- United Kingdom

- /

- Medical Equipment

- /

- AIM:AMS

UK Value Stocks Trading At Up To 49.1% Estimated Discount

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China and declining commodity prices impacting key sectors. Amid these conditions, investors may find potential opportunities in undervalued stocks that offer a significant discount relative to their intrinsic value, providing a cushion against broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.68 | £12.31 | 45.7% |

| tinyBuild (AIM:TBLD) | £0.07125 | £0.13 | 45.7% |

| SigmaRoc (AIM:SRC) | £1.172 | £2.31 | 49.2% |

| Likewise Group (AIM:LIKE) | £0.26 | £0.52 | 49.8% |

| Gooch & Housego (AIM:GHH) | £5.72 | £11.08 | 48.4% |

| Forterra (LSE:FORT) | £1.822 | £3.61 | 49.6% |

| Essentra (LSE:ESNT) | £1.066 | £1.98 | 46.1% |

| Barratt Redrow (LSE:BTRW) | £3.938 | £7.54 | 47.8% |

| AstraZeneca (LSE:AZN) | £124.06 | £245.91 | 49.5% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.18 | £4.29 | 49.1% |

Underneath we present a selection of stocks filtered out by our screen.

Advanced Medical Solutions Group (AIM:AMS)

Overview: Advanced Medical Solutions Group plc develops, manufactures, and distributes products for the surgical, woundcare, and wound-closure markets across the UK, Germany, Europe, the US, and internationally with a market cap of £469.97 million.

Operations: The company's revenue is primarily derived from its Surgical segment, which generated £175.23 million, and its Woundcare segment, contributing £45.07 million.

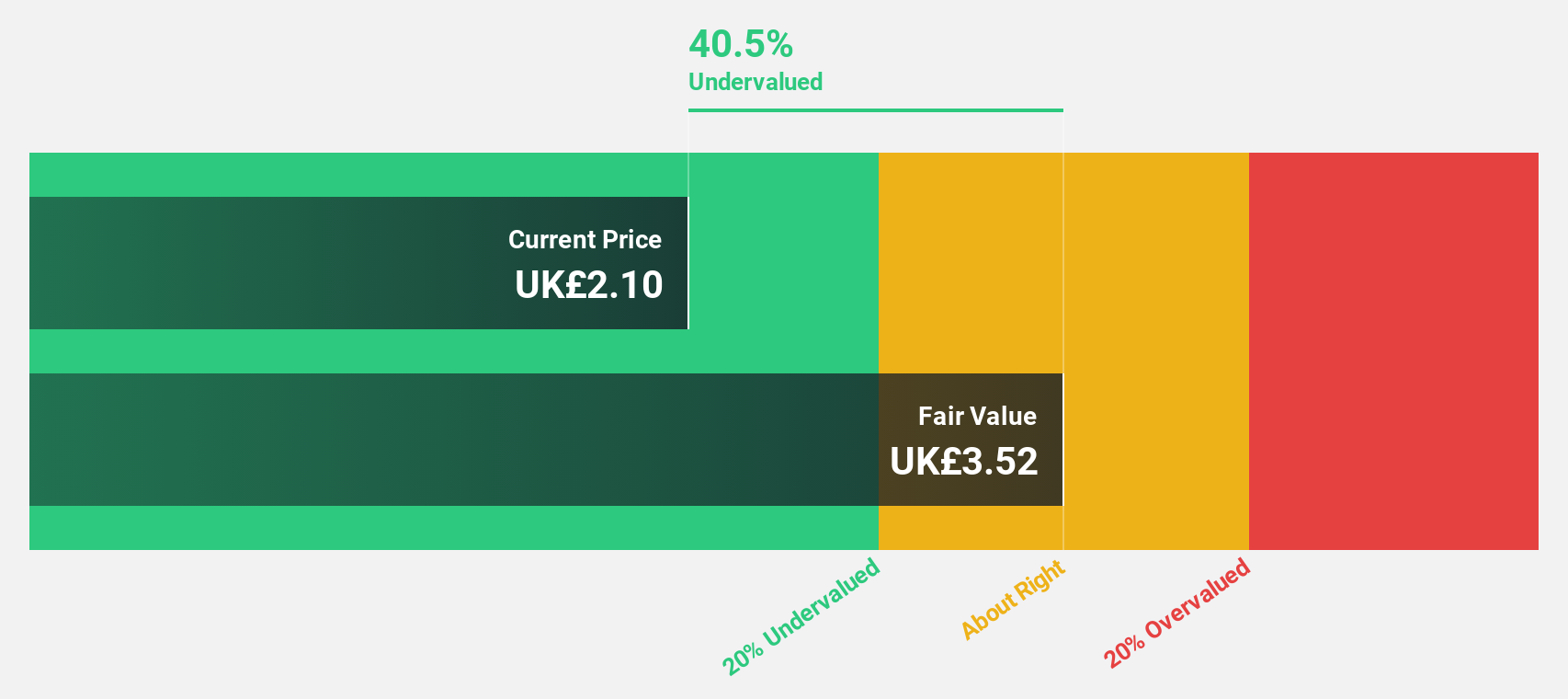

Estimated Discount To Fair Value: 49.1%

Advanced Medical Solutions Group is trading at a significant discount to its estimated fair value of £4.29, with the current price at £2.18. Recent earnings for H1 2025 showed sales of £110.77 million, up from £67.99 million a year ago, and net income increased to £6.21 million from £4.18 million, despite lower profit margins compared to last year. Forecasts indicate robust annual earnings growth of over 30%, outpacing the UK market average significantly.

- Our expertly prepared growth report on Advanced Medical Solutions Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Advanced Medical Solutions Group.

DFS Furniture (LSE:DFS)

Overview: DFS Furniture plc designs, manufactures, delivers, installs, and retails upholstered furniture in the United Kingdom and the Republic of Ireland with a market cap of £374.36 million.

Operations: The company's revenue segments include £804.60 million from DFS and £225.70 million from Sofology.

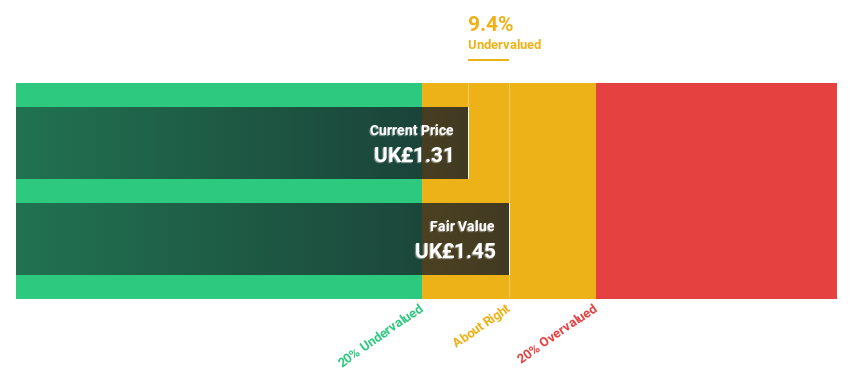

Estimated Discount To Fair Value: 42.2%

DFS Furniture is currently trading at £1.62, significantly below its estimated fair value of £2.8, indicating potential undervaluation based on cash flows. The company recently reported a return to profitability with net income of £24.2 million compared to a loss last year, and sales increased to £1.03 billion from £987.1 million previously. Earnings are expected to grow 27% annually over the next three years, surpassing the UK market's growth rate of 14.5%.

- According our earnings growth report, there's an indication that DFS Furniture might be ready to expand.

- Take a closer look at DFS Furniture's balance sheet health here in our report.

PayPoint (LSE:PAY)

Overview: PayPoint plc operates in the United Kingdom, offering payments and banking, shopping, and e-commerce services with a market cap of £460.59 million.

Operations: The company's revenue is derived from Love2shop (£147.14 million) and Pay Point (£163.58 million) segments in the UK.

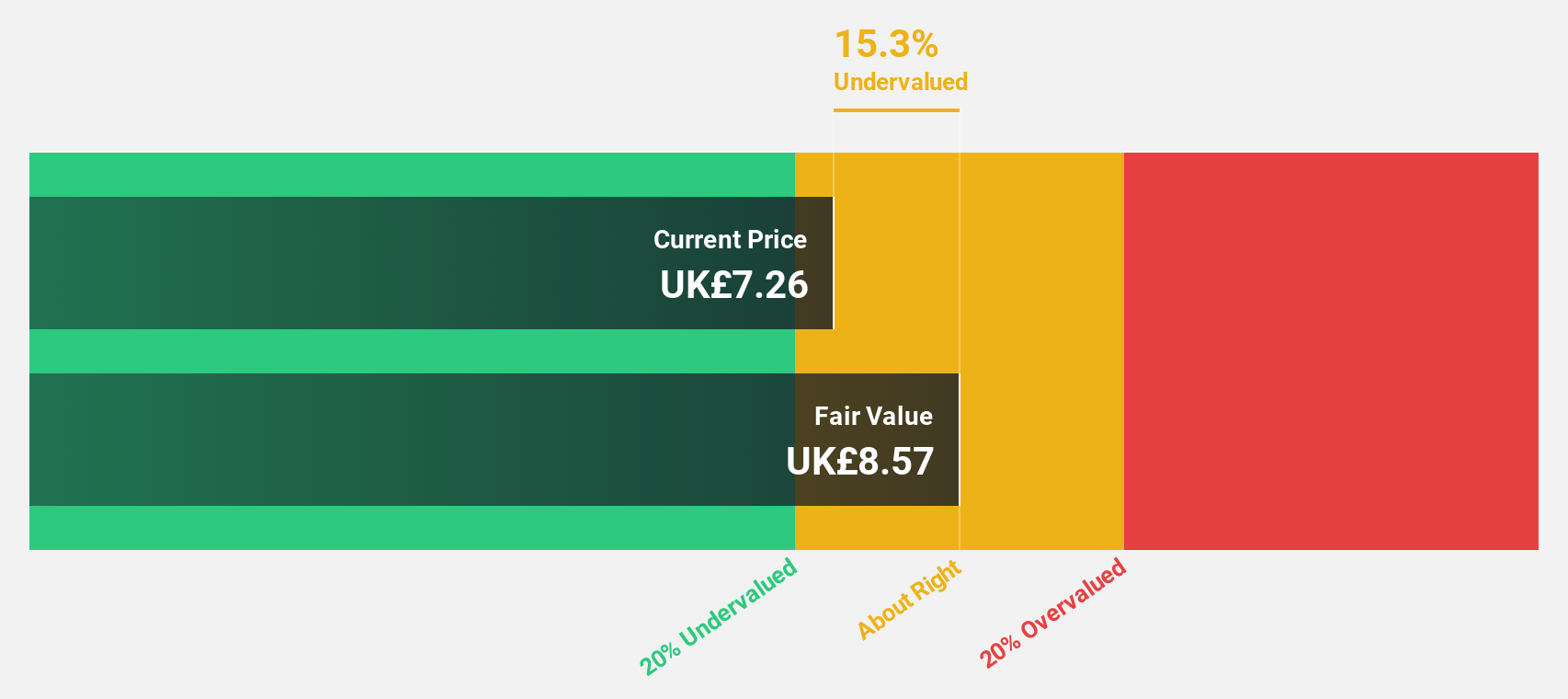

Estimated Discount To Fair Value: 20.9%

PayPoint, trading at £7.24, is undervalued based on cash flows, with a fair value estimate of £9.16. Despite forecasted revenue declines of 12.1% annually over three years, earnings are expected to grow significantly at 43.5% per year, outpacing the UK market's growth rate. However, high debt levels and unsustainable dividends pose risks. Recent strategic investments and partnerships aim to bolster long-term growth prospects despite current financial challenges and profit margin declines from 12% to 6.4%.

- Upon reviewing our latest growth report, PayPoint's projected financial performance appears quite optimistic.

- Dive into the specifics of PayPoint here with our thorough financial health report.

Make It Happen

- Dive into all 52 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AMS

Advanced Medical Solutions Group

Develops, manufactures, and distributes products for the surgical, woundcare, and wound-closure markets in the United Kingdom, Germany, rest of Europe, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives