- United Kingdom

- /

- Food

- /

- LSE:ABF

Associated British Foods (LSE:ABF) Appoints Loraine Woodhouse, Reports 57.2% Earnings Growth and Digital Gains

Reviewed by Simply Wall St

The Associated British Foods (LSE:ABF) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a significant earnings growth of 57.2% and strategic investments in digital strategies, juxtaposed against performance issues in agriculture and FX translation losses. In the discussion that follows, we will explore ABF's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click to explore a detailed breakdown of our findings on Associated British Foods.

Strengths: Core Advantages Driving Sustained Success For Associated British Foods

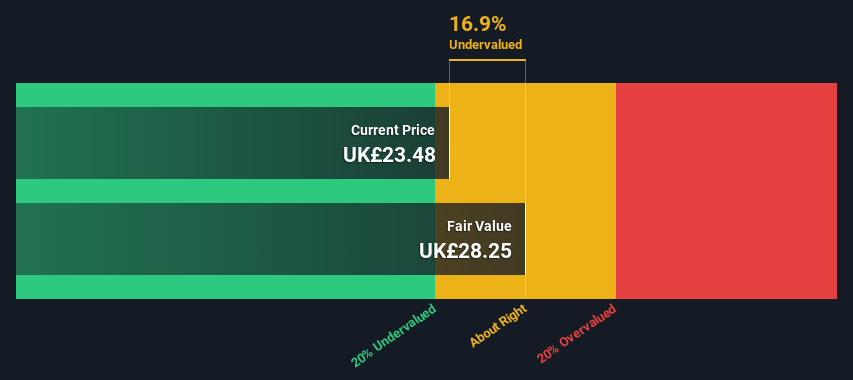

Associated British Foods (ABF) has demonstrated strong financial health, highlighted by a significant earnings growth of 57.2% over the past year, surpassing its five-year average of 7.4% per year. This impressive growth is further supported by strong cash flow and record adjusted earnings per share, as noted by CEO George Weston. The company's strategic investments, particularly in digital strategy within Primark, have shown promising results. Furthermore, ABF is currently trading at a Price-To-Earnings Ratio of 14.4x, which is considered favorable compared to its peers' average of 16.4x. Additionally, it is trading below the estimated fair value of £44.53, currently priced at £22.95, indicating potential for significant upside.

To gain deeper insights into Associated British Foods's historical performance, explore our detailed analysis of past performance.

Weaknesses: Critical Issues Affecting Associated British Foods' Performance and Areas For Growth

ABF faces several challenges. The company's Price-To-Earnings Ratio of 14.4x is slightly higher than the European Food industry average of 14.3x, suggesting it may be overvalued in its sector. Performance issues in agriculture, particularly in the UK and China, have led to lower sales, as highlighted by CFO Eoin Tonge. Additionally, profits were impacted by FX translation losses, particularly in Illovo. The company's return on equity is forecasted to be low at 11.6% in three years, and its revenue growth of 3.5% per year is expected to lag behind the UK market's 3.7% growth rate.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

ABF has several opportunities to enhance its market position. The expansion plans, including adding 1 million square feet of space in Primark, are expected to drive growth. The company's digital engagement strategy has shown good progress, and the rollout of the Click + Collect service across GB stores is anticipated to boost customer convenience and sales. Additionally, the expansion of product offerings aims to attract both existing and new customers. These strategic initiatives could significantly enhance ABF's competitive advantage and market share.

See what the latest analyst reports say about Associated British Foods's future prospects and potential market movements.

Threats: Key Risks and Challenges That Could Impact Associated British Foods' Success

ABF faces several external threats that could impact its success. Geopolitical risks and economic factors, such as consumer downturns in Australia and New Zealand, pose significant challenges. The company also faces intense competition, particularly from discounters and own-label brands, which could affect sales. Regulatory issues, such as the use of neonicotinoids on sugar beet crops, add to the uncertainty. Additionally, the company's dividend payments have been volatile over the past 10 years, which may concern investors seeking stable returns.

Conclusion

Associated British Foods' significant earnings growth of 57.2% over the past year, coupled with strong cash flow and strategic investments in digital strategies, underscores its solid financial health. However, challenges such as lower sales in agriculture and FX translation losses, particularly in Illovo, present hurdles to sustained performance. The company's expansion plans and digital engagement strategies offer promising avenues for growth, potentially enhancing its competitive advantage. Despite trading at a Price-To-Earnings Ratio of 14.4x, which is higher than the European Food industry average but lower than its peers, ABF's current price of £22.95, well below the estimated fair value of £44.53, indicates substantial upside potential. This mix of strengths, weaknesses, opportunities, and threats suggests a cautiously optimistic outlook for ABF's future performance, contingent on effective management of its challenges and strategic execution of growth initiatives.

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:ABF

Associated British Foods

Operates as a diversified food, ingredients, and retail company worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives