- United Kingdom

- /

- Medical Equipment

- /

- AIM:AMS

Should You Be Adding Advanced Medical Solutions Group (LON:AMS) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Advanced Medical Solutions Group (LON:AMS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Advanced Medical Solutions Group

How Quickly Is Advanced Medical Solutions Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Advanced Medical Solutions Group grew its EPS by 12% per year. That's a good rate of growth, if it can be sustained.

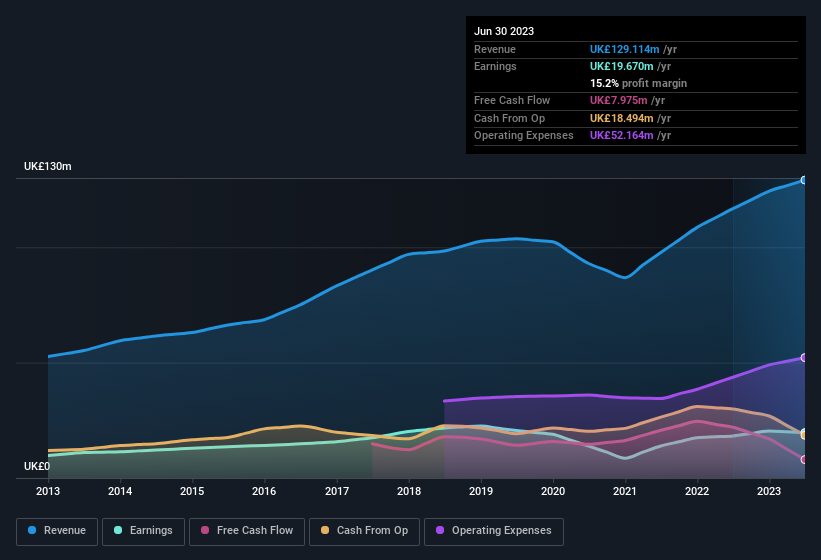

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the revenue front, Advanced Medical Solutions Group has done well over the past year, growing revenue by 11% to UK£129m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Advanced Medical Solutions Group.

Are Advanced Medical Solutions Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite UK£99k worth of sales, Advanced Medical Solutions Group insiders have overwhelmingly been buying the stock, spending UK£285k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Director Elizabeth Shanahan for UK£100k worth of shares, at about UK£1.99 per share.

Is Advanced Medical Solutions Group Worth Keeping An Eye On?

One important encouraging feature of Advanced Medical Solutions Group is that it is growing profits. Not every business can grow its EPS, but Advanced Medical Solutions Group certainly can. The real kicker is that insiders have been accumulating, suggesting that those who understand the company best see some potential. It is worth noting though that we have found 1 warning sign for Advanced Medical Solutions Group that you need to take into consideration.

The good news is that Advanced Medical Solutions Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AMS

Advanced Medical Solutions Group

Develops, manufactures, and distributes products for the surgical, woundcare, and wound-closure markets in the United Kingdom, Germany, rest of Europe, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026