- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

How Shell’s Valuation Stacks Up After $3.5B Low-Carbon Investment in 2025

Reviewed by Bailey Pemberton

If you’ve found yourself wondering what to do with Shell shares right now, you’re not alone. With the stock up an impressive 224.0% over the past five years, it’s easy to see why Shell has so many investors’ attention. But more recently, things have been a bit choppier. Last week’s performance slipped by -1.1%, while a 2.9% gain in the past month signals there’s still some momentum behind the name. Year-to-date, Shell has delivered 6.9%, and over the last year, it has handed shareholders a solid 9.3% return. For a company that sits squarely between old-world energy and a fast-changing industry, such moves often reflect shifting risk perceptions as much as underlying financials.

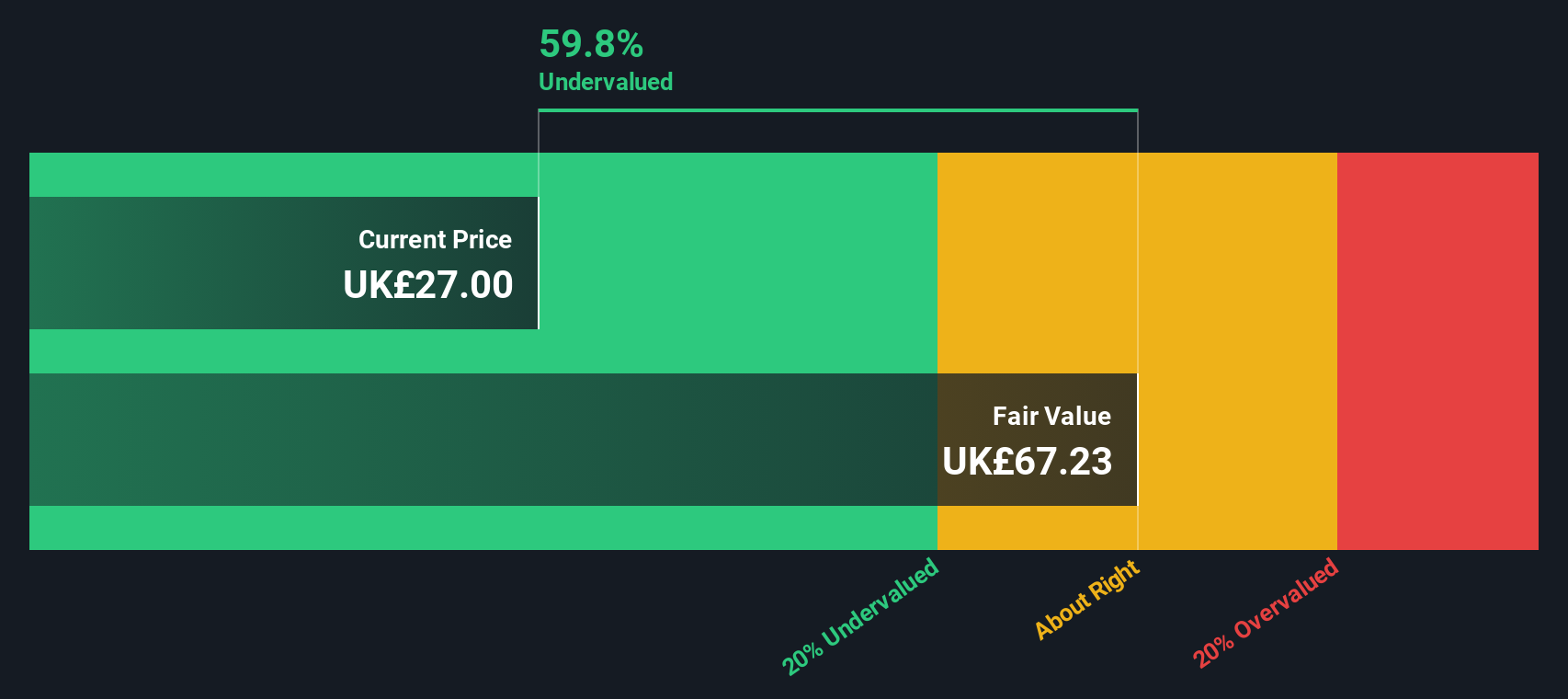

But what’s driving these swings, and more importantly, is Shell undervalued or overvalued today? To help make sense of that, we use a value score. A higher score means Shell checks more boxes for being undervalued. Right now, Shell has a valuation score of 3 out of 6, suggesting there’s certainly some value to be found, but maybe not across the board.

If you’re trying to figure out whether now is the time to buy, sell, or hold, it pays to dig deeper into the valuation methods behind the score. In this next section, I’ll break down how Shell fares across key valuation checks. Later, I’ll reveal an even more insightful way to think about what Shell’s truly worth.

Approach 1: Shell Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach aims to determine what Shell is worth based on how much cash it is expected to generate in the coming years, rather than focusing on current profits alone.

Shell's latest twelve-month Free Cash Flow stands at approximately $30.57 billion. Analysts provide cash flow estimates for up to five years, after which projections are extrapolated based on expected industry trends. According to current forecasts, Shell's Free Cash Flow in 2029 is expected to reach around $26.71 billion. By 2035, these estimates continue to be adjusted using more moderate growth rates to reflect greater uncertainty further into the future.

When all future cash flows are added up and discounted to today’s value, the resulting intrinsic value is calculated at $53.84 per share. This figure is nearly 50 percent higher than the current share price, suggesting the stock trades at a significant discount to its estimated true worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shell is undervalued by 49.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Shell Price vs Earnings

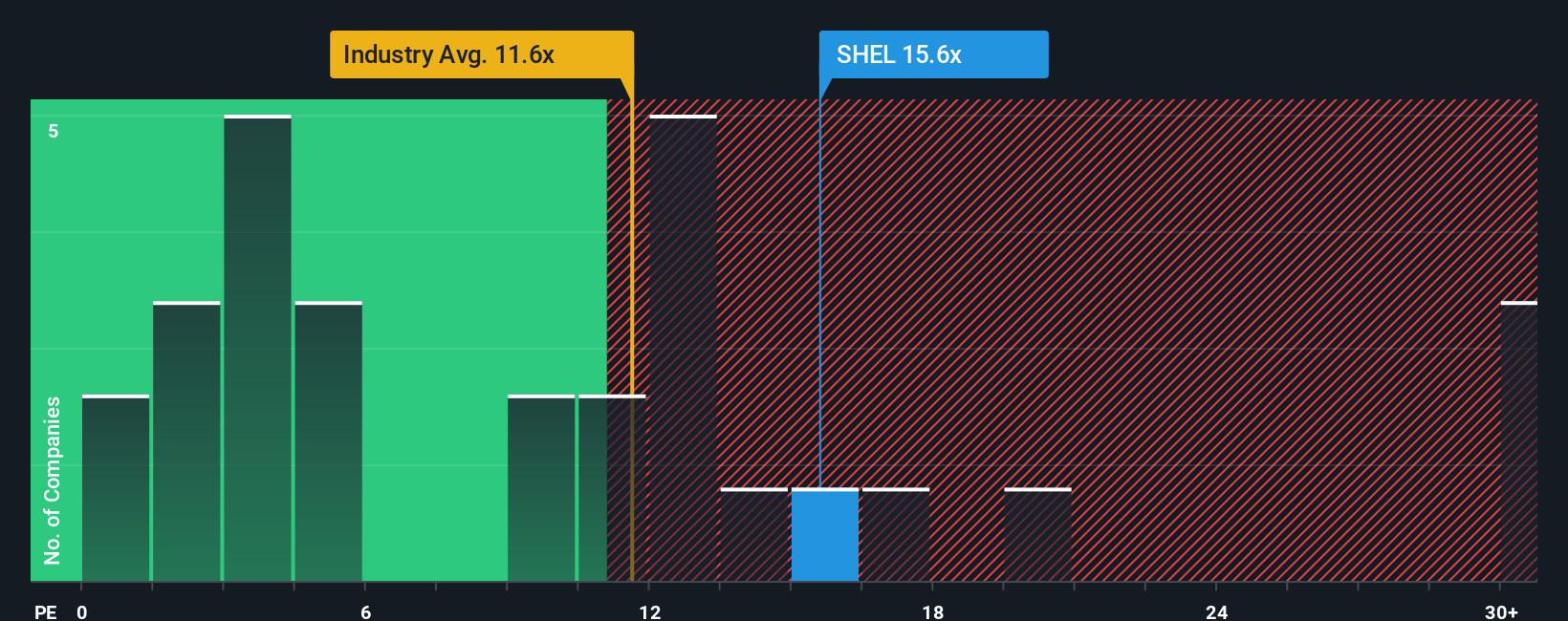

The Price-to-Earnings (PE) ratio is a useful measure for valuing profitable companies like Shell, since it indicates how much investors are willing to pay for each dollar of earnings. A company's PE ratio reflects not just its financial strength, but also investor expectations for future growth and the risks they anticipate. Higher expected growth or lower perceived risk typically drive a "fair" PE ratio up. On the other hand, uncertainties or weaker prospects push it down.

Shell currently trades at a PE ratio of 15.6x. To put that in context, the average for the oil and gas industry sits lower at around 13.0x, and Shell’s peer group is at about 15.1x. At first glance, Shell is valued slightly above the industry but is well in line with its direct peers. This suggests solid performance and moderate growth expectations.

Simply Wall St’s Fair Ratio offers a more tailored benchmark. This proprietary metric reflects not only earnings growth, but also the company’s profit margins, risk profile, market cap, and the broader industry landscape. Unlike simple peer or industry comparisons, the Fair Ratio provides a well-rounded view that accounts for Shell's unique strengths and vulnerabilities. For Shell, the Fair Ratio is estimated at 21.4x, significantly higher than its current PE. This indicates that, considering its growth potential, profitability, and risk, Shell is trading below the level warranted by its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shell Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story or perspective about Shell’s future, tying together your assumptions about revenue, profit margins, and risk with the numbers that drive fair value estimates.

Unlike traditional methods that focus just on past performance or simple ratios, Narratives let you explore how a company’s big picture story links directly to a financial forecast and fair value. This helps you see how your expectations stack up against the current price. Narratives are accessible and easy to use on Simply Wall St’s platform, where millions of investors share their outlooks on the Community page.

A key advantage of Narratives is that they update dynamically when new facts emerge, like company announcements or earnings reports. This keeps your fair value and decision-making in sync with the market. This hands-on approach helps you decide when to buy or sell by revealing the gap between your estimated value and the stock price.

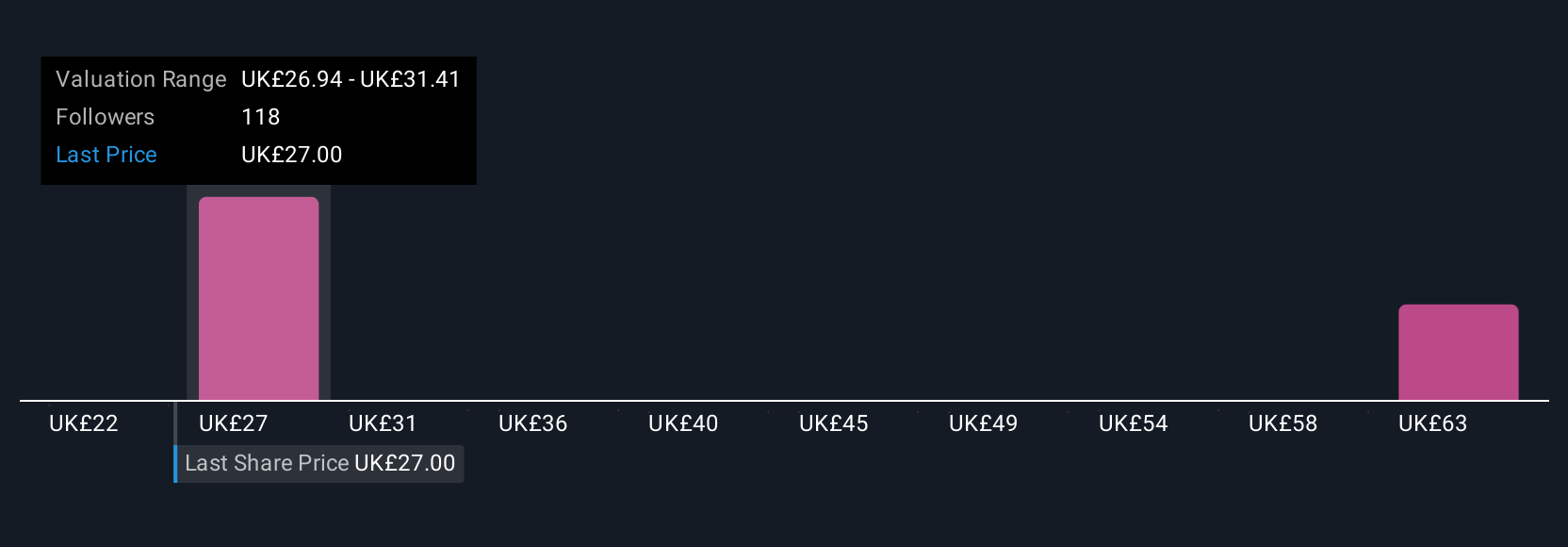

For example, some investors believe Shell’s focus on LNG and cost efficiency could push its fair value as high as £39.36. Others worry about margin risks and assign a much lower value around £27.06. This demonstrates how different Narratives empower you to make choices grounded in your unique view of Shell’s future.

Do you think there's more to the story for Shell? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives