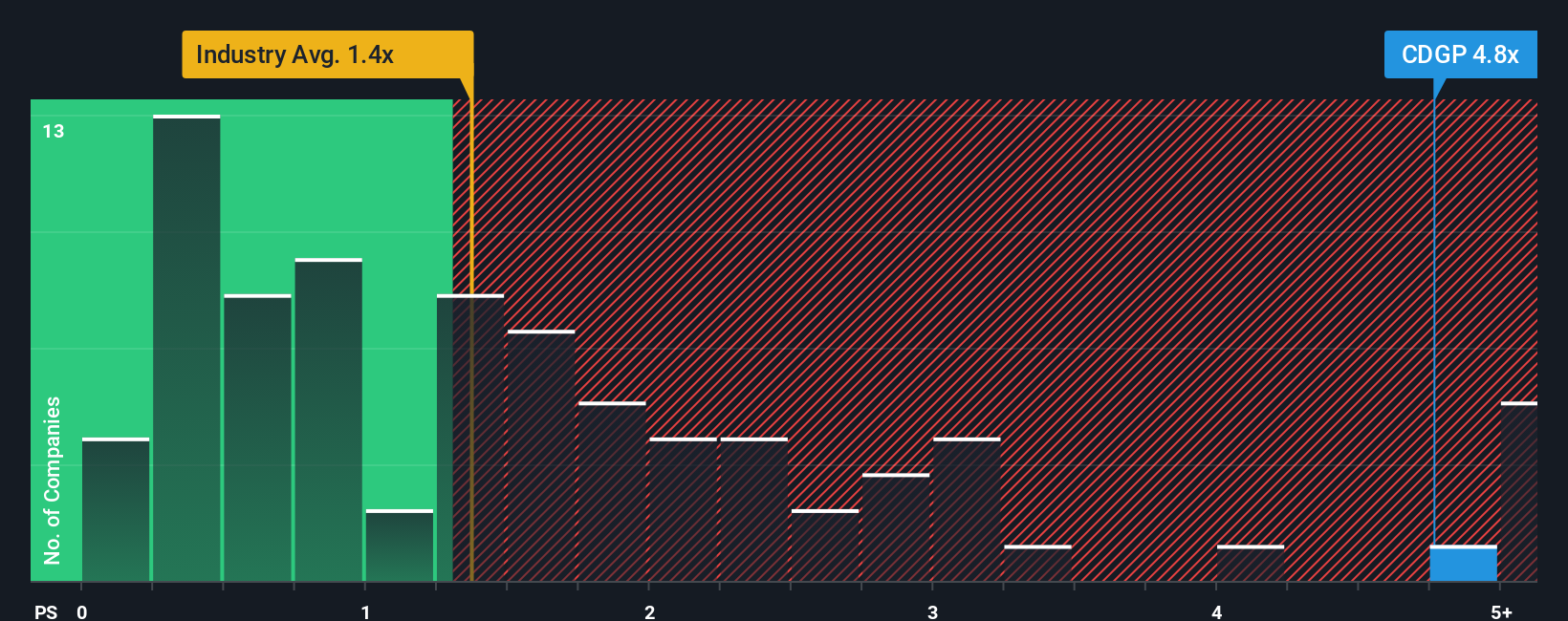

When you see that almost half of the companies in the Beverage industry in the United Kingdom have price-to-sales ratios (or "P/S") below 2.1x, Chapel Down Group Plc (LON:CDGP) looks to be giving off strong sell signals with its 4.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Chapel Down Group

How Has Chapel Down Group Performed Recently?

Chapel Down Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Chapel Down Group will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Chapel Down Group?

In order to justify its P/S ratio, Chapel Down Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 4.9% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 1.7% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the lone analyst following the company. With the industry only predicted to deliver 3.7% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Chapel Down Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Chapel Down Group's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Chapel Down Group shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Chapel Down Group that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CDGP

Chapel Down Group

Through its subsidiaries, engages in the production and sale of alcoholic beverages in the United Kingdom and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives