- United Kingdom

- /

- Beverage

- /

- LSE:BVIC

Britvic plc (LON:BVIC) Is About To Go Ex-Dividend, And It Pays A 1.4% Yield

Britvic plc (LON:BVIC) is about to trade ex-dividend in the next 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase Britvic's shares on or after the 27th of May will not receive the dividend, which will be paid on the 7th of July.

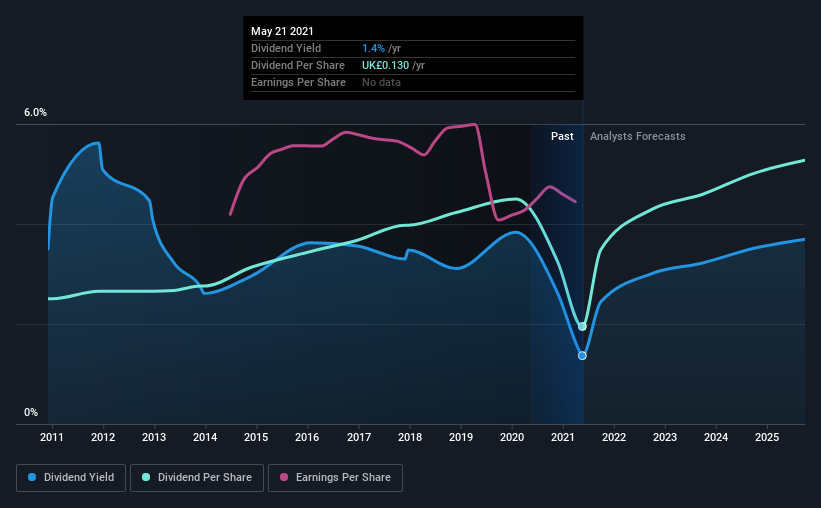

The company's upcoming dividend is UK£0.065 a share, following on from the last 12 months, when the company distributed a total of UK£0.13 per share to shareholders. Looking at the last 12 months of distributions, Britvic has a trailing yield of approximately 1.4% on its current stock price of £9.51. If you buy this business for its dividend, you should have an idea of whether Britvic's dividend is reliable and sustainable. As a result, readers should always check whether Britvic has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Britvic

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Its dividend payout ratio is 84% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. It could become a concern if earnings started to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Thankfully its dividend payments took up just 34% of the free cash flow it generated, which is a comfortable payout ratio.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's not ideal to see Britvic's earnings per share have been shrinking at 4.4% a year over the previous five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Britvic's dividend payments per share have declined at 2.5% per year on average over the past 10 years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

Final Takeaway

Has Britvic got what it takes to maintain its dividend payments? We're not enthused by the declining earnings per share, although at least the company's payout ratio is within a reasonable range, meaning it may not be at imminent risk of a dividend cut. All things considered, we are not particularly enthused about Britvic from a dividend perspective.

However if you're still interested in Britvic as a potential investment, you should definitely consider some of the risks involved with Britvic. Case in point: We've spotted 2 warning signs for Britvic you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Britvic, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:BVIC

Carlsberg Britvic

Britvic plc, together with its subsidiaries, manufactures, markets, distributes, and sells soft drinks in the United Kingdom, the Republic of Ireland, France, Brazil, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success