- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Shell (LSE:SHEL) Updates Q2 2025 Production Guidance Across Key Segments

Reviewed by Simply Wall St

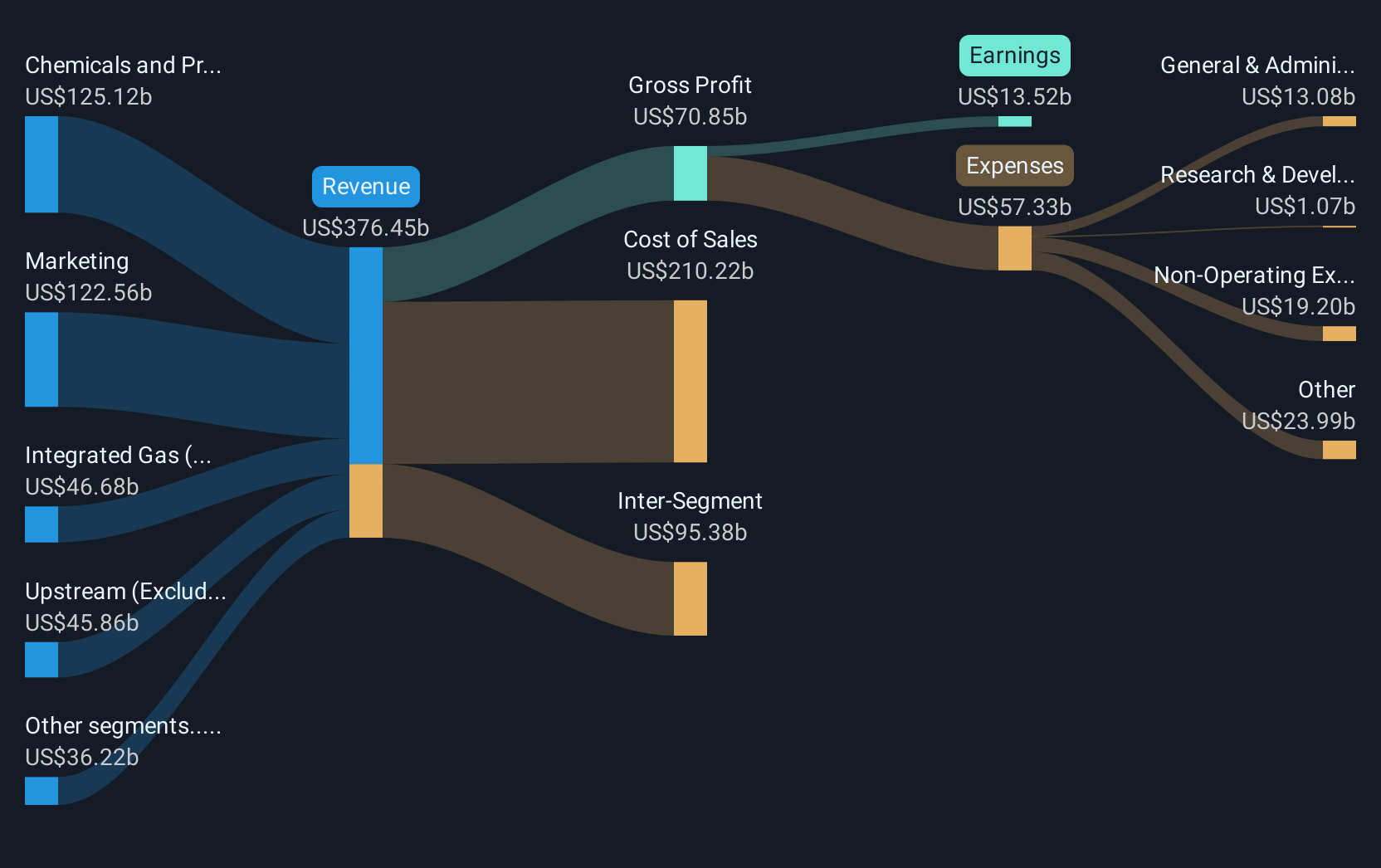

Recent corporate guidance adjustments by Shell (LSE:SHEL) have aligned with a 10% increase in its stock price over the last quarter, reflecting better integrated gas and upstream production expectations. Despite a decline in sales and revenue for Q1 2025, the company's initiation of a new $3.5 billion share repurchase program likely bolstered investor sentiment. M&A rumors, despite being clarified, may also have added intrigue. Meanwhile, broader market trends, such as tariff concerns impacting indices like the S&P 500, presented a more varied landscape, but Shell's specific financial maneuvers seem to have supported its upward trajectory against market fluctuations.

Every company has risks, and we've spotted 1 risk for Shell you should know about.

The recent news about Shell's revised corporate guidance leading to a 10% share price increase aligns well with the narrative's emphasis on long-term performance through AI and robotics. Despite Q1 2025's decline in sales, the company's new $3.5 billion share buyback appears to have strengthened investor confidence, potentially supporting earnings and revenue forecasts. The anticipation that innovative technologies will enhance operational safety and efficiency underpins expectations for net margin improvement, which could offset revenue challenges linked to LNG market volatility.

Over a five-year period, Shell's total return, including share price and dividends, was 150.26%. This long-term gain helps contextualize the company's efforts to maintain steady growth in shareholder value. Comparatively, over the past year, Shell underperformed the UK market, which returned 4.8%, but exceeded the UK Oil and Gas industry's 12% decline. This discrepancy with the market suggests a mixed performance amidst volatile industry conditions.

The share price's recent rise, when set against the analyst consensus price target of £31.22, reveals a 21.8% potential upside from its current price of £24.4. This mirrors analyst forecasts of an increase in profit margins to 7.6% in three years, although some market risks, such as regulatory challenges, remain. Investors may find reassurance in Shell's commitment to capex reduction and improving free cash flow, though achieving the projected fair value depends heavily on successful execution of strategic projects and favorable market conditions.

Examine Shell's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives