- United Kingdom

- /

- Biotech

- /

- AIM:TRX

Kooth And 2 Other Prominent Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns over global economic recovery. Despite these broader market pressures, certain investment opportunities remain attractive to investors seeking growth potential. Penny stocks, often representing smaller or newer companies with solid fundamentals, continue to offer intriguing possibilities for those looking to uncover hidden value in the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kooth (AIM:KOO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kooth plc, with a market cap of £66.21 million, provides digital mental health services to children, young people, and adults in the United Kingdom.

Operations: The company generates revenue from its Pharmacy Services segment, which amounts to £54.17 million.

Market Cap: £66.21M

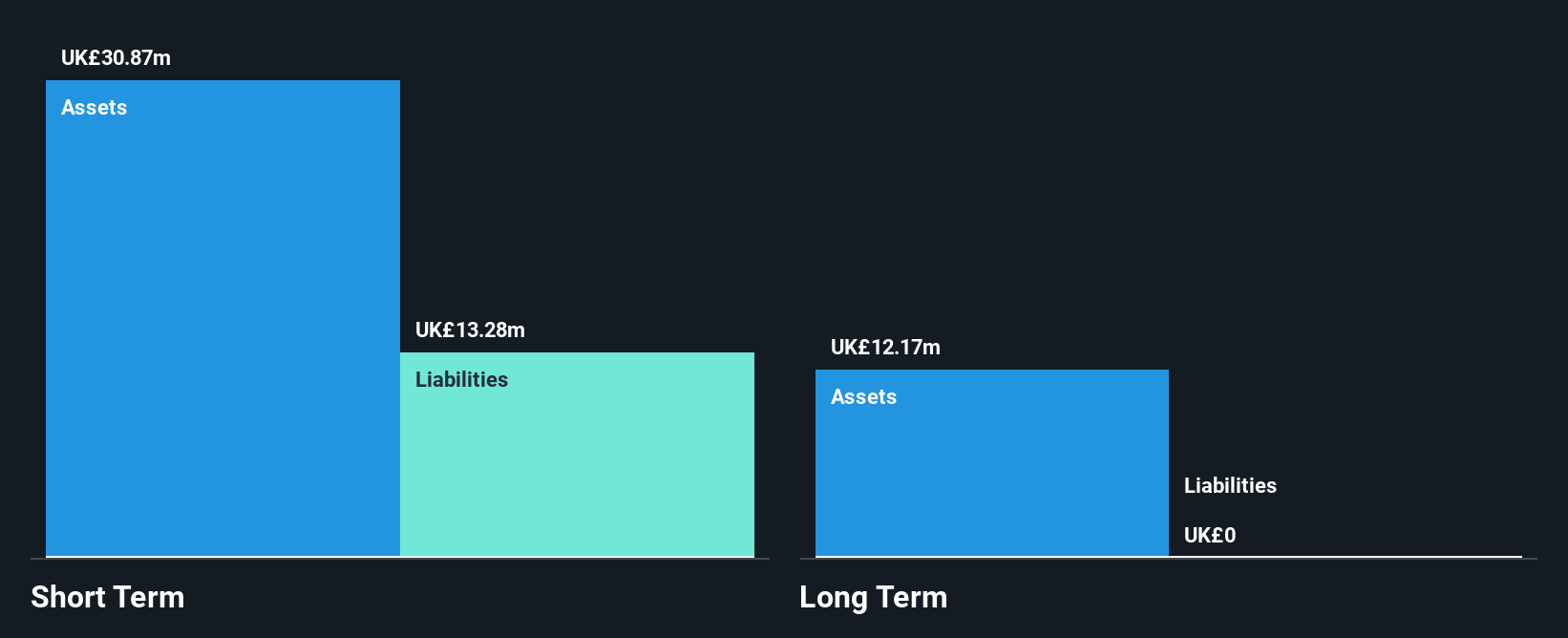

Kooth plc, with a market cap of £66.21 million, is gaining attention in the digital mental health sector. Despite having a relatively inexperienced management team, Kooth has shown strong financial health with no debt and short-term assets exceeding liabilities. The company recently became profitable and forecasts suggest continued earnings growth. Its share price remains volatile but trades significantly below estimated fair value, suggesting potential upside according to analyst consensus. Recent developments include a $1.45 million pilot contract in New Jersey, expanding its US footprint despite uncertainties following the termination notice of its Pennsylvania contract.

- Dive into the specifics of Kooth here with our thorough balance sheet health report.

- Understand Kooth's earnings outlook by examining our growth report.

Tissue Regenix Group (AIM:TRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tissue Regenix Group plc is a medical technology company that develops and commercializes platform technologies for bone graft substitutes and soft tissue in the United States and internationally, with a market cap of £42.74 million.

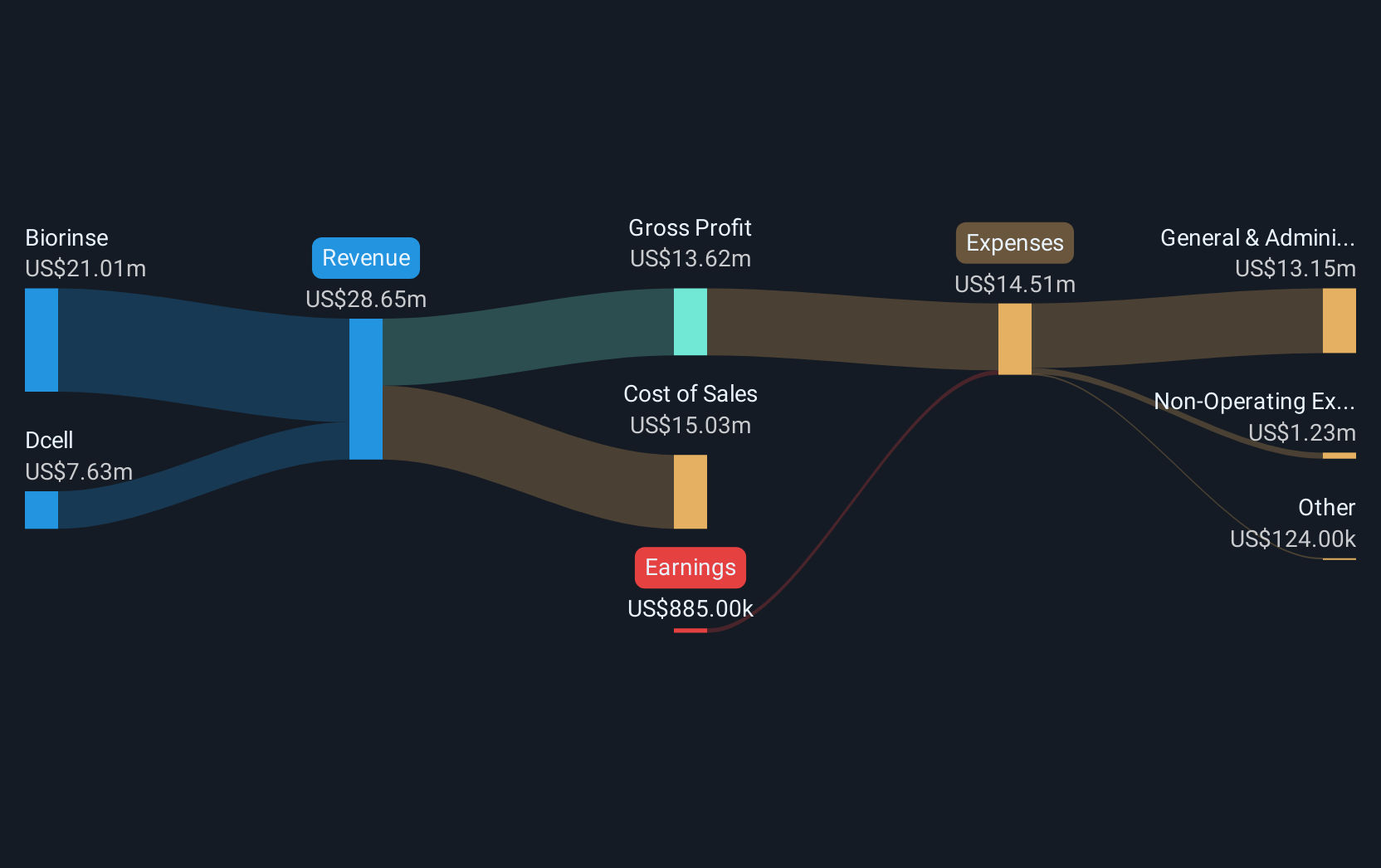

Operations: The company's revenue is derived from three segments: Dcell generating $7.24 million, GBM-V contributing $3.28 million, and Biorinse accounting for $21.28 million.

Market Cap: £42.74M

Tissue Regenix Group, with a market cap of £42.74 million, operates in the medical technology sector and has shown revenue growth from US$14.1 million to US$16.4 million over nine months ending September 2024, while reducing net losses significantly. Despite being unprofitable, it has decreased losses by 35% annually over five years and maintains a satisfactory net debt to equity ratio of 23.1%. The company is exploring strategic alternatives for shareholder value enhancement but no offers have been made yet. With sufficient cash runway exceeding three years, its financial position appears stable despite current challenges in profitability.

- Jump into the full analysis health report here for a deeper understanding of Tissue Regenix Group.

- Assess Tissue Regenix Group's future earnings estimates with our detailed growth reports.

Stelrad Group (LSE:SRAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £172.56 million.

Operations: The company generates revenue of £294.27 million from its radiator manufacturing and distribution operations.

Market Cap: £172.56M

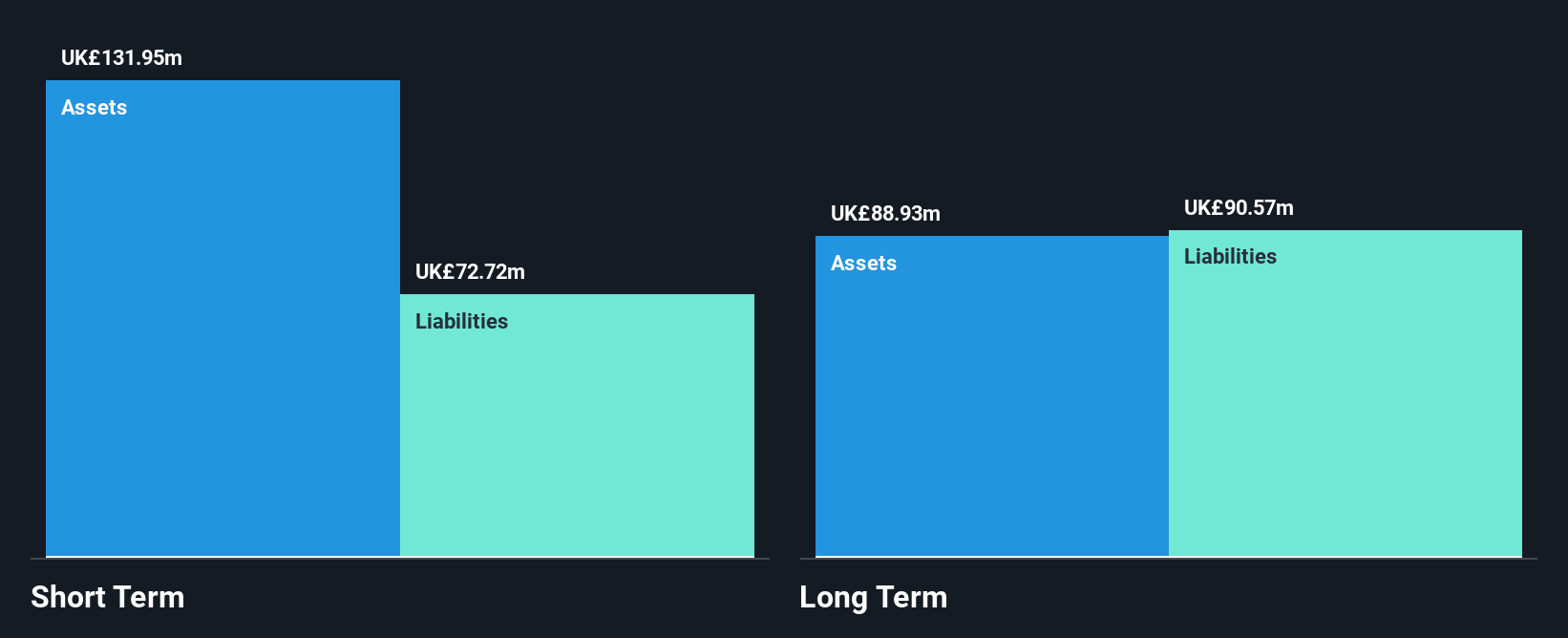

Stelrad Group PLC, with a market cap of £172.56 million, demonstrates strong financial health within the penny stock segment. The company reported revenues of £294.27 million from its radiator operations and has shown significant earnings growth, up 32.9% over the past year, surpassing its five-year average growth rate of 23.8%. Despite a high net debt to equity ratio of 116.1%, Stelrad's interest payments are well-covered by EBIT at 4.5 times coverage and operating cash flow covers debt by 37.1%. Trading below estimated fair value and analyst price targets suggest potential for price appreciation amidst stable profit margins improvement.

- Navigate through the intricacies of Stelrad Group with our comprehensive balance sheet health report here.

- Examine Stelrad Group's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Explore the 469 names from our UK Penny Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tissue Regenix Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRX

Tissue Regenix Group

A medical technology company, develops and commercializes platform technologies for bone graft substitutes, skin, and soft tissue biologics markets in the United States and internationally.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives