- United Kingdom

- /

- Capital Markets

- /

- LSE:ALPH

Uncovering 3 Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

The United Kingdom market has experienced a modest rise of 1.2% in the last seven days, while the Healthcare sector has declined by 3.2%. Over the past year, the market is up 7.1%, with earnings projected to grow by 14% annually. In this dynamic environment, identifying stocks that have strong growth potential and are currently undervalued can be particularly rewarding for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.15 billion.

Operations: Yellow Cake plc generates revenue primarily through its holdings of U3O8 for long-term capital appreciation, valued at $735.02 million.

Yellow Cake has shown remarkable improvement, becoming profitable in the last year with net income of US$727.01 million compared to a net loss of US$102.94 million previously. The company is debt-free and trades at a price-to-earnings ratio of 2.1x, well below the UK market average of 16.7x, suggesting good relative value. However, shareholders have experienced dilution over the past year, and earnings are forecasted to decline by an average of 91% annually for the next three years.

- Click to explore a detailed breakdown of our findings in Yellow Cake's health report.

Assess Yellow Cake's past performance with our detailed historical performance reports.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the United Kingdom, Europe, Canada, and internationally, with a market cap of £947.42 million.

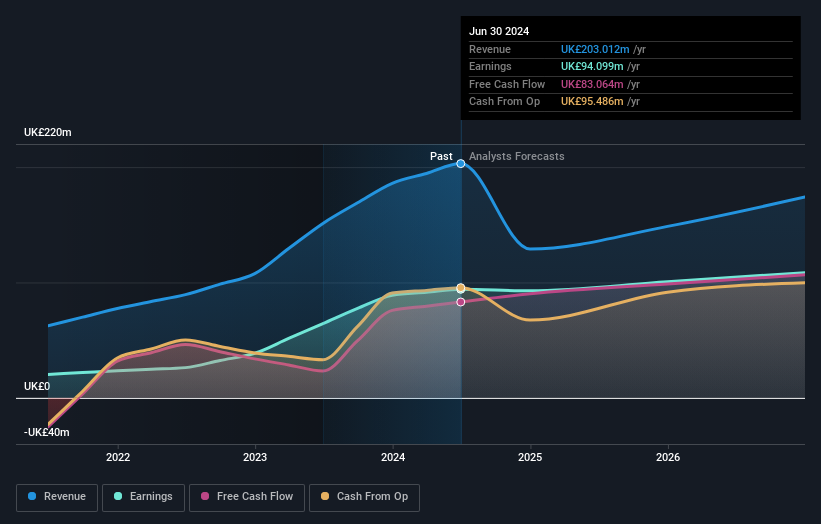

Operations: Alpha Group International plc generates revenue primarily through its Alpha Pay (£72.30 million), Institutional (£67.47 million), Corporate London excluding Amsterdam (£46.92 million), Corporate Amsterdam (£9.57 million), and Corporate Toronto (£3.72 million) segments, with a segment adjustment of £1.45 million.

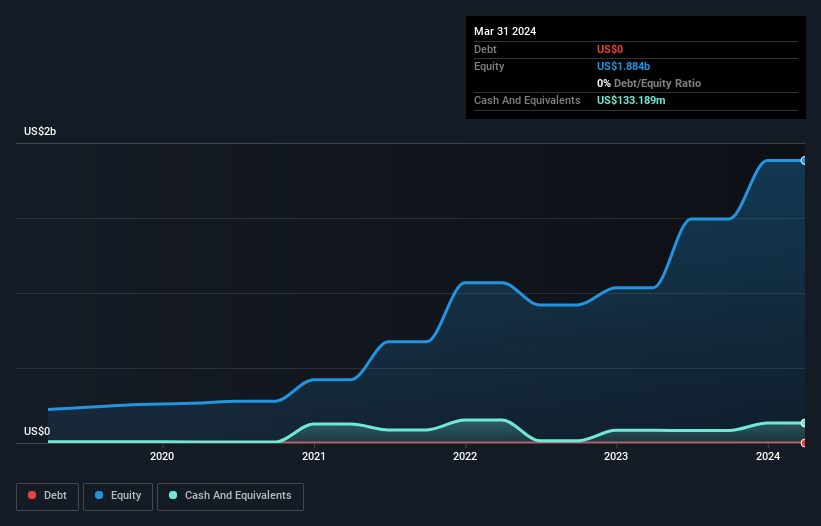

Alpha Group International has shown impressive growth, with earnings increasing by 46.3% over the past year, far outpacing the Capital Markets industry average of 1.2%. The company boasts a strong financial position, being debt-free for five years and trading at a favorable price-to-earnings ratio of 10.1x compared to the UK market's 16.7x. Recent executive changes include Clive Kahn stepping in as CEO from January 2025, ensuring continued strategic leadership and stability.

- Click here and access our complete health analysis report to understand the dynamics of Alpha Group International.

Learn about Alpha Group International's historical performance.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing activities across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.15 billion.

Operations: Seplat Energy generates revenue primarily from oil ($815.03 million) and gas ($120.87 million). The company’s market cap is £1.15 billion.

Earnings for Seplat Energy have surged by 207.6% over the past year, significantly outpacing the Oil and Gas industry’s -55.3%. The company’s net debt to equity ratio stands at 20.6%, a satisfactory level, while interest payments are well covered by EBIT at 5.8x coverage. Recent unaudited production averaged 48,407 boepd for H1 2024, with sales reaching US$421.64 million compared to US$547.02 million a year ago and net income of US$40.76 million from continuing operations matching last year's figures.

- Dive into the specifics of Seplat Energy here with our thorough health report.

Understand Seplat Energy's track record by examining our Past report.

Where To Now?

- Investigate our full lineup of 81 UK Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALPH

Alpha Group International

Provides foreign exchange risk management and alternative banking solutions in the United Kingdom, Europe, Canada, and internationally.

Flawless balance sheet with proven track record.