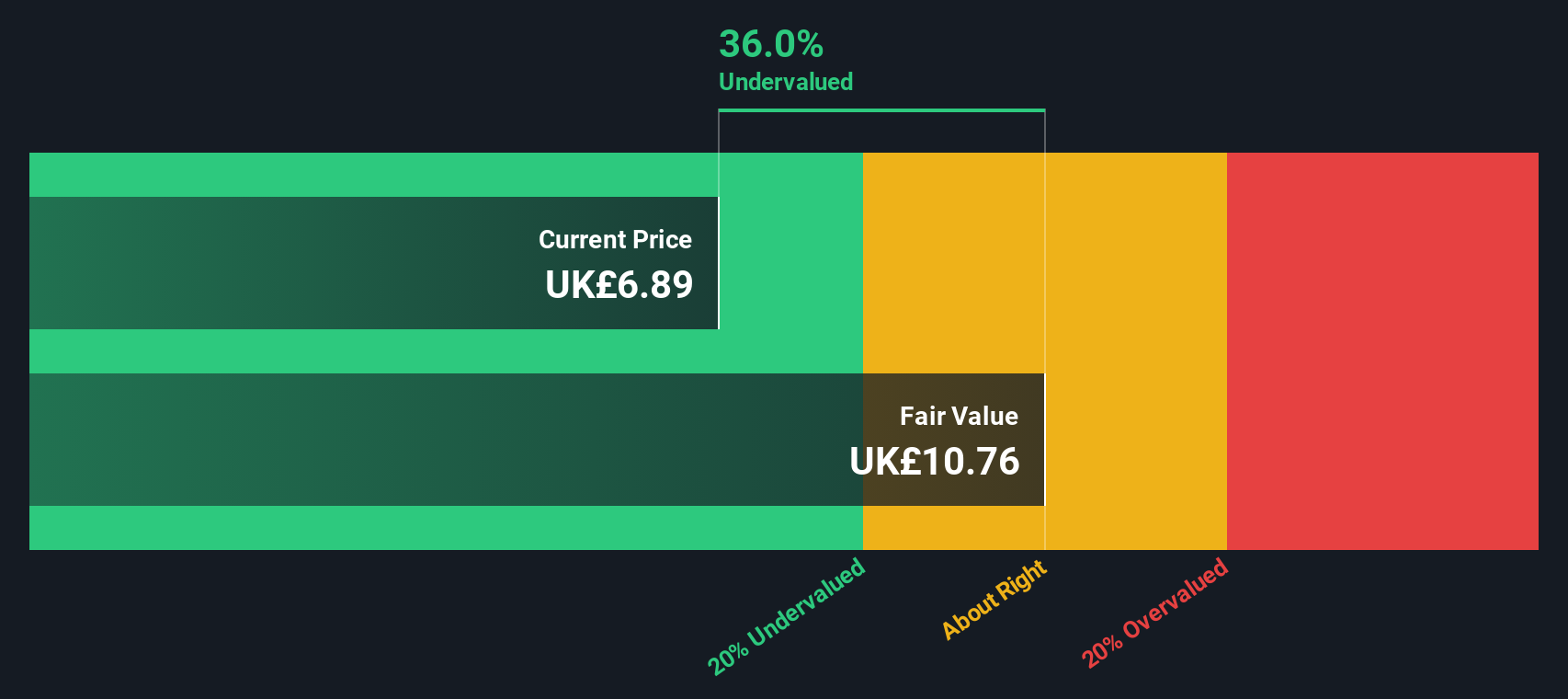

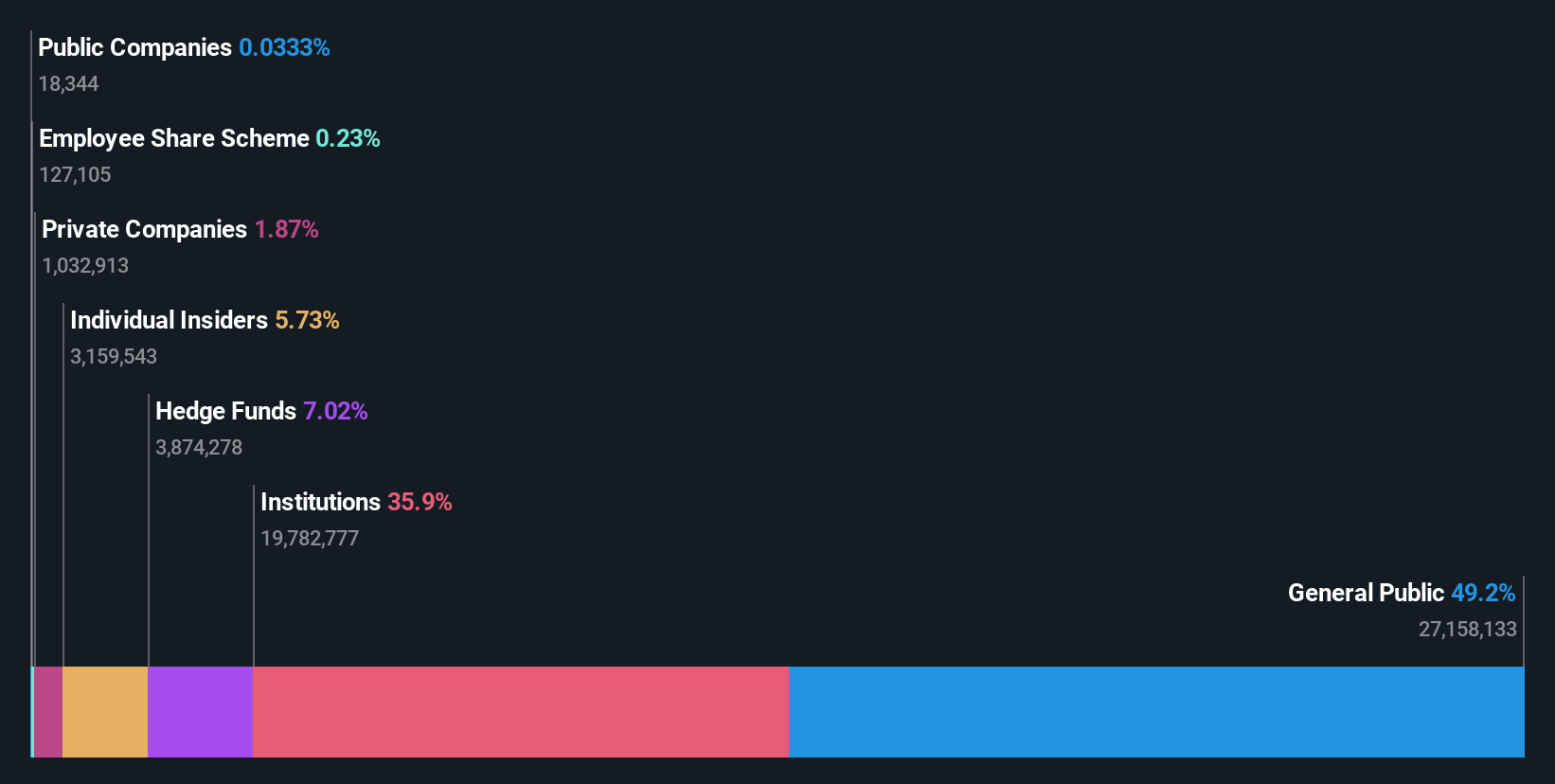

Tristel (AIM:TSTL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tristel is a company specializing in infection prevention and contamination control products, primarily serving the hospital medical device decontamination and environmental surface disinfection markets, with a market cap of £0.24 billion.

Operations: The primary revenue stream is from Hospital Medical Device Decontamination, contributing £37.68 million, followed by Hospital Environmental Surface Disinfection at £3.51 million. The company has experienced a notable trend in its gross profit margin, which reached 81.42% as of December 2024. Operating expenses have been substantial, with General & Administrative Expenses being the largest component at £24.13 million for the same period.

PE: 31.7x

Tristel, a company focused on infection control products, has recently gained FDA clearance for Tristel OPH, a high-level disinfectant foam for ophthalmic devices. This development offers a practical alternative to outdated disinfection methods in the US market. Despite relying solely on external borrowing for funding, which carries higher risk compared to customer deposits, insider confidence is evident with recent share purchases by executives in early 2025. Earnings are projected to grow at 19% annually.

- Click to explore a detailed breakdown of our findings in Tristel's valuation report.

Assess Tristel's past performance with our detailed historical performance reports.

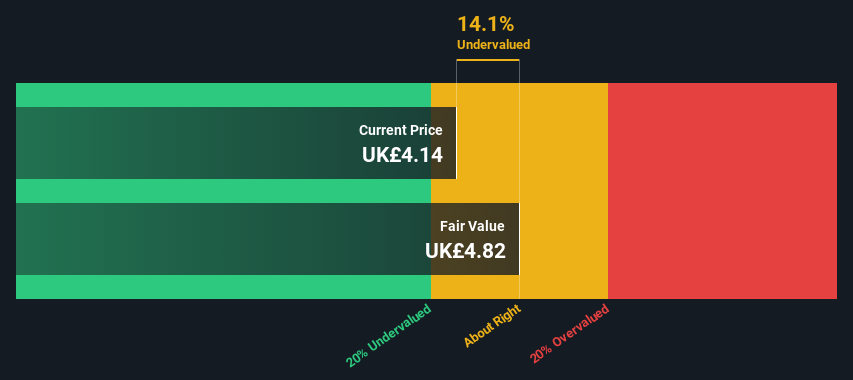

Fuller Smith & Turner (LSE:FSTA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fuller Smith & Turner operates a portfolio of tenanted inns and managed pubs and hotels, with a focus on hospitality services, and has a market capitalization of approximately £0.56 billion.

Operations: The company generates revenue primarily from its Managed Pubs and Hotels segment, with a smaller contribution from Tenanted Inns. Over recent periods, the gross profit margin has shown an upward trend, reaching 32.21% in March 2025. Operating expenses have been a significant component of costs, with notable amounts allocated to depreciation and amortization expenses.

PE: 12.0x

Fuller, Smith & Turner, a European company with a small market capitalization, recently reported significant financial growth. For the year ending March 2025, sales increased to £376.3 million from £359.1 million the previous year, while net income rose substantially to £27.2 million from £9.1 million. The board proposed an 11% increase in dividends, reflecting confidence in future performance despite earnings forecasted to decline by 0.6% annually over the next three years due to large one-off items impacting results and reliance on external borrowing for funding without customer deposits as a buffer.

Where To Now?

- Reveal the 70 hidden gems among our Undervalued European Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tristel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TSTL

Tristel

Develops, manufactures, and sells infection prevention products in the United Kingdom, Australia, Germany, Western Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives