- United Kingdom

- /

- Tobacco

- /

- LSE:BATS

British American Tobacco p.l.c. (LON:BATS) Not Lagging Industry On Growth Or Pricing

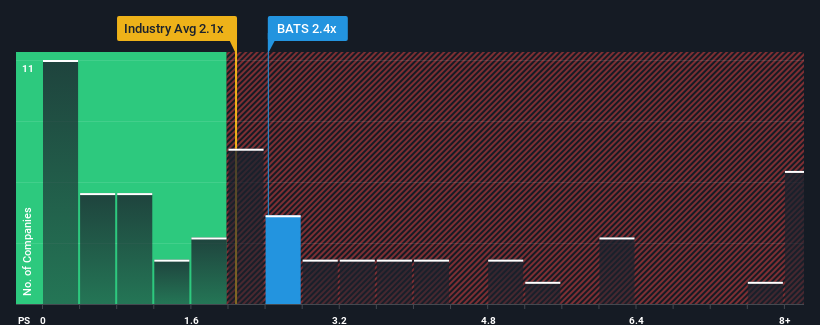

With a median price-to-sales (or "P/S") ratio of close to 2x in the Tobacco industry in the United Kingdom, you could be forgiven for feeling indifferent about British American Tobacco p.l.c.'s (LON:BATS) P/S ratio of 2.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for British American Tobacco

How Has British American Tobacco Performed Recently?

With revenue that's retreating more than the industry's average of late, British American Tobacco has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on British American Tobacco will help you uncover what's on the horizon.How Is British American Tobacco's Revenue Growth Trending?

British American Tobacco's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.2%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 1.8% per annum as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 0.6% each year, which is not materially different.

In light of this, it's understandable that British American Tobacco's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On British American Tobacco's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at British American Tobacco's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It is also worth noting that we have found 2 warning signs for British American Tobacco that you need to take into consideration.

If these risks are making you reconsider your opinion on British American Tobacco, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if British American Tobacco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BATS

British American Tobacco

Engages in the provision of tobacco and nicotine products to consumers worldwide.

Average dividend payer and fair value.