- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Just Four Days Till Shell plc (LON:SHEL) Will Be Trading Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Shell plc (LON:SHEL) is about to go ex-dividend in just four days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Shell's shares on or after the 13th of February will not receive the dividend, which will be paid on the 24th of March.

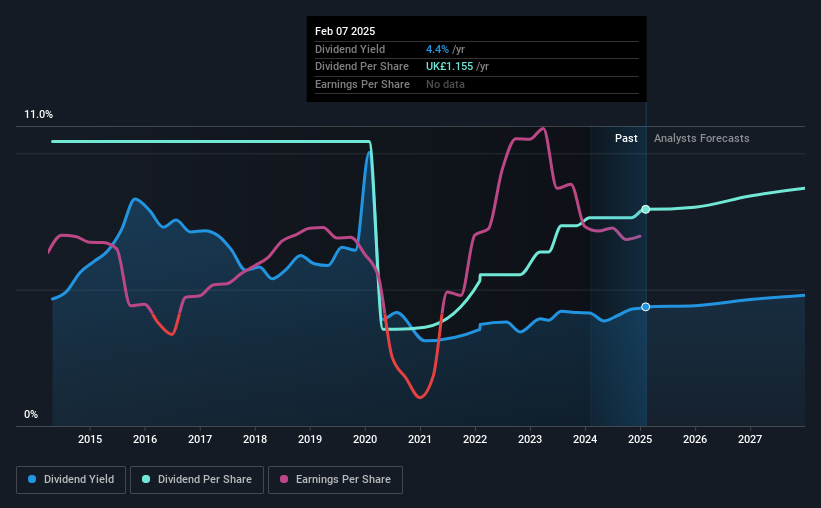

The company's next dividend payment will be US$0.358 per share. Last year, in total, the company distributed US$1.43 to shareholders. Based on the last year's worth of payments, Shell stock has a trailing yield of around 4.4% on the current share price of UK£26.45. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Shell

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Shell is paying out an acceptable 54% of its profit, a common payout level among most companies. A useful secondary check can be to evaluate whether Shell generated enough free cash flow to afford its dividend. It paid out 25% of its free cash flow as dividends last year, which is conservatively low.

It's positive to see that Shell's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're encouraged by the steady growth at Shell, with earnings per share up 6.0% on average over the last five years. Decent historical earnings per share growth suggests Shell has been effectively growing value for shareholders. However, it's now paying out more than half its earnings as dividends. If management lifts the payout ratio further, we'd take this as a tacit signal that the company's growth prospects are slowing.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Shell's dividend payments per share have declined at 2.7% per year on average over the past 10 years, which is uninspiring. Shell is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

The Bottom Line

Should investors buy Shell for the upcoming dividend? While earnings per share growth has been modest, Shell's dividend payouts are around an average level; without a sharp change in earnings we feel that the dividend is likely somewhat sustainable. Pleasingly the company paid out a conservatively low percentage of its free cash flow. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

In light of that, while Shell has an appealing dividend, it's worth knowing the risks involved with this stock. In terms of investment risks, we've identified 1 warning sign with Shell and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion