- United Kingdom

- /

- Healthcare Services

- /

- AIM:PHSC

It Looks Like The CEO Of PHSC plc (LON:PHSC) May Be Underpaid Compared To Peers

The solid performance at PHSC plc (LON:PHSC) has been impressive and shareholders will probably be pleased to know that CEO Stephen King has delivered. This would be kept in mind at the upcoming AGM on 30 September 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

Check out our latest analysis for PHSC

How Does Total Compensation For Stephen King Compare With Other Companies In The Industry?

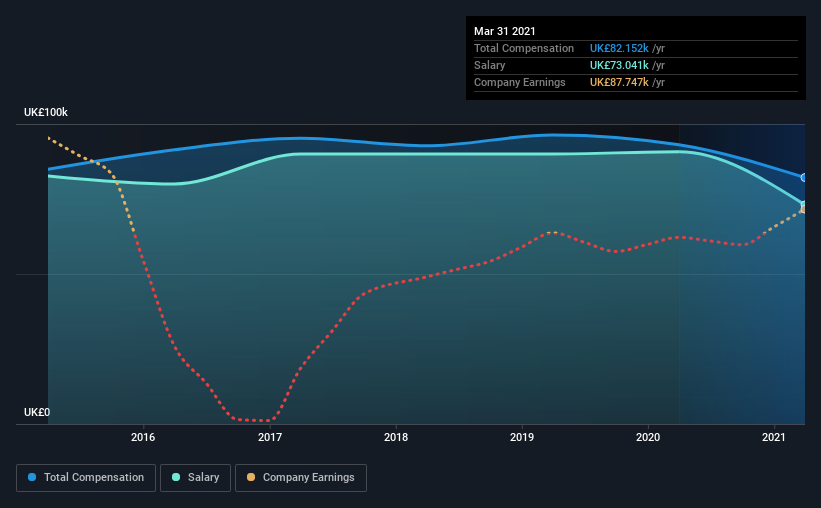

Our data indicates that PHSC plc has a market capitalization of UK£2.9m, and total annual CEO compensation was reported as UK£82k for the year to March 2021. We note that's a decrease of 12% compared to last year. In particular, the salary of UK£73.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under UK£146m, the reported median total CEO compensation was UK£147k. This suggests that Stephen King is paid below the industry median. What's more, Stephen King holds UK£637k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£73k | UK£91k | 89% |

| Other | UK£9.1k | UK£2.3k | 11% |

| Total Compensation | UK£82k | UK£93k | 100% |

Speaking on an industry level, nearly 66% of total compensation represents salary, while the remainder of 34% is other remuneration. PHSC is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

PHSC plc's Growth

Over the past three years, PHSC plc has seen its earnings per share (EPS) grow by 92% per year. Its revenue is down 26% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has PHSC plc Been A Good Investment?

Most shareholders would probably be pleased with PHSC plc for providing a total return of 139% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for PHSC (1 is a bit concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading PHSC or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:PHSC

PHSC

Through its subsidiaries, engages in health, safety, hygiene, and environmental consultancy services and security solutions to the public and private sectors in the United Kingdom.

Flawless balance sheet and fair value.

Market Insights

Community Narratives