- United Kingdom

- /

- Specialty Stores

- /

- LSE:MOON

UK Stocks That May Be Trading Below Estimated Value In November 2025

Reviewed by Simply Wall St

In recent times, the UK market has faced challenges, with the FTSE 100 index experiencing declines after weak trade data from China highlighted ongoing global economic uncertainties. As investors navigate this complex landscape, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on undervaluation amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victorian Plumbing Group (AIM:VIC) | £0.688 | £1.28 | 46.1% |

| ProCook Group (LSE:PROC) | £0.305 | £0.56 | 45.4% |

| PageGroup (LSE:PAGE) | £2.368 | £4.52 | 47.6% |

| Nichols (AIM:NICL) | £10.10 | £18.53 | 45.5% |

| Motorpoint Group (LSE:MOTR) | £1.41 | £2.81 | 49.8% |

| Ibstock (LSE:IBST) | £1.336 | £2.62 | 49.1% |

| Fintel (AIM:FNTL) | £2.06 | £3.79 | 45.6% |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £2.19 | 49.8% |

| Airtel Africa (LSE:AAF) | £3.146 | £5.81 | 45.9% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.185 | £4.16 | 47.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Advanced Medical Solutions Group (AIM:AMS)

Overview: Advanced Medical Solutions Group plc develops, manufactures, and distributes products for the surgical, woundcare, and wound-closure markets globally with a market cap of £471.22 million.

Operations: The company's revenue is primarily derived from its Surgical segment, contributing £175.23 million, and its Woundcare segment, generating £45.07 million.

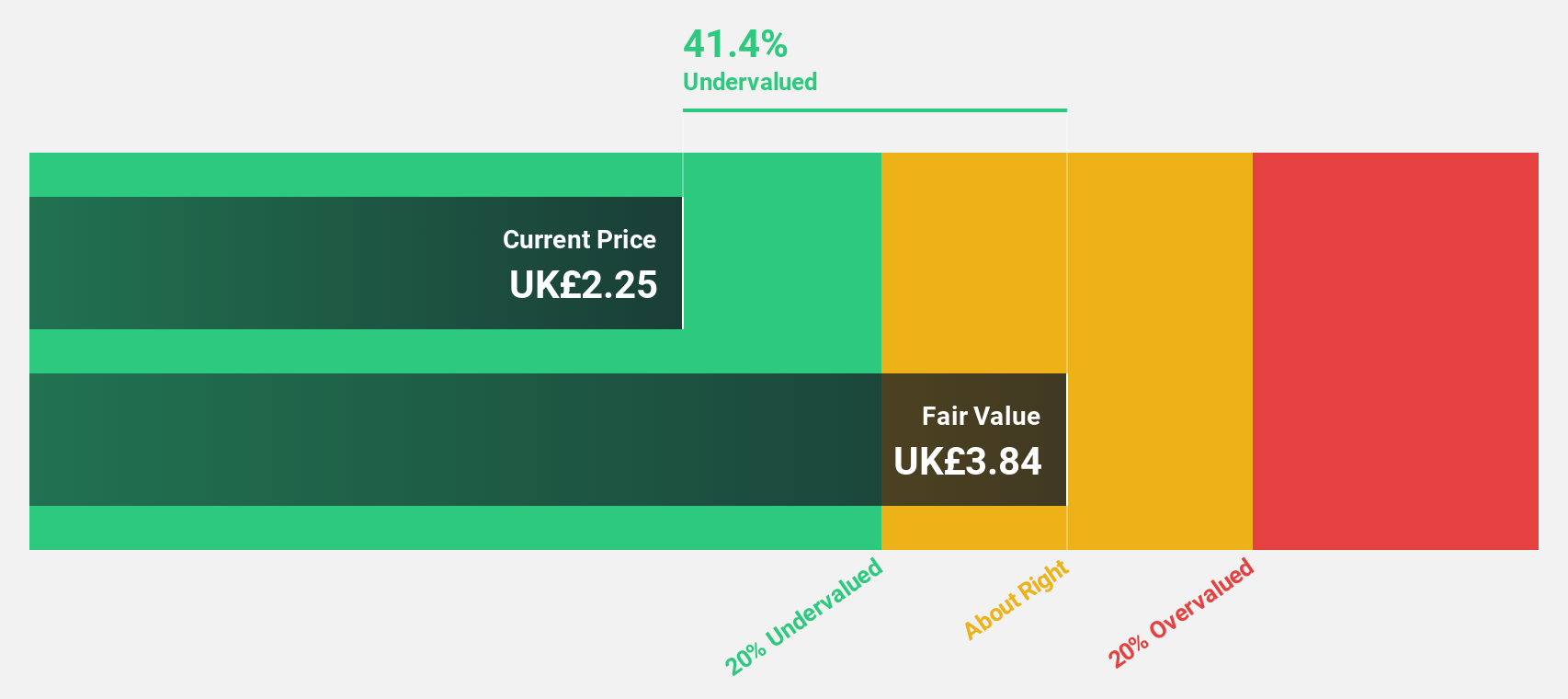

Estimated Discount To Fair Value: 47.5%

Advanced Medical Solutions Group is trading at £2.19, significantly below its estimated fair value of £4.16, suggesting it may be undervalued based on cash flows. Despite a forecasted low return on equity of 12.9%, earnings are expected to grow substantially at 30.51% annually over the next three years, outpacing the UK market's growth rate of 14.5%. Recent half-year results showed increased sales (£110.77 million) and net income (£6.21 million), supporting positive growth expectations despite insider selling concerns.

- Our growth report here indicates Advanced Medical Solutions Group may be poised for an improving outlook.

- Take a closer look at Advanced Medical Solutions Group's balance sheet health here in our report.

GB Group (LSE:GBG)

Overview: GB Group plc, with a market cap of £611.37 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets.

Operations: The company's revenue segments include Identity (£156.59 million), Location (£86.87 million), and Global Fraud Solutions (£37.90 million).

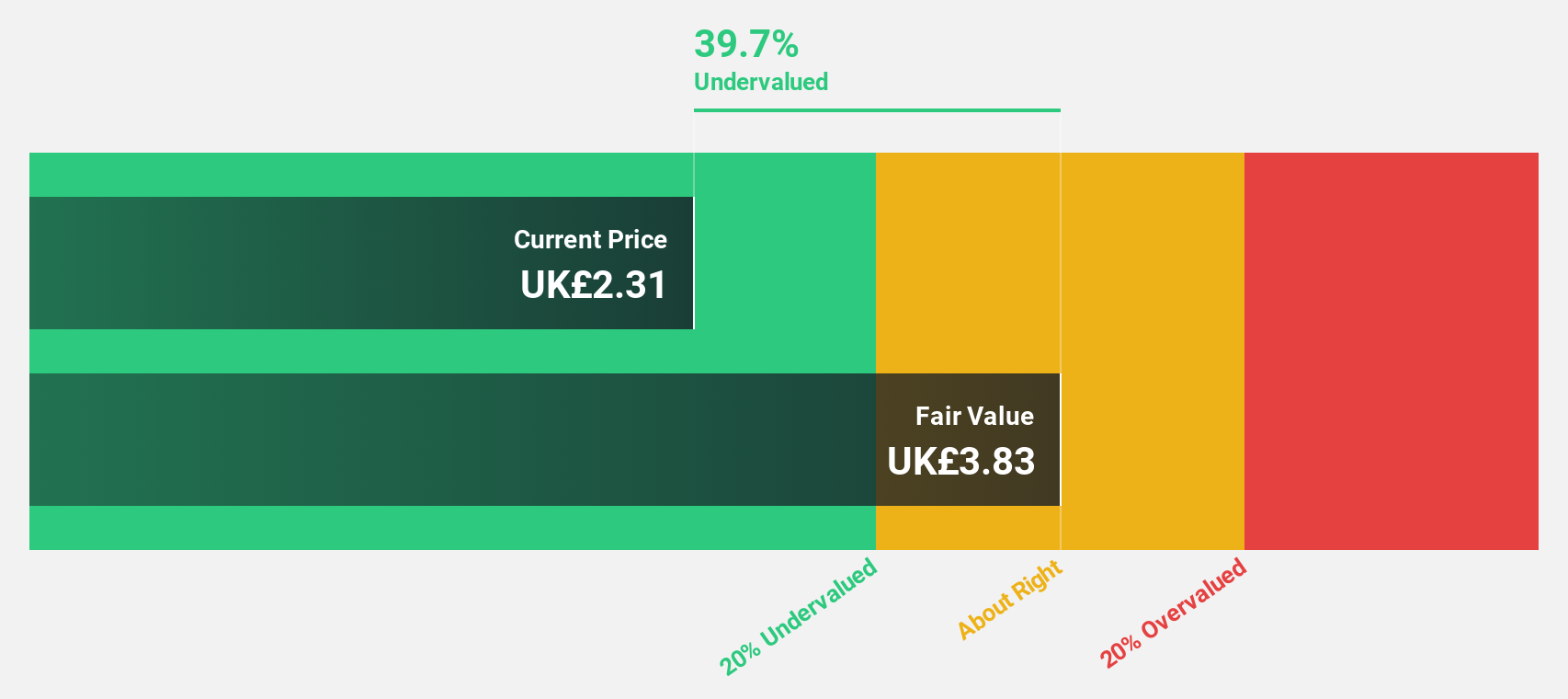

Estimated Discount To Fair Value: 39.6%

GB Group's current trading price of £2.56 is well below its estimated fair value of £4.24, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 41.9% annually, surpassing the UK market average growth rate of 14.5%. Recent half-year results showed stable sales (£135.54 million) and increased net income (£1.99 million). Additionally, GB Group has expanded its equity buyback plan by $10 million to enhance shareholder value further.

- The analysis detailed in our GB Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of GB Group stock in this financial health report.

Moonpig Group (LSE:MOON)

Overview: Moonpig Group PLC operates as a data and technology platform specializing in online greeting cards and gifting across the Netherlands, Ireland, Australia, the United States, and the United Kingdom with a market cap of £664.24 million.

Operations: The company's revenue is primarily derived from its Moonpig segment at £262 million, followed by Greetz at £48.85 million and Experiences at £39.21 million.

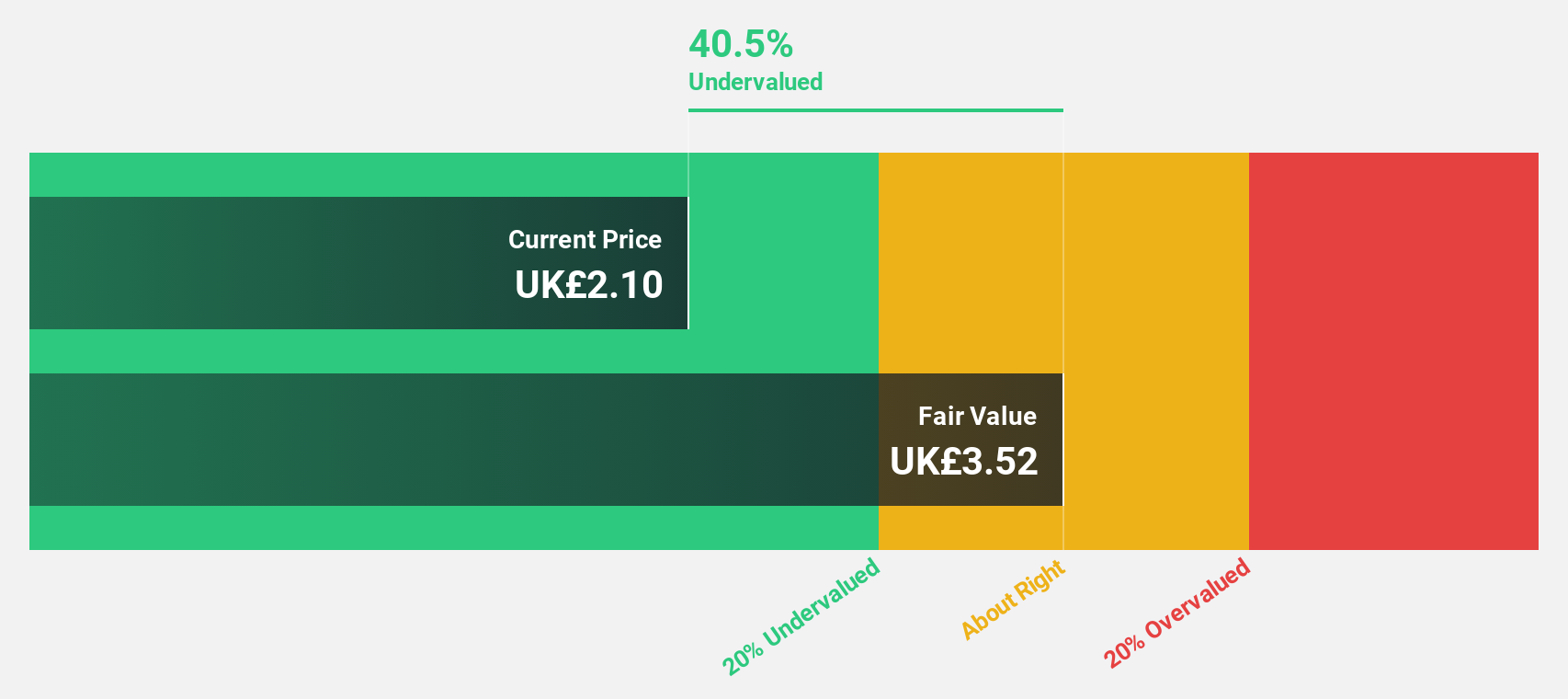

Estimated Discount To Fair Value: 41.5%

Moonpig Group's share price of £2.06 is significantly below its estimated fair value of £3.52, suggesting undervaluation based on cash flows. Despite having negative shareholders' equity and high debt, Moonpig is expected to achieve profitability within three years, with earnings projected to grow at 56.58% annually. The company has initiated a share buyback program, repurchasing 13.44 million shares for £30 million, which may enhance shareholder value amidst executive changes in leadership.

- Upon reviewing our latest growth report, Moonpig Group's projected financial performance appears quite optimistic.

- Dive into the specifics of Moonpig Group here with our thorough financial health report.

Next Steps

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 49 more companies for you to explore.Click here to unveil our expertly curated list of 52 Undervalued UK Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MOON

Moonpig Group

Operates as a data and technology platform for online greeting cards and gifting in the Netherlands, Ireland, Australia, the United States, and the United Kingdom.

High growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success