- United Kingdom

- /

- Food

- /

- LSE:TATE

Tate & Lyle plc's (LON:TATE) Popularity With Investors Is Under Threat From Overpricing

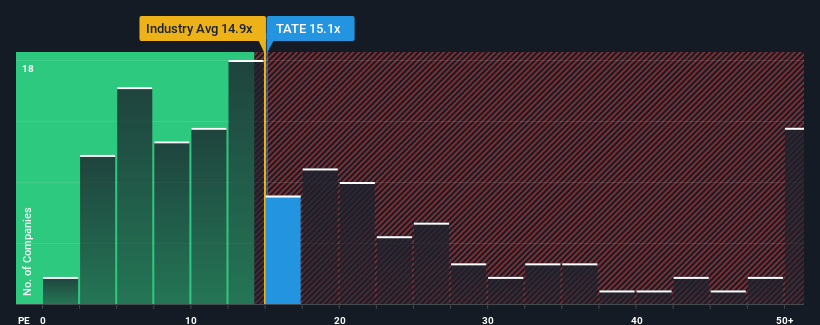

It's not a stretch to say that Tate & Lyle plc's (LON:TATE) price-to-earnings (or "P/E") ratio of 15.1x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Tate & Lyle certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Tate & Lyle

Is There Some Growth For Tate & Lyle?

Tate & Lyle's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 151% last year. The latest three year period has also seen a 8.8% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 10% per annum over the next three years. That's shaping up to be materially lower than the 14% per annum growth forecast for the broader market.

With this information, we find it interesting that Tate & Lyle is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Tate & Lyle's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Tate & Lyle.

Of course, you might also be able to find a better stock than Tate & Lyle. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tate & Lyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TATE

Tate & Lyle

Engages in the provision of ingredients and solutions to the food, beverages, and other industries in North America, Asia, Middle East, Africa, Latin America, and Europe.

Moderate risk with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives