- United Kingdom

- /

- Medical Equipment

- /

- AIM:EKF

While shareholders of EKF Diagnostics Holdings (LON:EKF) are in the red over the last five years, underlying earnings have actually grown

It is doubtless a positive to see that the EKF Diagnostics Holdings plc (LON:EKF) share price has gained some 37% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 47% in that half decade.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate half decade during which the share price slipped, EKF Diagnostics Holdings actually saw its earnings per share (EPS) improve by 11% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

The revenue decline of 2.4% isn't too bad. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

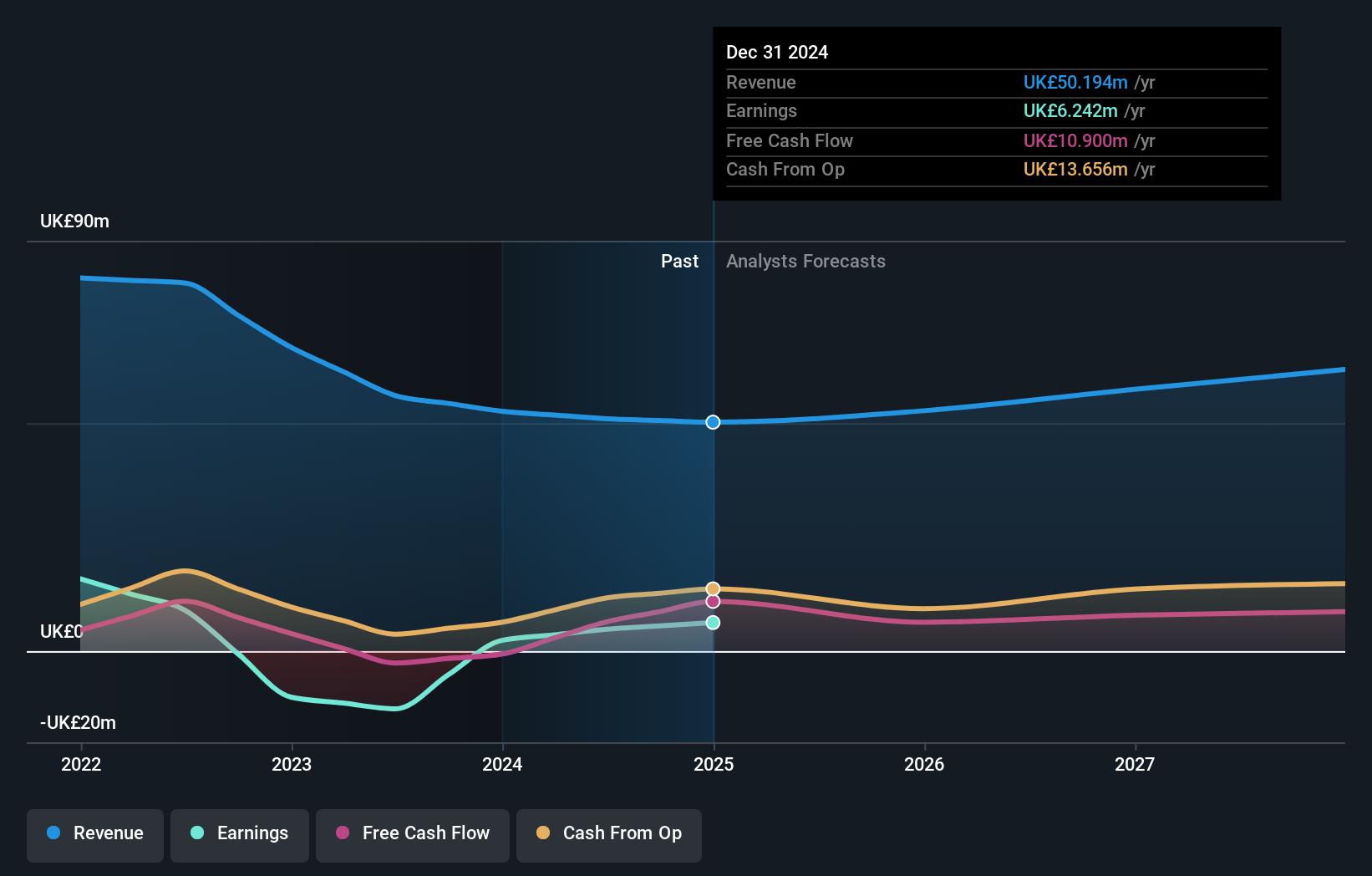

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between EKF Diagnostics Holdings' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. EKF Diagnostics Holdings' TSR of was a loss of 41% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

EKF Diagnostics Holdings provided a TSR of 7.4% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 7% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - EKF Diagnostics Holdings has 2 warning signs (and 1 which is concerning) we think you should know about.

EKF Diagnostics Holdings is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EKF Diagnostics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:EKF

EKF Diagnostics Holdings

Engages in the design, development, manufacture, and sale of diagnostic instruments, reagents, and other ancillary products in the Americas, Europe, the Middle East, Asia, Africa, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives