- United Kingdom

- /

- Software

- /

- AIM:TRCS

3 UK Stocks That May Be Priced Below Intrinsic Value In November 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting the global interconnectedness of economies. In such a climate, identifying stocks that may be priced below their intrinsic value becomes crucial for investors seeking potential opportunities amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ConvaTec Group (LSE:CTEC) | £2.154 | £3.91 | 44.9% |

| Gaming Realms (AIM:GMR) | £0.375 | £0.74 | 49% |

| GlobalData (AIM:DATA) | £2.02 | £3.75 | 46.1% |

| Informa (LSE:INF) | £8.146 | £15.46 | 47.3% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Mpac Group (AIM:MPAC) | £4.90 | £8.98 | 45.4% |

| Quartix Technologies (AIM:QTX) | £1.665 | £3.08 | 45.9% |

| Foxtons Group (LSE:FOXT) | £0.584 | £1.06 | 44.7% |

| Auction Technology Group (LSE:ATG) | £4.69 | £8.44 | 44.5% |

| Genel Energy (LSE:GENL) | £0.754 | £1.45 | 48% |

We'll examine a selection from our screener results.

GB Group (AIM:GBG)

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets; it has a market cap of £865.76 million.

Operations: The company's revenue is derived from three main segments: Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million).

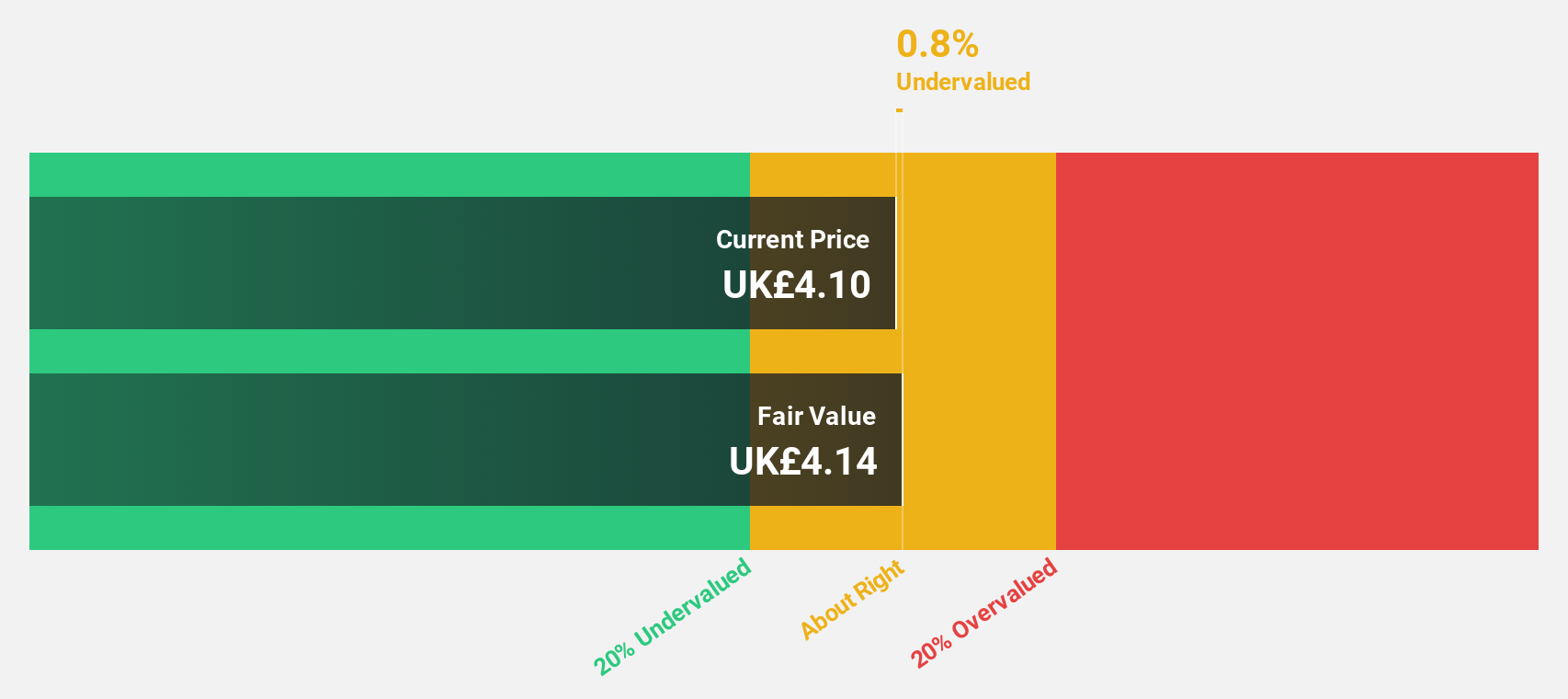

Estimated Discount To Fair Value: 30.2%

GB Group is trading at £3.43, below its estimated fair value of £4.92, indicating it may be undervalued based on cash flows. Analysts expect revenue to grow by 6.1% annually, outpacing the UK market's 3.6%. The company's earnings are forecast to grow significantly at 90.56% per year and become profitable within three years, although return on equity remains low at 3.4%. Recent announcements include upcoming sales results for October 2024.

- Our growth report here indicates GB Group may be poised for an improving outlook.

- Dive into the specifics of GB Group here with our thorough financial health report.

Tracsis (AIM:TRCS)

Overview: Tracsis plc, along with its subsidiaries, offers software and hardware solutions as well as data analytics/GIS services for the rail, traffic data, and transportation industries, with a market cap of £195.77 million.

Operations: The company generates revenue from two main segments: Rail Technology & Services, contributing £34.59 million, and Data, Analytics, Consultancy & Events, contributing £44.80 million.

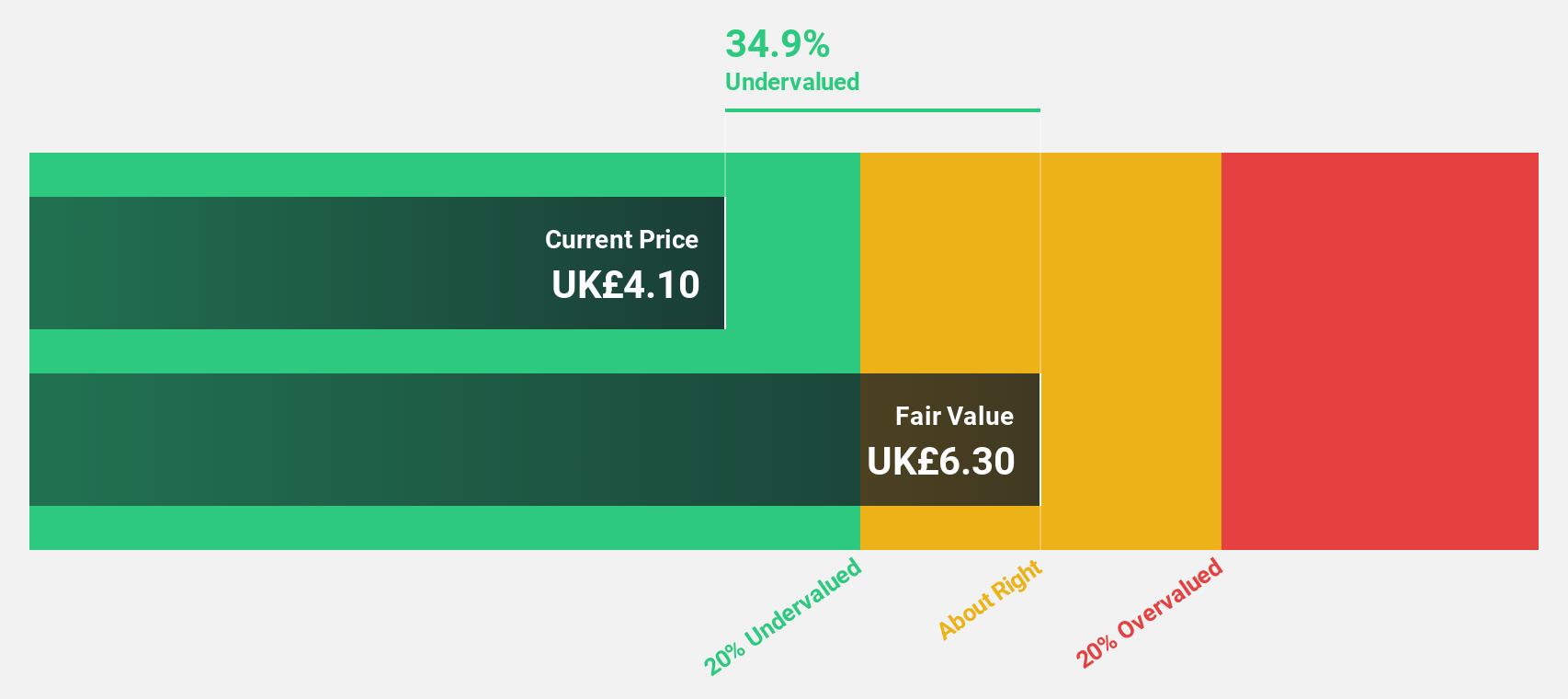

Estimated Discount To Fair Value: 35.1%

Tracsis, trading at £6.45, is undervalued with a fair value estimate of £9.93 based on discounted cash flow analysis. Analysts predict earnings to grow significantly at 40.64% annually, surpassing the UK market's growth rate of 14.4%. Revenue is expected to increase by 6.3% per year, also outpacing the broader market growth of 3.6%. Despite high share price volatility recently, consensus suggests a potential price rise of 96.3%.

- Our comprehensive growth report raises the possibility that Tracsis is poised for substantial financial growth.

- Click here to discover the nuances of Tracsis with our detailed financial health report.

Tristel (AIM:TSTL)

Overview: Tristel plc develops, manufactures, and sells infection prevention products in the United Kingdom and internationally, with a market cap of £200.13 million.

Operations: The company's revenue is primarily derived from Hospital Medical Device Decontamination (£36.34 million) and Hospital Environmental Surface Disinfection (£3.44 million).

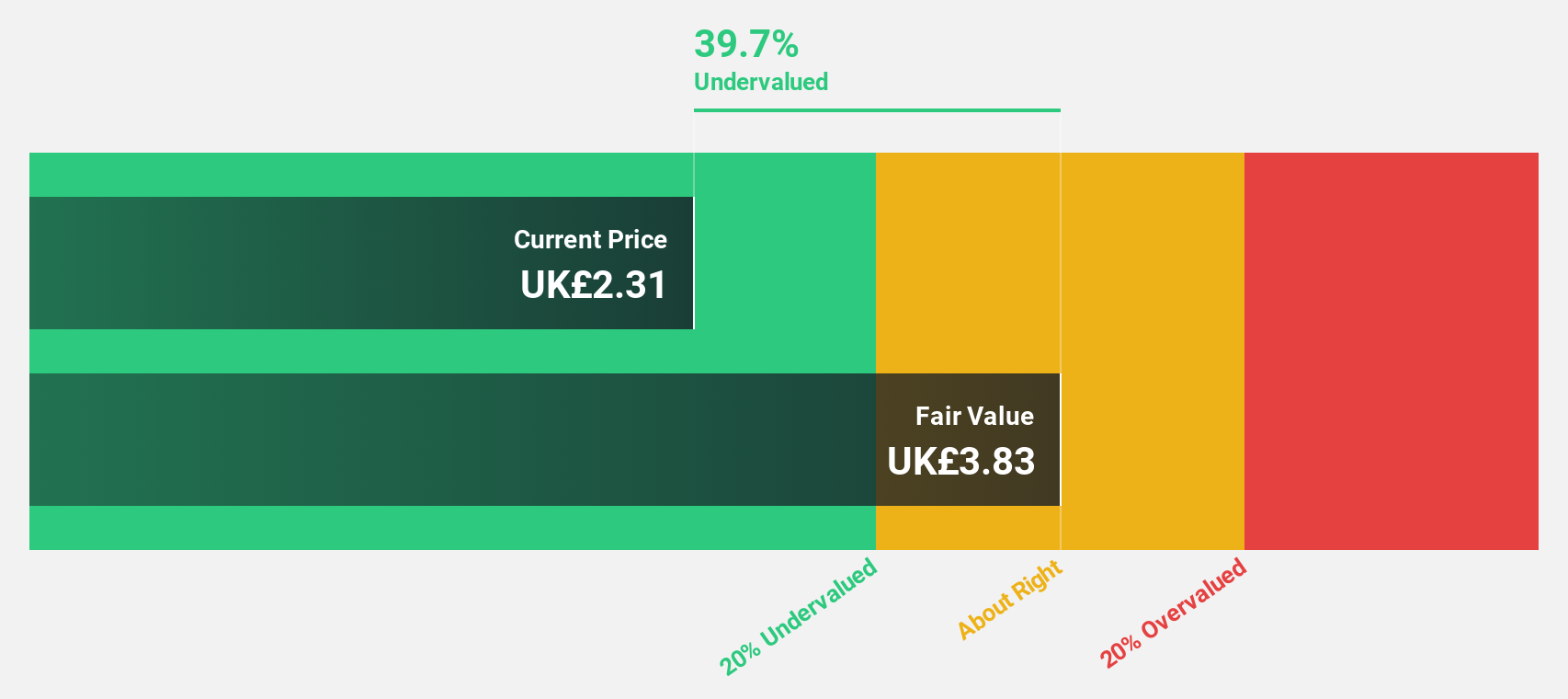

Estimated Discount To Fair Value: 12.1%

Tristel, with a trading price of £4.20, is undervalued relative to its fair value estimate of £4.78 based on discounted cash flow analysis. The company's revenue grew to £41.93 million from £36.01 million last year, while net income increased to £6.49 million from £4.46 million, reflecting robust financial health despite recent insider selling activity and a dividend not fully covered by earnings. Revenue growth is forecast at 10.3% annually, outpacing the UK market's 3.6%.

- According our earnings growth report, there's an indication that Tristel might be ready to expand.

- Navigate through the intricacies of Tristel with our comprehensive financial health report here.

Summing It All Up

- Embark on your investment journey to our 56 Undervalued UK Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tracsis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRCS

Tracsis

Provides software and hardware, data analytics/GIS services for the rail, traffic data, and transportation industries in the United Kingdom, Ireland, rest of Europe, Europe, North America, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives