- United Kingdom

- /

- Food

- /

- AIM:ANP

Anpario plc's (LON:ANP) Popularity With Investors Under Threat As Stock Sinks 30%

Anpario plc (LON:ANP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 36% in the last year.

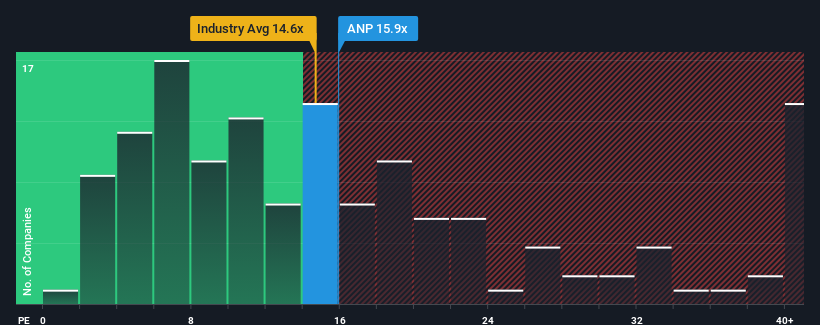

In spite of the heavy fall in price, there still wouldn't be many who think Anpario's price-to-earnings (or "P/E") ratio of 15.9x is worth a mention when the median P/E in the United Kingdom is similar at about 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Anpario certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Anpario

What Are Growth Metrics Telling Us About The P/E?

Anpario's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 83% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 12% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Anpario's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

Following Anpario's share price tumble, its P/E is now hanging on to the median market P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Anpario revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 4 warning signs for Anpario (1 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Anpario's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ANP

Anpario

Manufactures and distributes natural animal feed additives for animal health, nutrition, and biosecurity.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives