- United Kingdom

- /

- Metals and Mining

- /

- LSE:ALTN

Undiscovered Gems In The UK Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns about global economic recovery. In this environment of uncertainty, small-cap stocks can offer unique opportunities for growth as they often possess agility and innovative potential that can thrive despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Serabi Gold (AIM:SRB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Serabi Gold plc is involved in the evaluation, exploration, and development of gold and other metals mining projects in Brazil, with a market capitalization of £196.91 million.

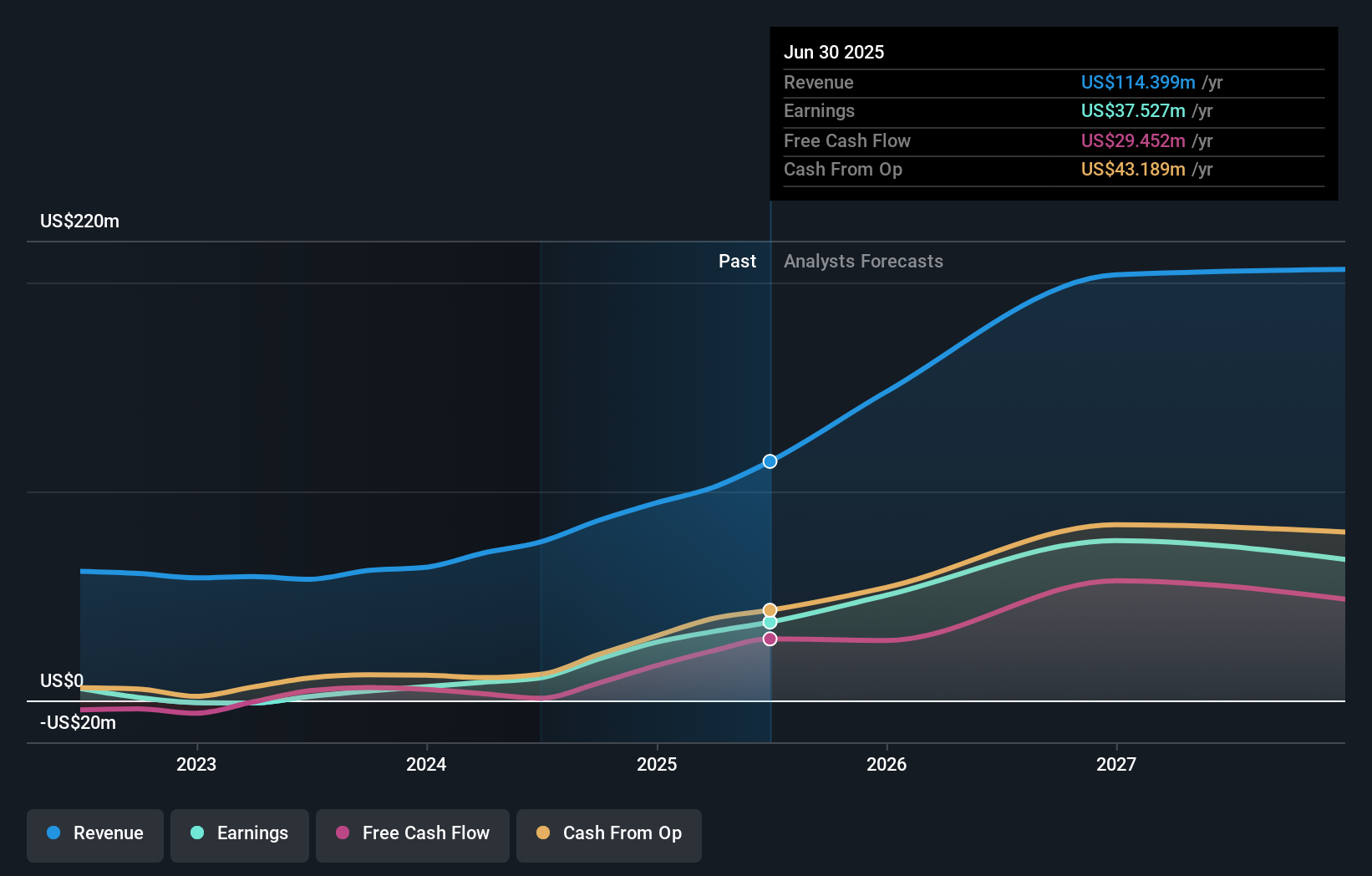

Operations: Serabi Gold generates revenue primarily from its gold mining and exploration activities, amounting to $114.40 million. The company's financial performance is reflected in its market capitalization of £196.91 million.

Serabi Gold, a promising player in the mining sector, has shown impressive growth with earnings surging by 246.9% over the past year, outpacing its industry peers. The company reported a net income of US$10 million for Q2 2025 compared to US$5.58 million in the previous year, reflecting robust operational performance. Recent production results show gold output reaching 12,090 ounces this quarter from 9,489 ounces last year. However, challenges such as regulatory hurdles and reliance on vein mining techniques pose risks to sustained profitability amidst fluctuating gold prices and operational uncertainties in Brazil's Para state.

AltynGold (LSE:ALTN)

Simply Wall St Value Rating: ★★★★★★

Overview: AltynGold plc, along with its subsidiaries, focuses on the exploration and development of gold-producing mines in the Republic of Kazakhstan, with a market capitalization of £262.94 million.

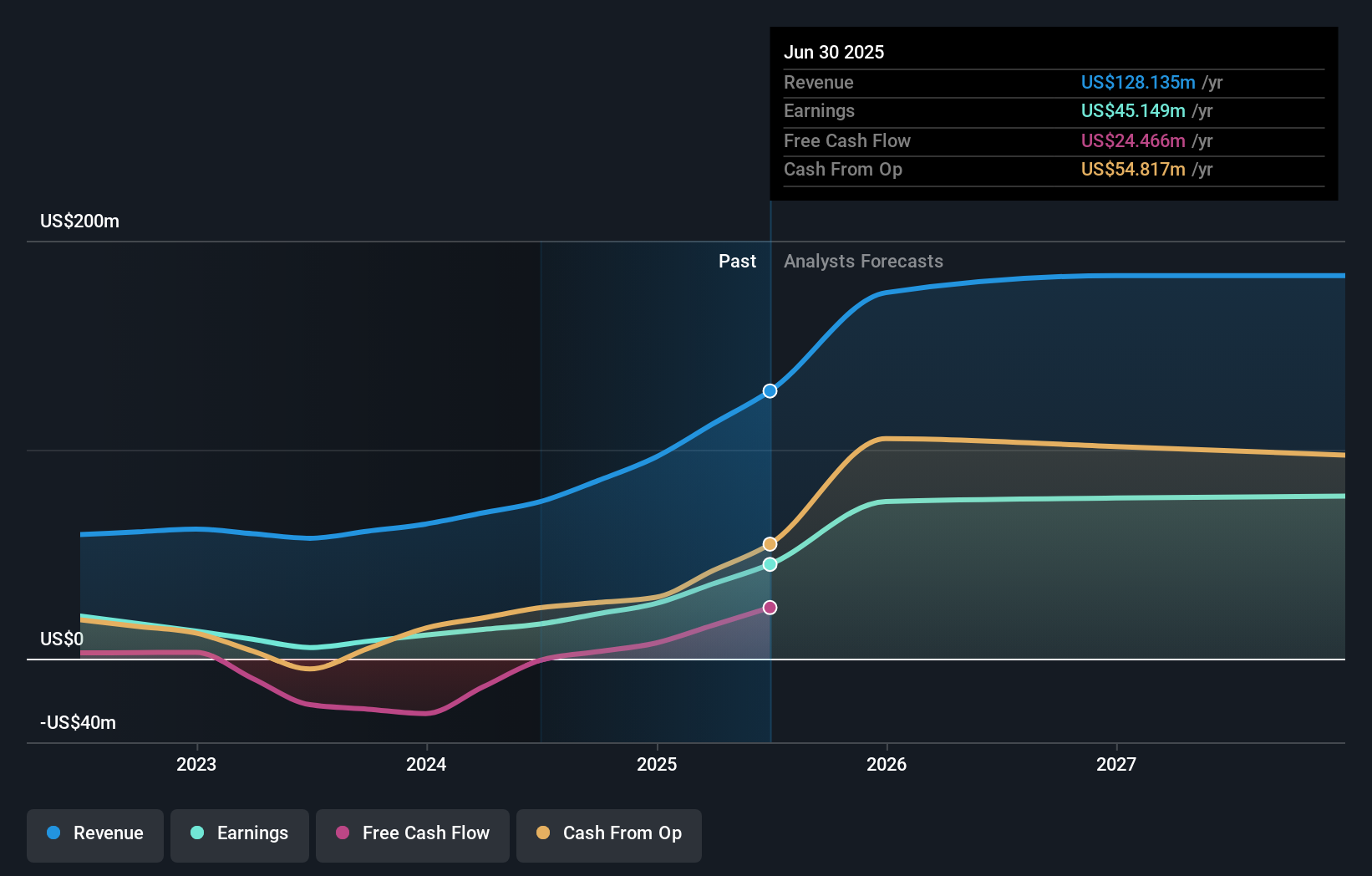

Operations: AltynGold generates revenue primarily through the exploration and development of its Sekisovskoye gold mine, contributing $128.14 million. The company's financial performance is influenced by factors such as operational costs and market conditions affecting gold prices.

AltynGold, a small player in the mining sector, has shown robust financial performance with net income reaching US$26.98 million for the half year ending June 2025, up from US$8.26 million the previous year. The company's earnings per share surged to US$0.99 from US$0.30, reflecting strong growth momentum. With a satisfactory net debt to equity ratio of 31.1% and interest payments well covered by EBIT at 14 times, financial health appears solid. Despite recent share price volatility, AltynGold trades at an attractive value relative to its peers and industry benchmarks, suggesting potential upside for investors exploring niche opportunities in metals and mining.

- Click here to discover the nuances of AltynGold with our detailed analytical health report.

Assess AltynGold's past performance with our detailed historical performance reports.

Greencore Group (LSE:GNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Greencore Group plc, along with its subsidiaries, focuses on manufacturing and selling convenience food products in the United Kingdom and Ireland, with a market capitalization of £1.02 billion.

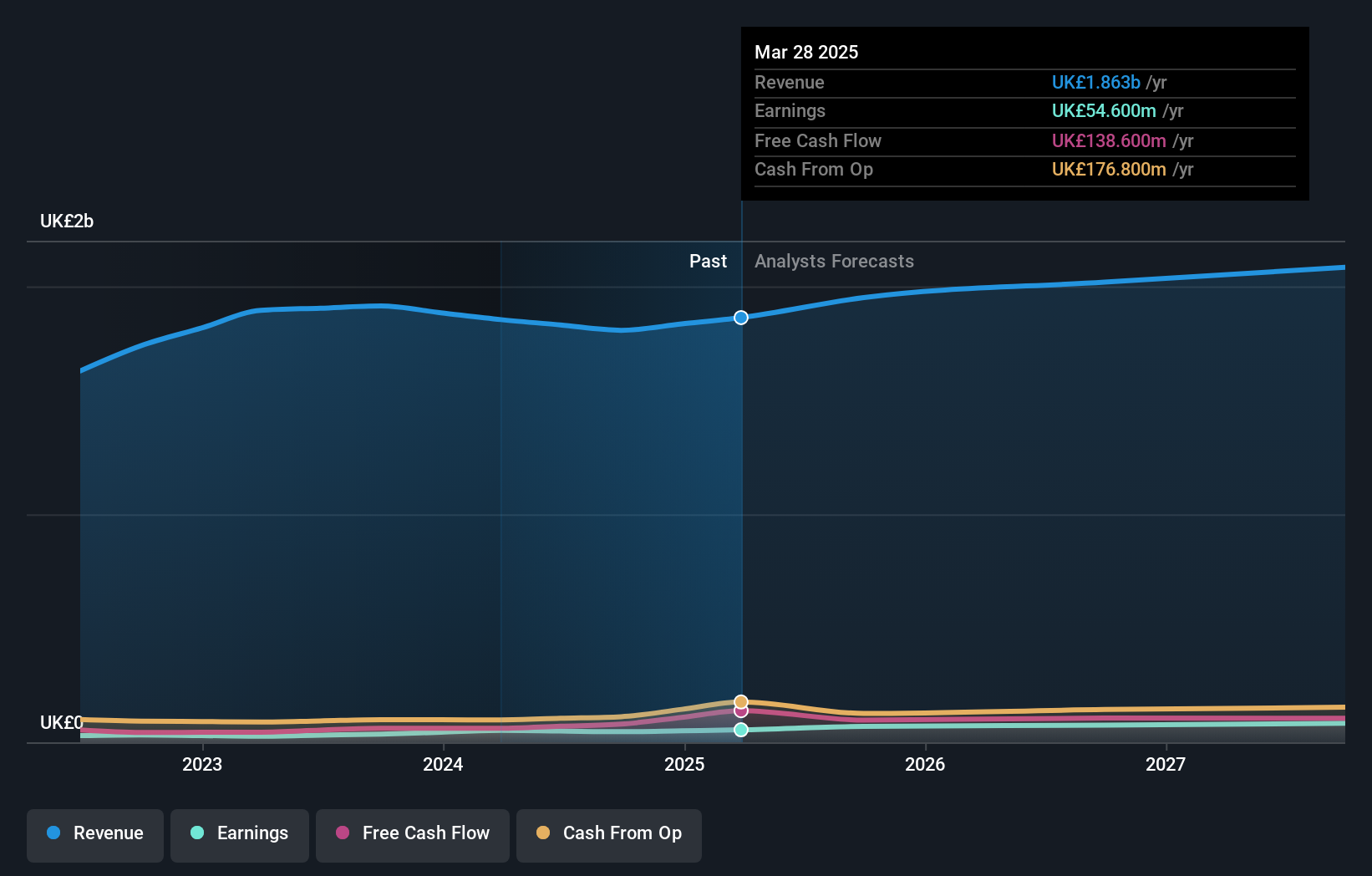

Operations: Greencore Group generates revenue primarily through the sale of convenience food products in the United Kingdom and Ireland. It experiences fluctuations in its net profit margin, which impacts its overall profitability. The company's financial performance is influenced by various cost components associated with manufacturing and selling these products.

Greencore Group, a notable player in the UK food sector, has shown resilience with its recent financial performance. Over the past year, earnings surged by 24%, outpacing the industry average of 12%. The company reported sales of £1.95 billion and net income of £57.6 million for the year ending September 2025. Despite a one-off loss affecting results, Greencore's debt-to-equity ratio improved significantly from 218% to 31% over five years, reflecting stronger financial stability. Trading at approximately 57% below estimated fair value suggests potential upside for investors who appreciate its strategic focus on cost management and innovation amidst challenges like rising labor costs and sustainability issues.

Key Takeaways

- Delve into our full catalog of 56 UK Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALTN

AltynGold

Engages in the exploration and development of gold producing mine in the Republic of Kazakhstan.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives