- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Shell (LSE:SHEL) Announces New Chairman in Kazakhstan and $3.5 Billion Share Buyback Program

Shell(LSE:SHEL) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include robust financial health with adjusted earnings of $6.3 billion, alongside strategic exits and paused projects that underscore operational hurdles. In the discussion that follows, we will delve into Shell's core advantages, critical issues, growth strategies, and key risks to provide a comprehensive overview of the company's current business situation.

Get an in-depth perspective on Shell's performance by reading our analysis here.

Strengths: Core Advantages Driving Sustained Success For Shell

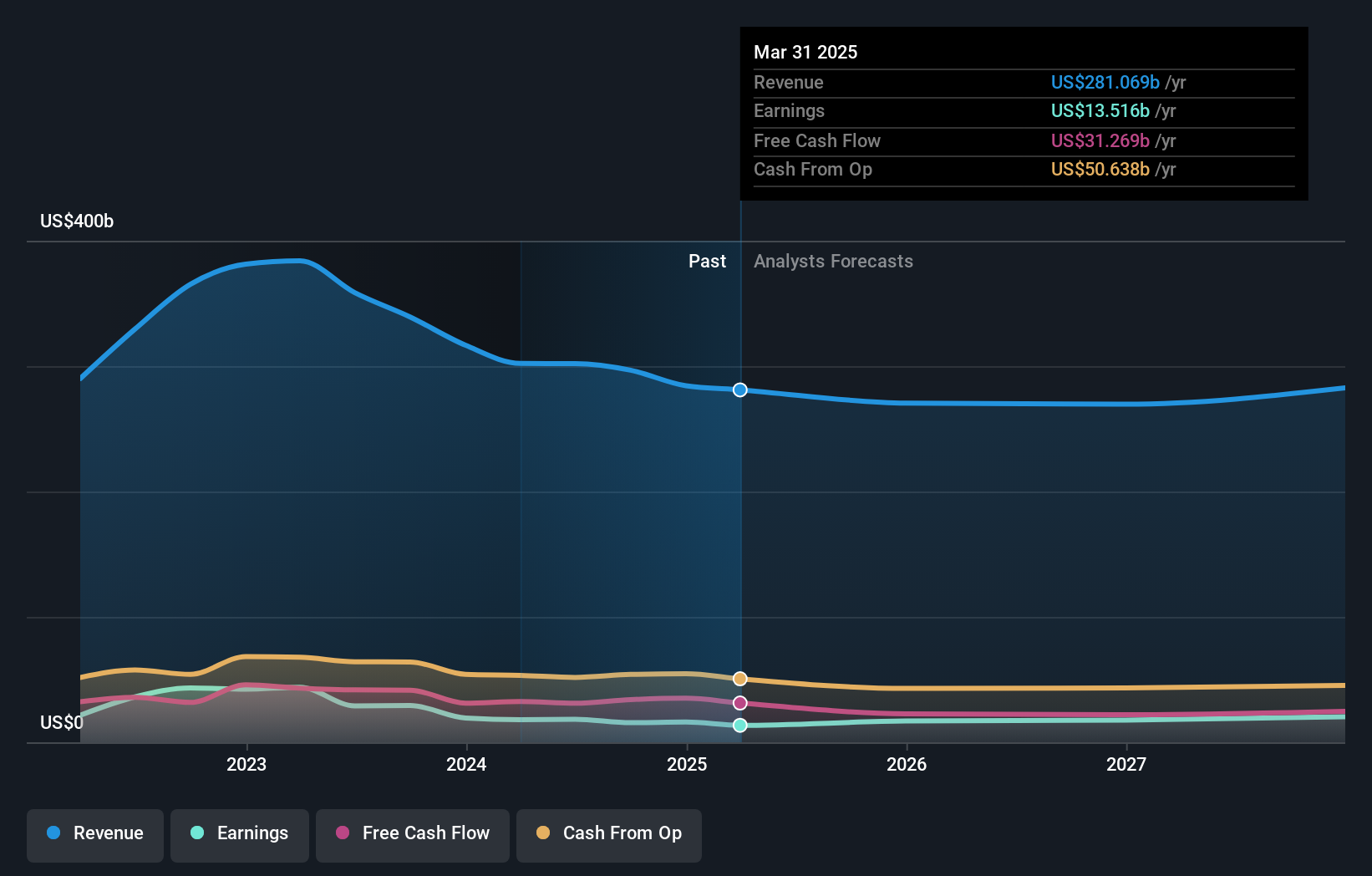

Shell's financial health is robust, with adjusted earnings of $6.3 billion and cash flow from operations reaching $13.5 billion, as highlighted by CEO Wael Sawan in the latest earnings call. The company is making significant progress against its four financial targets, demonstrating operational efficiency and strategic focus. Notably, in the Chemicals business, the full operational status of all three polyethylene trains at Shell Polymers Monaca underscores its innovation and operational performance. Additionally, Shell's LNG portfolio is expanding through increased liquefaction and third-party volume access, which further strengthens its market position. The company is currently trading below its estimated fair value (£25.61 vs. £28.56) and is considered good value compared to peers, although it appears expensive relative to the UK Oil and Gas industry average.

Weaknesses: Critical Issues Affecting Shell's Performance and Areas For Growth

Despite its strengths, Shell faces notable weaknesses. The company's exit from the home energy business in Europe and the paused construction at the biofuels plant in Rotterdam highlight challenges in project delivery and competitive positioning. Furthermore, Shell's current net profit margins have decreased from 8.1% last year to 6.1%, indicating a decline in profitability. The company also experienced a negative earnings growth of -36.6% over the past year, contrasting sharply with the Oil and Gas industry average of -55.3%. For a more comprehensive look at how these weaknesses could impact Shell's financial stability, explore our section on Shell's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Shell has several strategic opportunities that could enhance its market position. The anticipated start-up of projects like Wale in the Gulf of Mexico, Brazil's Mero-3, and Penguins in the North Sea represent significant expansion initiatives. These projects align with Shell's commitment to maintaining capital discipline and improving operational performance, as reiterated by CEO Wael Sawan. Additionally, Shell's focus on leveraging knowledge in innovative ways and maintaining a competitive advantage by targeting high-margin, low-cost operations could capitalize on emerging market trends. Learn more about how these opportunities could impact Shell's future growth by reviewing our analysis of Shell's Future Performance.

Threats: Key Risks and Challenges That Could Impact Shell's Success

Shell faces several external threats that could impact its growth and market share. Competitive pressures and economic cycles pose significant risks, as acknowledged by Wael Sawan. The company must navigate these cycles strategically to maintain its market position. Regulatory challenges also loom large, with final investment decisions on projects like Atapu-2 in Brazil and Sparta in the Gulf of Mexico potentially affecting operational dynamics. Additionally, Shell's unstable dividend track record could undermine investor confidence and shareholder returns. The structural OpEx reduction target, with $1.7 billion already delivered out of the $2 billion to $3 billion committed by the end of 2025, reflects ongoing cost management efforts but also highlights the scale of operational challenges ahead.

Conclusion

Shell's strong financial health, with significant earnings and operational cash flow, underscores its operational efficiency and strategic focus. However, challenges such as declining profitability and project delivery issues highlight areas for improvement. The company's numerous expansion projects and focus on high-margin operations present substantial growth opportunities, though it must navigate competitive pressures and regulatory hurdles. Currently trading below its estimated fair value (£25.61 vs. £28.56), Shell is considered a good value compared to peers, though it appears expensive relative to the UK Oil and Gas industry average. This valuation suggests potential for future appreciation, contingent on the successful execution of its strategic initiatives and effective risk management.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives