- United Kingdom

- /

- Beverage

- /

- LSE:BVIC

Results: Britvic plc Beat Earnings Expectations And Analysts Now Have New Forecasts

Britvic plc (LON:BVIC) just released its latest half-year results and things are looking bullish. Results were good overall, with revenues beating analyst predictions by 2.5% to hit UK£617m. Statutory earnings per share (EPS) came in at UK£0.12, some 6.0% above whatthe analysts had expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Britvic

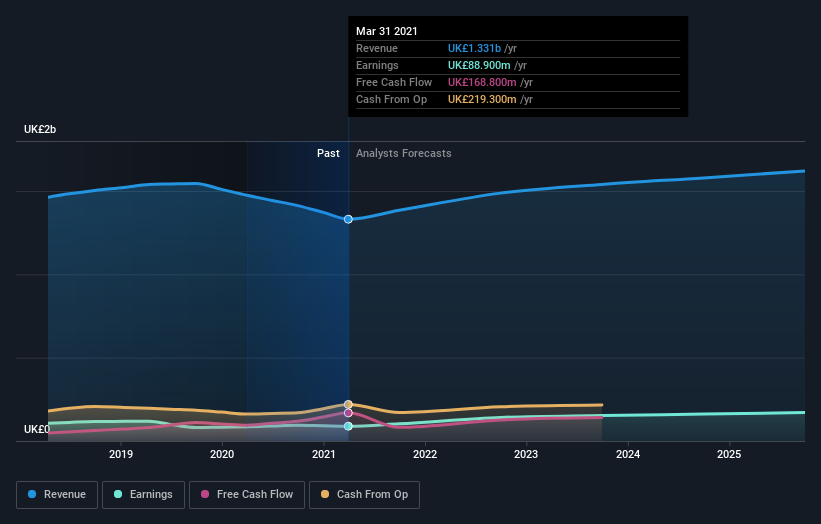

After the latest results, the 15 analysts covering Britvic are now predicting revenues of UK£1.38b in 2021. If met, this would reflect a modest 4.0% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to climb 19% to UK£0.40. In the lead-up to this report, the analysts had been modelling revenues of UK£1.39b and earnings per share (EPS) of UK£0.42 in 2021. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts.

The consensus price target held steady at UK£9.29, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Britvic analyst has a price target of UK£10.70 per share, while the most pessimistic values it at UK£8.00. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Britvic's rate of growth is expected to accelerate meaningfully, with the forecast 8.2% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 0.4% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 5.9% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Britvic to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Britvic. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at UK£9.29, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Britvic analysts - going out to 2025, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Britvic .

If you decide to trade Britvic, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:BVIC

Carlsberg Britvic

Britvic plc, together with its subsidiaries, manufactures, markets, distributes, and sells soft drinks in the United Kingdom, the Republic of Ireland, France, Brazil, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.