- United Kingdom

- /

- Medical Equipment

- /

- AIM:EKF

Rainbows and Unicorns: EKF Diagnostics Holdings plc (LON:EKF) Analysts Just Became A Lot More Optimistic

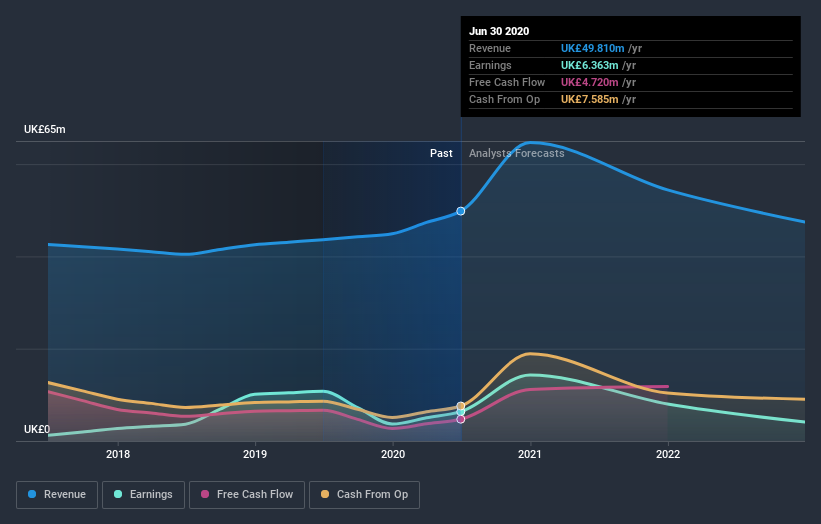

Celebrations may be in order for EKF Diagnostics Holdings plc (LON:EKF) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts have sharply increased their revenue numbers, with a view that EKF Diagnostics Holdings will make substantially more sales than they'd previously expected. Investors have been pretty optimistic on EKF Diagnostics Holdings too, with the stock up 10% to UK£0.74 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

Following the upgrade, the current consensus from EKF Diagnostics Holdings' dual analysts is for revenues of UK£60m in 2021 which - if met - would reflect a substantial 21% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of UK£52m in 2021. The consensus has definitely become more optimistic, showing a nice increase in revenue forecasts.

View our latest analysis for EKF Diagnostics Holdings

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the EKF Diagnostics Holdings' past performance and to peers in the same industry. It's clear from the latest estimates that EKF Diagnostics Holdings' rate of growth is expected to accelerate meaningfully, with the forecast 21% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 7.7% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 10% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect EKF Diagnostics Holdings to grow faster than the wider industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for EKF Diagnostics Holdings this year. They're also forecasting more rapid revenue growth than the wider market. More bullish expectations could be a signal for investors to take a closer look at EKF Diagnostics Holdings.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 3 potential warning signs with EKF Diagnostics Holdings, including its declining profit margins. You can learn more, and discover the 2 other warning signs we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading EKF Diagnostics Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EKF Diagnostics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:EKF

EKF Diagnostics Holdings

Engages in the design, development, manufacture, and sale of diagnostic instruments, reagents, and other ancillary products in the Americas, Europe, the Middle East, Asia, Africa, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.