- United Kingdom

- /

- Oil and Gas

- /

- LSE:TLW

Why Investors Shouldn't Be Surprised By Tullow Oil plc's (LON:TLW) 26% Share Price Plunge

Tullow Oil plc (LON:TLW) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

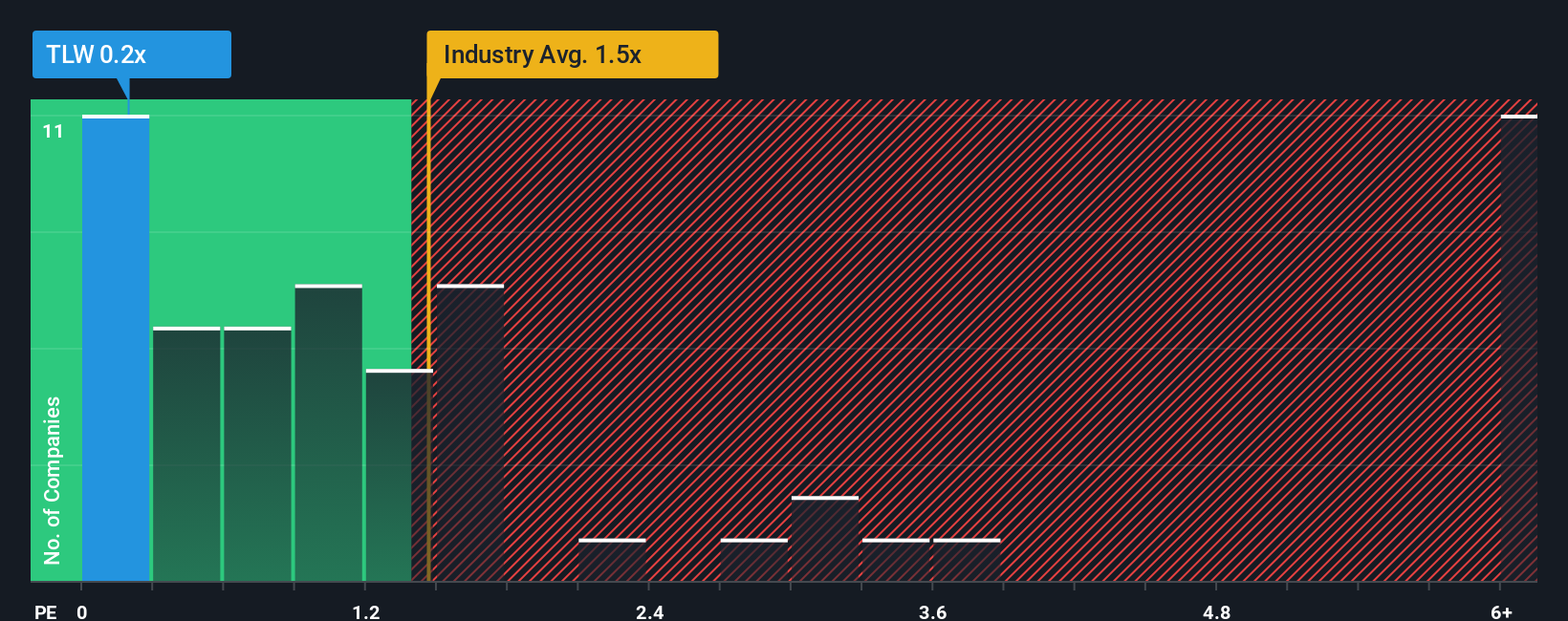

After such a large drop in price, Tullow Oil may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Oil and Gas industry in the United Kingdom have P/S ratios greater than 1.5x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Tullow Oil

What Does Tullow Oil's Recent Performance Look Like?

The recently shrinking revenue for Tullow Oil has been in line with the industry. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. You'd much rather the company continue improving its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Tullow Oil will help you uncover what's on the horizon.How Is Tullow Oil's Revenue Growth Trending?

In order to justify its P/S ratio, Tullow Oil would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 6.1% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 14% per annum during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 11% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Tullow Oil's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Tullow Oil's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Tullow Oil's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you take the next step, you should know about the 3 warning signs for Tullow Oil (2 are a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on Tullow Oil, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tullow Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TLW

Tullow Oil

An energy company, develops, produces, and sells oil and gas resources in Ghana, Gabon, Côte d’Ivoire, Kenya, and Argentina.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives