- United Kingdom

- /

- Tobacco

- /

- LSE:BATS

Are British American Tobacco Shares Fairly Priced After a Strong 56.5% Rally?

Reviewed by Bailey Pemberton

- Curious whether British American Tobacco is a hidden bargain or fully valued? You are not alone. In today's market, finding a fair price matters more than ever.

- The share price has rallied an impressive 10.5% over the last month and is up 56.5% in the past year, hinting at renewed optimism or shifting risk in the stock.

- Much of this market momentum has come alongside headlines about the company's ongoing ESG commitments and global regulatory challenges, with recent announcements sparking debate on the future of tobacco products. Investors have also responded to news of potential product innovation and leadership changes, fueling speculation about long-term growth prospects.

- The company's current valuation score is 3 out of 6. This reflects areas where the stock may be undervalued, but with some red flags to note. In the next sections, we will break down the main valuation methods and later reveal an even more insightful way to assess the true worth of British American Tobacco shares.

Approach 1: British American Tobacco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a stock by projecting its future cash flows and discounting them back to today's value. This approach provides a data-driven way to assess what shares could be worth if current growth and profit trends continue.

For British American Tobacco, the latest reported Free Cash Flow is £8.70 billion. Analyst forecasts expect annual Free Cash Flow to fluctuate, with a projected figure of £8.41 billion by 2029. Beyond that, Simply Wall St estimates extrapolate future numbers, which helps account for uncertainties after analyst visibility ends. Over the ten-year outlook, forecasted cash flows generally remain in the range of £8 to £9.1 billion per year.

After calculating these numbers through a two-stage DCF model, the estimated intrinsic value per share is £60.99. That figure is 28.8% above where the stock last traded, suggesting British American Tobacco could be meaningfully undervalued by the market today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests British American Tobacco is undervalued by 28.8%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: British American Tobacco Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it connects a company’s current share price to its actual earnings, providing investors a sense of how much they are paying for each pound of profit. For mature companies like British American Tobacco, which consistently delivers profits, the PE ratio is particularly useful for assessing whether the market is demanding a premium or offering a bargain for its steady earnings base.

Growth expectations and risk play a big part in what is considered a "normal" or “fair” PE ratio. Companies expected to grow quickly or with lower risk often trade at higher PE ratios, as investors are willing to pay up for potential future profits. Conversely, slower-growing or riskier firms typically see lower PE multiples.

British American Tobacco currently trades at a PE ratio of 31.0x. This is substantially above the Tobacco industry average of 13.8x and also ahead of its peer average of 15.0x. However, Simply Wall St’s proprietary “Fair Ratio,” which adjusts for the company’s own earnings growth, profit margins, market cap, and specific risk profile, suggests a fair multiple of 31.3x. Unlike simple peer or industry comparisons, the Fair Ratio provides a more customized benchmark that accounts for what actually makes this company unique.

With the company’s actual PE ratio of 31.0x nearly identical to the Fair Ratio of 31.3x, British American Tobacco shares look fairly valued by this method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your British American Tobacco Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a tool that helps you connect your unique perspective about a company with the numbers behind its future. A Narrative is a simple, story-driven forecast: you start by outlining what you believe will drive British American Tobacco’s next chapter (such as product innovation, regulatory shifts, or changes in global demand) and then estimate how those factors might shape future revenue, profit margins, and earnings. Narratives bridge the gap between a company's story, its financial outlook, and what fair value really means for you as an investor.

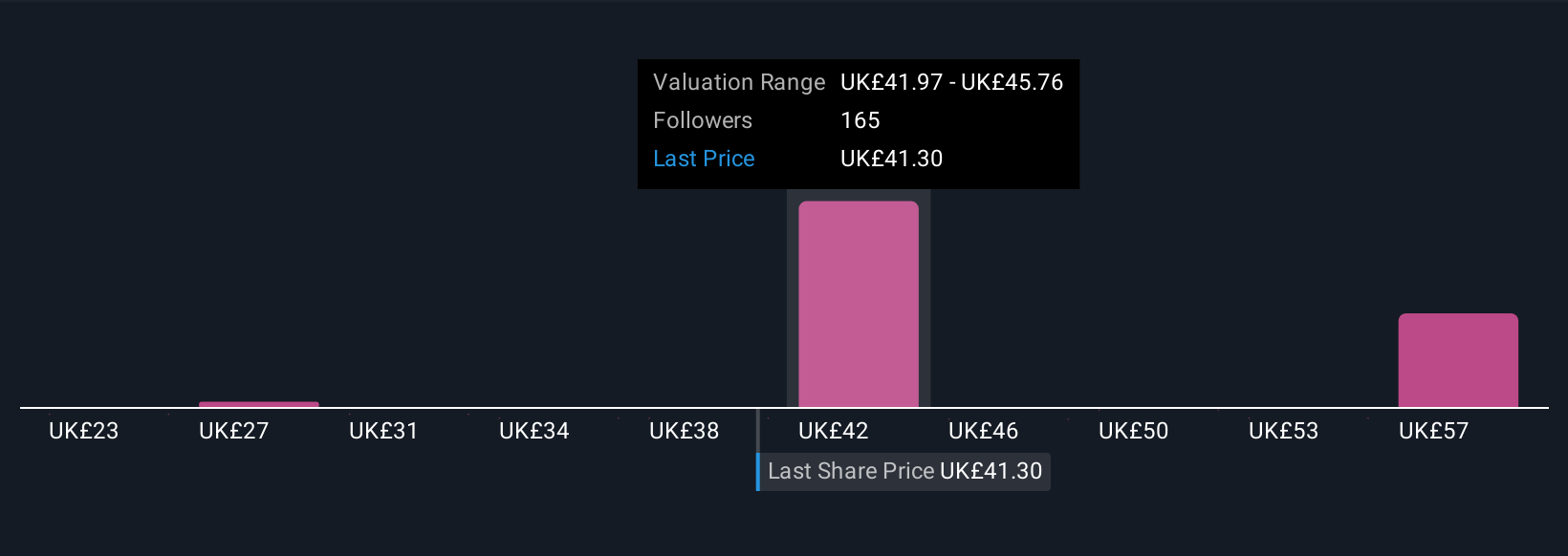

On Simply Wall St's Community page, millions of investors are already creating and debating Narratives, making it easy for anyone to compare viewpoints, see financial forecasts in action, and judge whether to buy or sell based on the difference between each Narrative's fair value and the current price. These Narratives update as new news or earnings reports emerge, ensuring your investment view stays current. For example, some investors may see British American Tobacco’s future value as high as £52.0 based on rapid innovation in reduced-risk products and aggressive global expansion, while others may predict a fair value as low as £30.0 due to regulatory risks and ongoing declines in cigarette consumption.

Do you think there's more to the story for British American Tobacco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if British American Tobacco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BATS

British American Tobacco

Provides tobacco and nicotine products to consumers in the Americas, Europe, the Asia-Pacific, the Middle East, Africa, and the United States.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.