- United Kingdom

- /

- Specialty Stores

- /

- LSE:AO.

3 UK Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces pressure from weak trade data out of China, investors are keenly observing the market for opportunities amidst global economic uncertainties. In such conditions, identifying stocks that might be trading below their estimated value can offer potential for growth, as these equities may provide a cushion against broader market volatility and present attractive entry points for those looking to capitalize on undervaluation.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pan African Resources (LSE:PAF) | £0.956 | £1.83 | 47.8% |

| PageGroup (LSE:PAGE) | £2.41 | £4.34 | 44.5% |

| Norcros (LSE:NXR) | £2.89 | £5.36 | 46% |

| Likewise Group (AIM:LIKE) | £0.275 | £0.50 | 45.1% |

| Fintel (AIM:FNTL) | £2.12 | £3.81 | 44.3% |

| Fevertree Drinks (AIM:FEVR) | £8.45 | £16.06 | 47.4% |

| Begbies Traynor Group (AIM:BEG) | £1.13 | £2.20 | 48.6% |

| Barratt Redrow (LSE:BTRW) | £3.932 | £7.42 | 47% |

| Airtel Africa (LSE:AAF) | £3.124 | £5.86 | 46.7% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.16 | £4.17 | 48.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

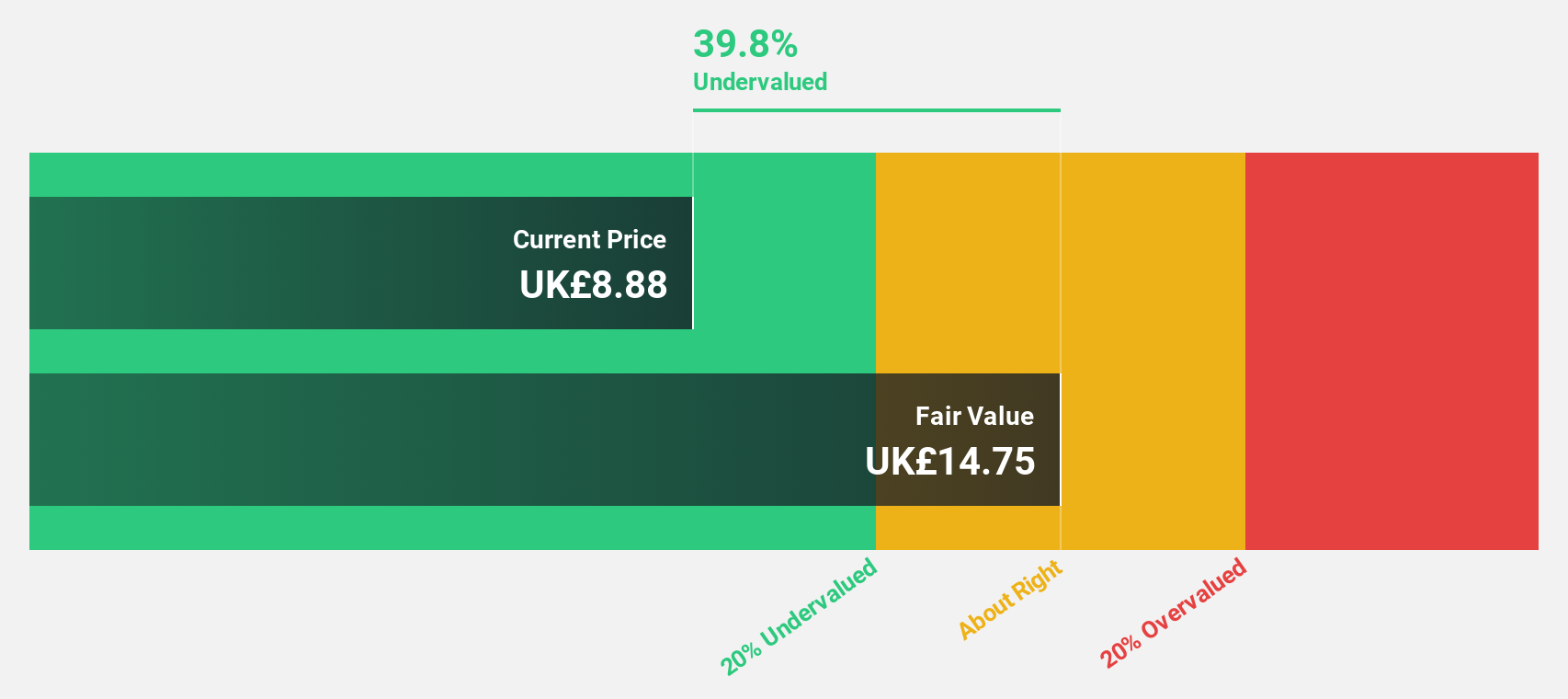

Fevertree Drinks (AIM:FEVR)

Overview: Fevertree Drinks PLC, with a market cap of £983.77 million, develops and sells mixer drinks across the United Kingdom, the United States, Europe, and internationally.

Operations: The company's revenue is primarily generated from its non-alcoholic beverages segment, which accounts for £339.90 million.

Estimated Discount To Fair Value: 47.4%

Fevertree Drinks is currently trading at £8.45, significantly below its estimated fair value of £16.06, suggesting it may be undervalued based on cash flows. Despite a decrease in sales to £144.3 million for the half-year ending June 2025, net income increased to £8.4 million from the previous year. The company's earnings are forecasted to grow by 21.54% annually over the next three years, outpacing the UK market's growth rate of 14.5%.

- Upon reviewing our latest growth report, Fevertree Drinks' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Fevertree Drinks.

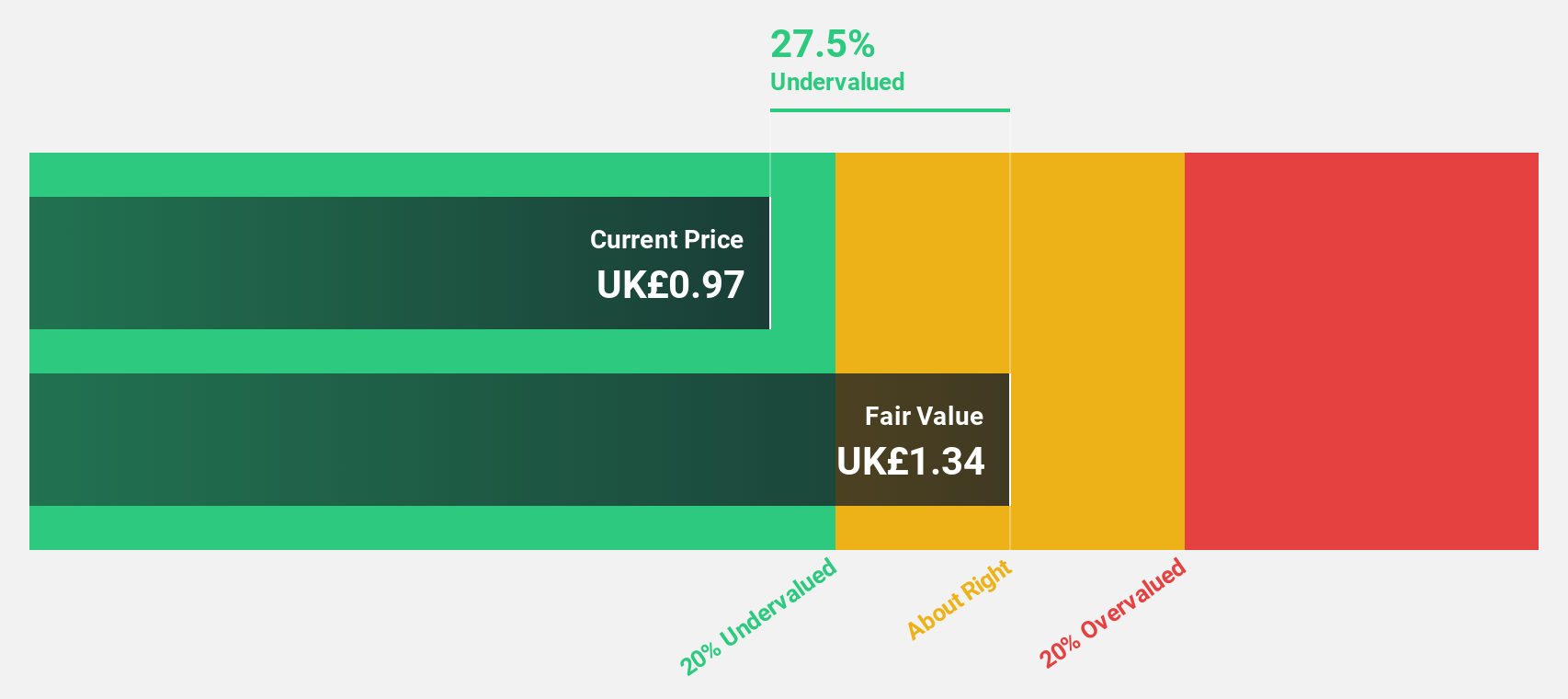

AO World (LSE:AO.)

Overview: AO World plc, along with its subsidiaries, operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany, with a market capitalization of approximately £589.58 million.

Operations: The company's revenue primarily derives from its online retailing of domestic appliances and ancillary services, totaling £1.14 billion.

Estimated Discount To Fair Value: 23%

AO World is trading at £1.05, below its estimated fair value of £1.36, indicating potential undervaluation based on cash flows. Despite a decline in profit margins from 2.4% to 0.9%, earnings are projected to grow significantly at 36% annually over the next three years, surpassing the UK market's growth rate of 14.5%. However, significant insider selling and large one-off items affecting financial results present risks to consider for investors.

- According our earnings growth report, there's an indication that AO World might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of AO World.

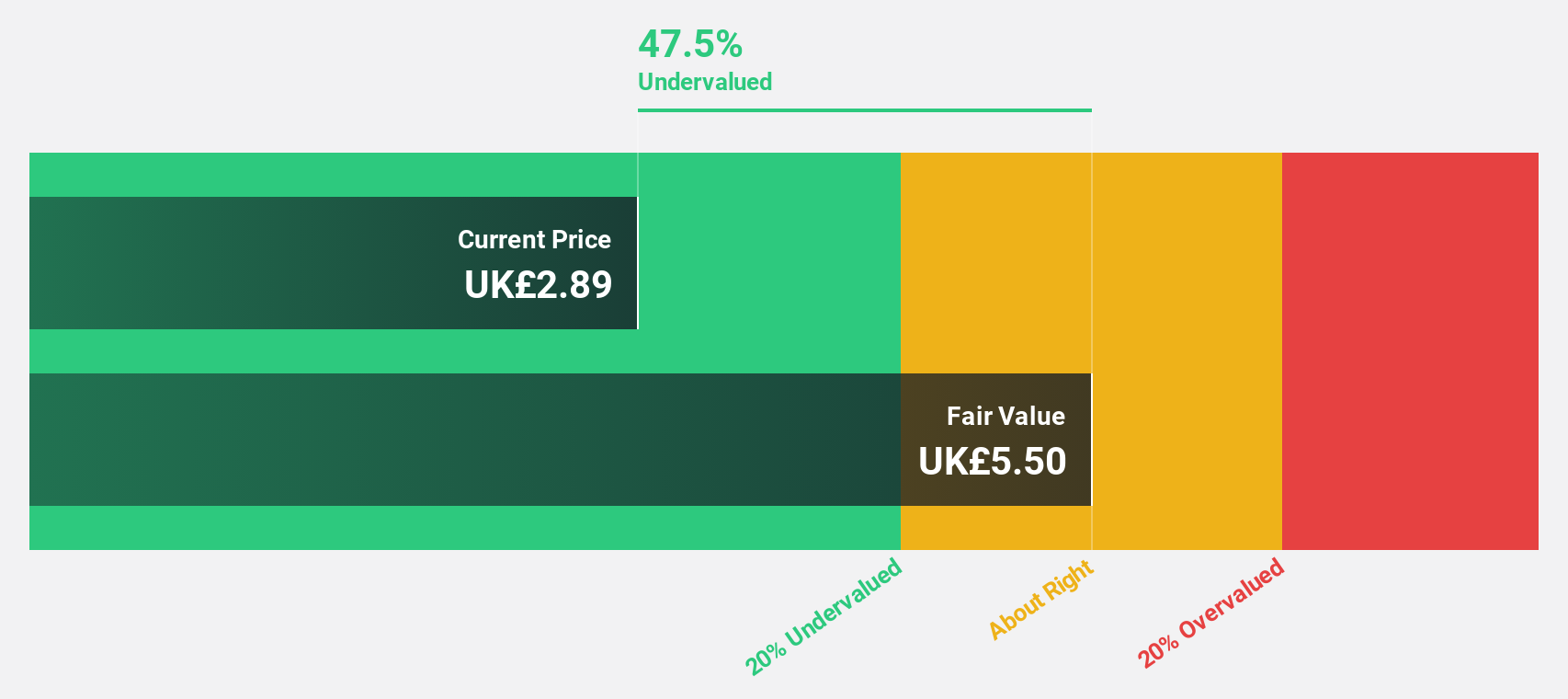

Norcros (LSE:NXR)

Overview: Norcros plc, with a market cap of £259.21 million, designs and supplies bathroom and kitchen products across the United Kingdom, Ireland, and South Africa.

Operations: The company generates revenue of £368.10 million from its Building Products segment.

Estimated Discount To Fair Value: 46%

Norcros is trading at £2.89, significantly below its estimated fair value of £5.36, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow 43.4% annually over the next three years, outpacing the UK market's growth rate of 14.5%. However, a low return on equity forecast of 12.5% and profit margins dropping from 6.8% to 1%, along with large one-off items impacting results, present challenges for investors to consider.

- The analysis detailed in our Norcros growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Norcros' balance sheet health report.

Key Takeaways

- Click this link to deep-dive into the 52 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AO.

AO World

Engages in the online retailing of domestic appliances and ancillary services in the United Kingdom and Germany.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives