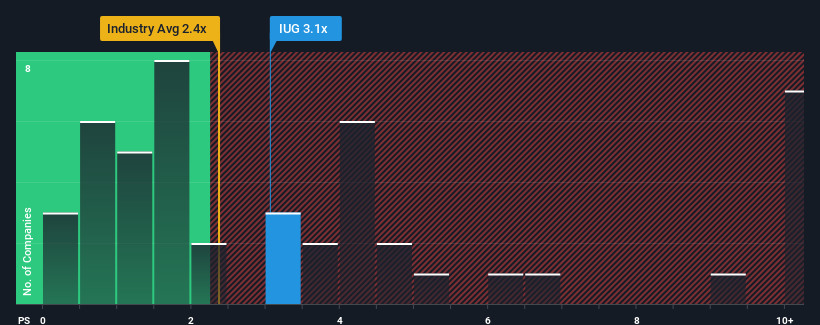

It's not a stretch to say that Intelligent Ultrasound Group plc's (LON:IUG) price-to-sales (or "P/S") ratio of 3.1x right now seems quite "middle-of-the-road" for companies in the Healthcare Services industry in the United Kingdom, where the median P/S ratio is around 3.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Intelligent Ultrasound Group

What Does Intelligent Ultrasound Group's Recent Performance Look Like?

There hasn't been much to differentiate Intelligent Ultrasound Group's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Intelligent Ultrasound Group will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Intelligent Ultrasound Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Intelligent Ultrasound Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 4.1% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 94% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 47% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 7.3%, which is noticeably less attractive.

With this information, we find it interesting that Intelligent Ultrasound Group is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Intelligent Ultrasound Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Intelligent Ultrasound Group, and understanding them should be part of your investment process.

If you're unsure about the strength of Intelligent Ultrasound Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IUG

Intelligent Ultrasound Group

Through its subsidiaries, develops, markets, and distributes medical training simulators in the United Kingdom, North America, and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives