- United Kingdom

- /

- Tobacco

- /

- LSE:BATS

British American Tobacco p.l.c.'s (LON:BATS) Price Is Out Of Tune With Revenues

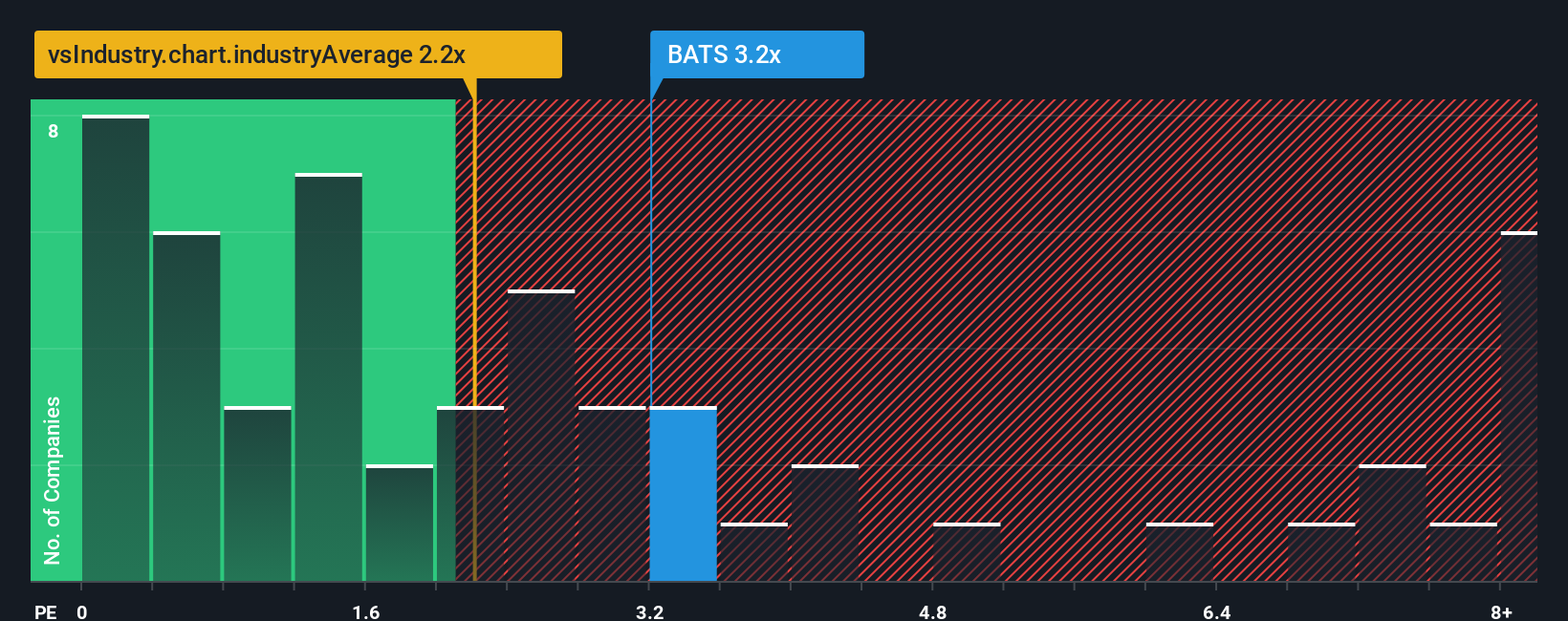

British American Tobacco p.l.c.'s (LON:BATS) price-to-sales (or "P/S") ratio of 3.2x may not look like an appealing investment opportunity when you consider close to half the companies in the Tobacco industry in the United Kingdom have P/S ratios below 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for British American Tobacco

What Does British American Tobacco's Recent Performance Look Like?

There hasn't been much to differentiate British American Tobacco's and the industry's retreating revenue lately. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think British American Tobacco's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

British American Tobacco's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.2%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 1.4% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 2.2% each year, which is not materially different.

With this information, we find it interesting that British American Tobacco is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From British American Tobacco's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given British American Tobacco's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 3 warning signs for British American Tobacco you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if British American Tobacco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BATS

British American Tobacco

Provides tobacco and nicotine products to consumers in the Americas, Europe, the Asia-Pacific, the Middle East, Africa, and the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives