- United Kingdom

- /

- Healthcare Services

- /

- AIM:CVSG

European Undervalued Small Caps With Insider Buying For Your Portfolio

Reviewed by Simply Wall St

As European markets show resilience with the pan-European STOXX Europe 600 Index rising by 1.77%, investors are keeping a close watch on small-cap stocks, which often react more sensitively to economic shifts and interest rate changes. In this environment, identifying undervalued small caps that display insider buying can offer unique opportunities for those looking to navigate the current market landscape effectively.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.9x | 1.5x | 31.30% | ★★★★★★ |

| Eurocell | 15.6x | 0.3x | 42.39% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.82% | ★★★★★☆ |

| Senior | 24.0x | 0.8x | 28.32% | ★★★★★☆ |

| J D Wetherspoon | 10.0x | 0.3x | 6.18% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.7x | 38.82% | ★★★★☆☆ |

| Kid | 18.0x | 1.4x | 4.83% | ★★★☆☆☆ |

| Fiskars Oyj Abp | 39.7x | 0.9x | 24.82% | ★★★☆☆☆ |

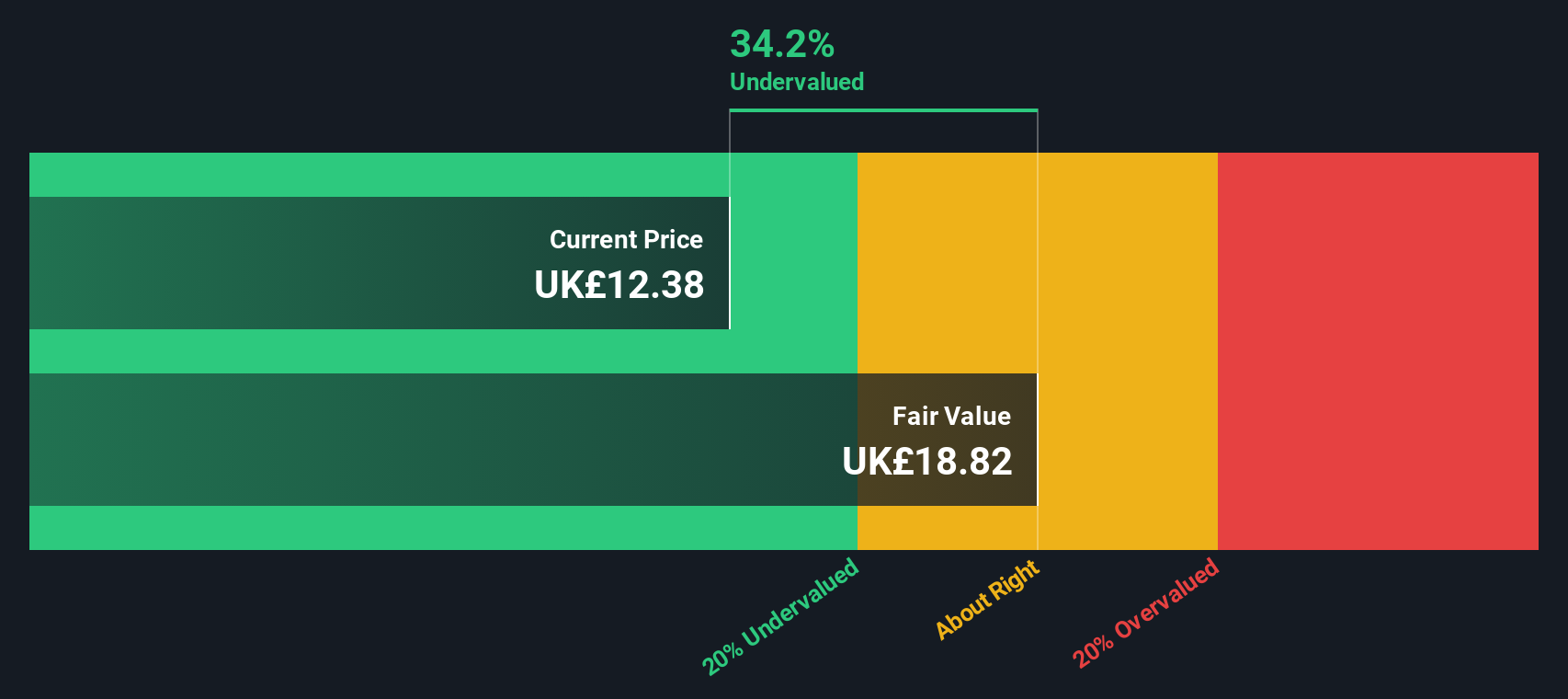

| CVS Group | 43.0x | 1.2x | 31.25% | ★★★☆☆☆ |

| Linc | NA | NA | 0.70% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CVS Group operates a network of veterinary practices, laboratories, and an online retail business, with a market cap of £1.42 billion.

Operations: CVS Group generates revenue primarily from its Veterinary Practices and Online Retail Business, with a smaller contribution from Laboratories. The company's gross profit margin has exhibited some variability, reaching 44.23% in December 2023 but later decreasing to 42.44% by June 2025. Operating expenses are significant, particularly within General & Administrative costs, which were £209.9 million as of June 2025.

PE: 43.0x

CVS Group, a smaller player in Europe, is catching attention with its share repurchase program of up to £20 million aimed at optimizing capital structure. Despite earnings not fully covering interest payments and reliance on external borrowing, the company forecasts an 18% annual earnings growth. Recent financials show sales rising to £673.2 million while net income surged to £52.8 million from £6.2 million last year, indicating potential for future value realization amidst strategic buybacks and dividend increases.

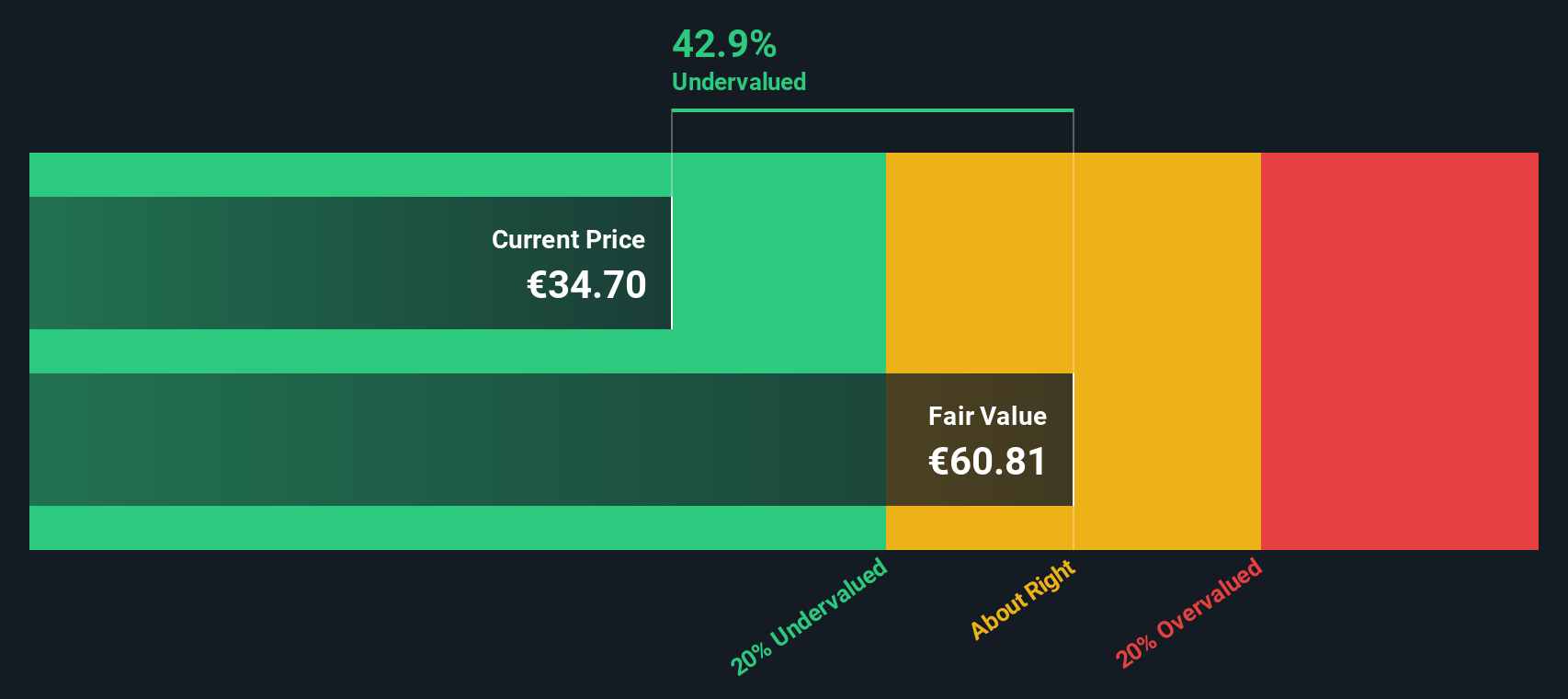

Harvia Oyj (HLSE:HARVIA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harvia Oyj is a company that specializes in the manufacturing and sale of sauna heaters, components, and related products with a market capitalization of approximately €1.29 billion.

Operations: The company generates revenue primarily from Building Materials - HVAC Equipment, with recent figures showing €196.19 million. The cost of goods sold (COGS) amounts to €71.88 million, contributing to a gross profit margin of 63.36%. Operating expenses are recorded at €87.12 million, while net income stands at €24.32 million, resulting in a net income margin of 12.40%.

PE: 31.0x

Harvia Oyj, a European sauna company, has seen insider confidence with share purchases in the past quarter. Despite its small size, Harvia's earnings for Q3 2025 showed growth, with sales rising to €46.01 million from €38.72 million the previous year and net income increasing to €6.11 million. The company faces challenges with high debt levels and volatile stock prices but is expanding in North America through strategic partnerships and leadership changes aimed at driving sustainable growth.

- Navigate through the intricacies of Harvia Oyj with our comprehensive valuation report here.

Evaluate Harvia Oyj's historical performance by accessing our past performance report.

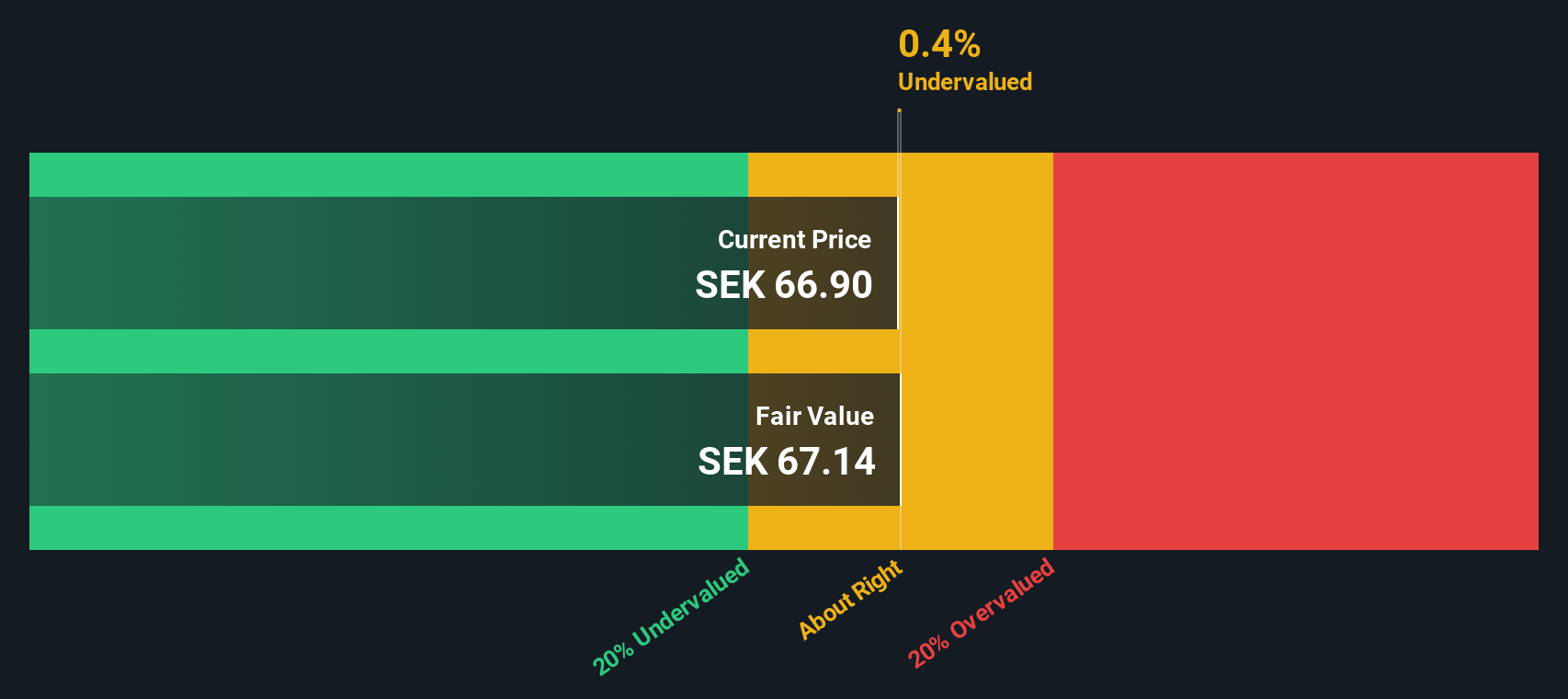

Linc (OM:LINC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Linc is an investment company focusing on both listed and unlisted holdings, with a market cap of SEK 3.92 billion.

Operations: Linc generates revenue primarily from unlisted holdings, while listed holdings and non-allocated items contribute negatively. The company consistently records a gross profit margin of 100%, indicating that its cost of goods sold is negligible or not applicable. Operating expenses are relatively low, with general and administrative expenses being the primary component. Net income margins have shown variability, with some periods exceeding 100%.

PE: -48.1x

Linc AB, a European company with a small market capitalization, recently showcased significant financial changes. In Q3 2025, it reported SEK 354.3 million in revenue and SEK 353.7 million in net income, reversing last year’s losses. However, the nine-month figures reveal challenges with negative revenue of SEK 292.49 million and a net loss of SEK 291.49 million compared to previous profits. Despite relying on external borrowing for funding, insider confidence remains high as insiders have actively purchased shares throughout this period.

- Click here to discover the nuances of Linc with our detailed analytical valuation report.

Understand Linc's track record by examining our Past report.

Make It Happen

- Discover the full array of 63 Undervalued European Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CVSG

CVS Group

Engages in veterinary, online pharmacy, and retail businesses in the United Kingdom and Australia.

Fair value with moderate growth potential.

Market Insights

Community Narratives