- United Kingdom

- /

- Medical Equipment

- /

- AIM:NIOX

UK Penny Stock Highlights: FIH group And 2 Other Noteworthy Companies

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. Despite these broader market pressures, certain investment opportunities remain attractive, particularly among penny stocks. Although often viewed as a relic of past speculative enthusiasm, penny stocks still present valuable prospects for growth when they are supported by strong financials and robust fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.505 | £505.45M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.81 | £307.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.725 | £219.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.879 | £325.03M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.99 | £307.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £192.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.50 | £77.24M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £2.195 | £829.03M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

FIH group (AIM:FIH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FIH group plc operates through its subsidiaries to offer services in retailing, property, automotive, insurance, tourism shipping, and fishing agency sectors in the Falkland Islands and the United Kingdom with a market cap of £26.92 million.

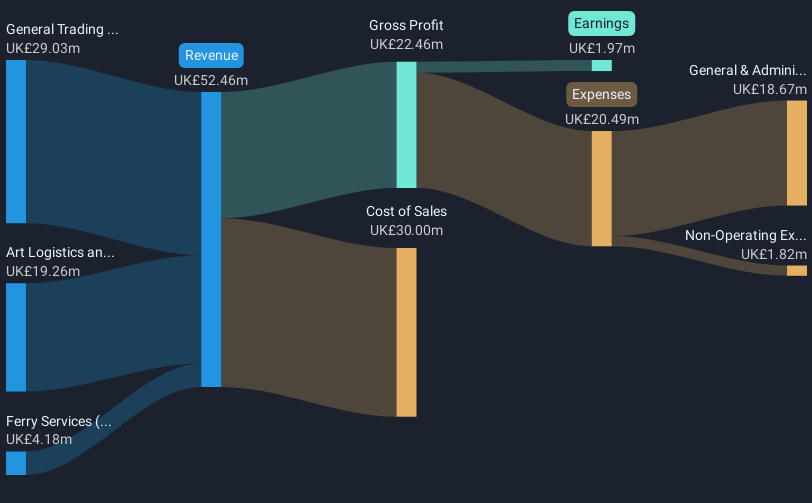

Operations: The company's revenue is derived from three main segments: Ferry Services in Portsmouth generating £4.28 million, General Trading in the Falkland Islands contributing £17 million, and Art Logistics and Storage in the United Kingdom with revenues of £19.57 million.

Market Cap: £26.92M

FIH group plc, with a market cap of £26.92 million, has faced challenges with declining sales from £52.46 million to £40.85 million and a net loss of £5.13 million for the year ended March 31, 2025. Despite this, the company maintains stable short-term assets exceeding both its long-term and short-term liabilities, alongside a satisfactory net debt to equity ratio of 9.7%. The dividend remains consistent at 6.75 pence per share despite being uncovered by earnings due to unprofitability. FIH's board is experienced with an average tenure of 3.5 years, providing some stability amidst financial volatility.

- Click here to discover the nuances of FIH group with our detailed analytical financial health report.

- Gain insights into FIH group's past trends and performance with our report on the company's historical track record.

Gattaca (AIM:GATC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gattaca plc is a human capital resources company offering contract and permanent recruitment services across private and public sectors, with a market cap of £28.40 million.

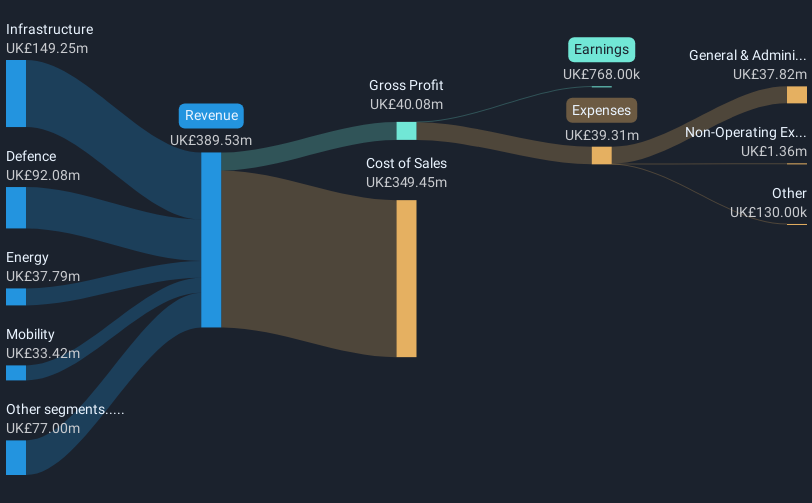

Operations: Gattaca's revenue is primarily derived from its Infrastructure segment (£151.28 million), followed by Defence (£92.76 million), Technology, Media & Telecoms (£33.71 million), Energy (£41.37 million), Mobility (£28.71 million), International operations (£2.53 million) and Gattaca Projects (£12.83 million).

Market Cap: £28.4M

Gattaca plc, with a market cap of £28.40 million, operates in the recruitment sector and shows financial stability with short-term assets (£67.8M) exceeding both short-term (£43.1M) and long-term liabilities (£1.2M). The company is debt-free, enhancing its financial flexibility despite low profit margins (0.1%) and declining earnings growth (-86.3%). Gattaca's board and management team are experienced, averaging 3.3 years in tenure; however, the dividend yield of 2.22% is not well-supported by earnings or cash flows. Revenue is projected to grow modestly at 4.32% annually, indicating potential for gradual improvement amidst current challenges.

- Unlock comprehensive insights into our analysis of Gattaca stock in this financial health report.

- Examine Gattaca's earnings growth report to understand how analysts expect it to perform.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc designs, develops, and commercializes medical devices for asthma diagnosis, monitoring, and management globally with a market cap of £292.29 million.

Operations: The company generates revenue of £41.8 million from its NIOX® segment, which focuses on medical devices for asthma-related applications.

Market Cap: £292.29M

NIOX Group, with a market cap of £292.29 million, is a penny stock focused on medical devices for asthma management. Despite becoming profitable over the past five years with significant earnings growth, recent performance has been less favorable with negative earnings growth last year and reduced profit margins from 25.8% to 8.1%. The company remains debt-free, which provides financial stability and eliminates interest coverage concerns. NIOX's short-term assets comfortably cover its liabilities, but insider selling in the past quarter may warrant caution. Earnings are forecasted to grow at 33.97% annually, suggesting potential future upside amidst current volatility challenges.

- Take a closer look at NIOX Group's potential here in our financial health report.

- Learn about NIOX Group's future growth trajectory here.

Summing It All Up

- Jump into our full catalog of 301 UK Penny Stocks here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIOX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NIOX

NIOX Group

Engages in the design, development, and commercialization of medical devices for asthma diagnosis, monitoring, and management worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives