- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Shell (LSE:SHEL): Reassessing Valuation After Recent Share Price Drift

Reviewed by Simply Wall St

Shell (LSE:SHEL) has been drifting lower over the past month, even as its longer term returns remain solid. This sets up an interesting moment to revisit the stock’s valuation.

See our latest analysis for Shell.

Over the past year Shell’s share price return has been steadily positive, while the recent 30 day pullback suggests momentum is cooling a little even as long term total shareholder returns remain robust.

If Shell’s recent drift has you reassessing the energy space, it could be a good moment to see what else is moving among aerospace and defense stocks.

With Shell trading at a double digit discount to analyst targets and an even steeper gap to some intrinsic value estimates, investors now face a key question: is this a genuine value window, or is the market already correctly pricing future growth?

Most Popular Narrative Narrative: 15% Undervalued

With Shell’s fair value estimate sitting above the £26.62 last close, the prevailing narrative points to upside that the recent pullback has not erased.

The company's strong shareholder returns policy reflected in ongoing multi-billion-dollar buyback programs and a commitment to distributing 40 to 50% of cash flow from operations combined with a solid balance sheet, is set to underpin EPS growth and maintain investor appeal, even in the face of cyclical price downturns.

What kind of earnings climb and margin uplift does it take to justify this richer future profit multiple on a slow growing revenue base? The narrative lays out a precise roadmap that leans heavily on rising profitability, disciplined capital returns and a tighter share count, but the real surprise is how much depends on one key set of assumptions you have not seen yet.

Result: Fair Value of £31.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent chemicals weakness and a tougher LNG pricing backdrop could squeeze margins and free cash flow, which may challenge both valuation upside and generous buyback plans.

Find out about the key risks to this Shell narrative.

Another Angle on Valuation

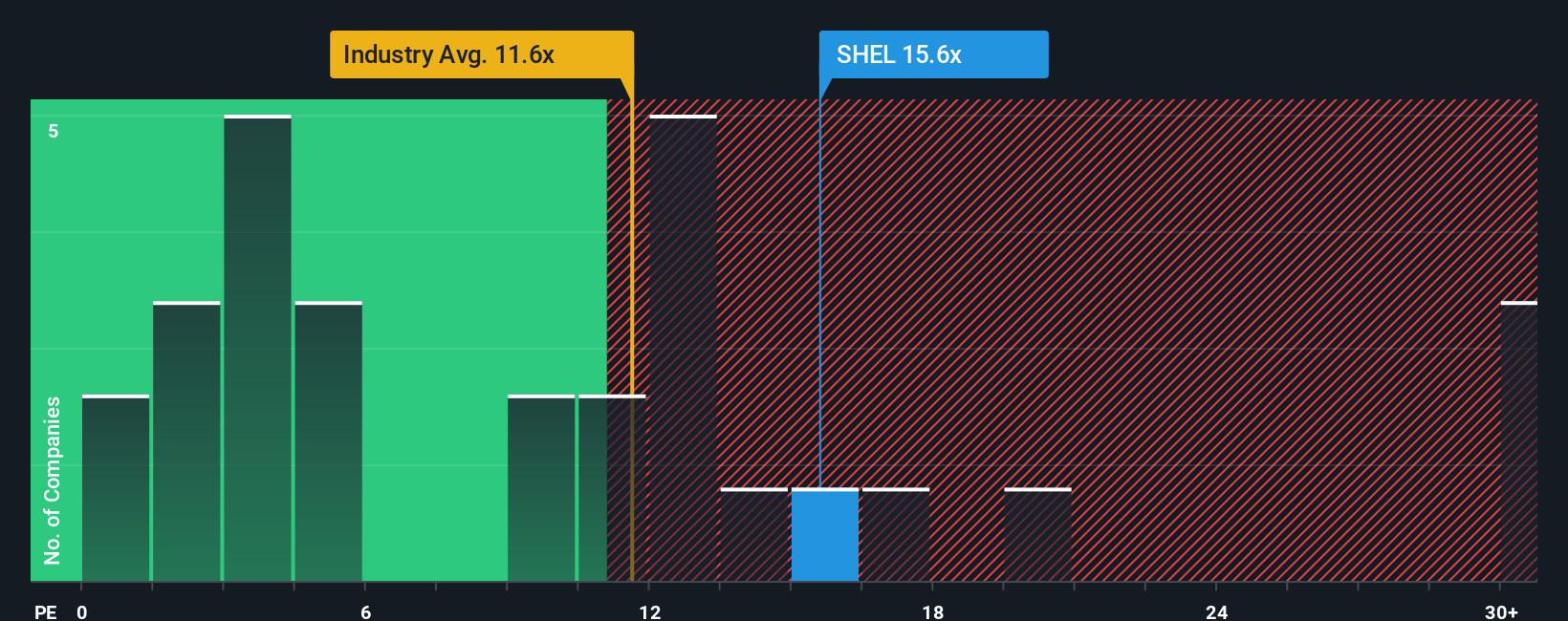

Shell looks cheap against our fair value estimate, but its 14x price to earnings sits above the European oil and gas industry at 11.5x and below a 15.2x peer average. With a fair ratio near 18.5x, is today’s discount a cushion or a value trap in disguise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shell Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a full narrative yourself in just a few minutes: Do it your way.

A great starting point for your Shell research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Shell might be compelling today, but you will kick yourself later if you ignore other stocks with strong momentum, resilient cash flows and powerful long term themes.

- Capture early stage growth potential by reviewing these 3608 penny stocks with strong financials that already pair compelling business models with solid financial underpinnings.

- Position your portfolio for the next productivity boom as you assess these 24 AI penny stocks reshaping industries with real world artificial intelligence applications.

- Lock in dependable income streams by focusing on these 13 dividend stocks with yields > 3% that can potentially support long term returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion